Are you overwhelmed with piling up debt and looking for a way out, but running out of ideas on what to do? If YES, here’s how to get out of tax debt as quickly as possible in 4 easy steps.

Few things can be more frustrating than struggling to pay off your tax debt. When it becomes big enough, it will affect your family, your career, and your wealth.

And the longer the tax refund debt, the more fines and interest you will have to pay. So if you have a huge tax debt, it can only get worse if you don’t find a way out of the quicksand quickly.

If you’re already mired in huge tax debt, you don’t have to think about it forever. Getting out of the situation should be the first thing on your mind. And the good news is that you can pay off your tax debts, no matter how much you owe, and get on with your life. But you can only do this with devotion and perseverance. Do you really want to pay off your tax debt quickly? ? Then the following tips will help you:

How to pay off your tax debt yourself in 4 easy steps

1. Pay as soon as possible

loud >

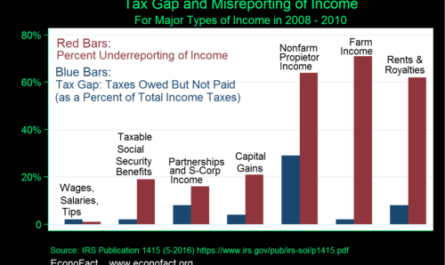

The smart way to get out of a huge tax debt is to pay it off immediately. If you don’t pay your tax bill by the due date, the IRS will charge interest on your back taxes until the day you pay them.

In the United States, interest is 3% plus a federal short term. This can be a significant amount if you don’t pay on time. And that doesn’t include the five percent penalties the IRS applies each month to collect back taxes.

So first, pay what you can before the tax due date. And if you already owe a tax refund, try to pay as much as you can. You can use a credit card for this. By paying off what you can, you will reduce your overall tax debt, which will lower your interest rate and eventually pay off the rest of your debt.

If for some reason you can’t pay or get a new credit card, consider borrowing money from a friend or relative and then using it to pay off as much of your tax debt as possible. Chances are, your friend or relative who lent you the money won’t charge you any interest. And if they do, it will be much less than what you have to pay in interest on your tax debt.

2. Use an installment plan

If you want to pay off your tax debt quickly but still don’t have enough money to pay a significant portion of your outstanding debts all at once, you can enter into an installment plan with the IRS (if you are in the United States ) or your state tax department.

Whether you qualify for a three-year installment plan or a six-year plan, you should consider that your minimum payment will be determined by dividing the total amount owed by the total number of months in the installment plan. you owe $27,000, your minimum payment is that amount ($27,000) divided by 72 (total number of months over 6 years). In this case, you will have to pay at least $375 per month for the entire period. 3. Request an extension You can reduce the rate at which your tax debt is compounded by you asking the tax office for an extension. For example, you can appeal a short extension of 120 days. If your appeal is successful, you will not pay any penalties during the 120 day period. However, your monthly interest will continue to accrue. So the extension only waives your monthly penalty, not your monthly interest. But the difference can be significant, especially if your tax debt is huge. For example, let’s say you owe $27,000 in tax debt and are granted a 120-day (four month) extension. If your monthly penalty is five percent of your debt, renewing will save you $1,350 per month over a four-month period. That’s a total of $5,400! 4. Submit a compromise proposal An Offer in Compromise (OIC) allows tax debtors to repay their debt to the IRS by paying less than the full amount owed. If your tax debt is over $25,000, you may consider applying for an OIC. Now keep in mind that OCI has its pros and cons. While this can help you significantly reduce your tax debt, it comes with some conditions that may not be in your best interest, such as losing the legal ability to challenge your tax debt in court.