Do you want to start a business in the United States as a foreigner? here are the legal requirements for successfully starting a US business for non-citizens.

Well, by providing an in-depth analysis of the 50 Best Small Business Ideas in the United States of America and a range of sample business plan templates from the industry; Now we will analyze in detail the legal requirements, market feasibility, and everything you need to start a business in the United States. So put on your entrepreneurial hat and let’s take action.

The United States is the world’s largest national economy and the world’s second-largest economy. It is based on purchasing power parity (PPP), i.e. 22% of nominal world GDP and 17% of gross world product (GWP).

Experts have estimated the US GDP at 17.914 billion. In addition, the US dollar is the most widely used currency in international transactions and the world’s leading reserve currency. There are countless people who gather in the United States every year to do business.

Also, many countries around the world use it as the official currency, while for others it is the de facto currency. Another reason you should consider doing business in the United States is that there is a mixed economy that maintains stable overall GDP growth, moderate unemployment, and high levels of research and investment. p65>

Conversely, there are many business ideas that you can use to make a lot of money in this country. Every day, like never before, millionaires are being created. Although it became a business idea, it made people popular and famous all over the world. You too can become that millionaire if you start trading.

Why start a business in the United States of America?

The United States is the world’s largest producer of oil and natural gas. It is one of the world’s largest countries in the world, as well as the world’s second largest producer, accounting for a fifth of global industrial production.

Another notable fact is that the United States not only has the largest domestic market for goods, but also controls skills in the service sector. Research has shown that in 2012 alone, the total US trade was US $ 4.93 thousand. It is also one of the 500 largest companies in the world, of which 128 are based in the United States.

The United States has one of the largest and most powerful financial markets in the world. The New York Stock Exchange is undoubtedly one of the largest in the world in terms of market capitalization. Foreign exchange reserves in the United States are over $ 2 trillion, and US economies in foreign countries exceed $ 3 trillion.

The economy is one of the safest in the world because it occupies a leading position in the international ranking of venture capital and in the financing of research and development on a global scale.

The United States has the largest consumer market in the world, with domestic consumption outflows five times that of Japan. It’s no wonder that the labor market attracts immigrants from all over the world, and its net migration rate is one of the highest in the world. This is the step you need to take to start a business in the United States of America.

Threats and potential challenges you will face in the United States of America

- Multiculturalism

- Individualism

- Low context culture

- Egalitarianism

- Complex tax system

- Legal Complexities of International Trade

- Cultural barriers

- The difference in marketing styles

Starting a Profitable Business in the United States as a Complete Guide for Foreigners

- Decide what type of business is right for you

Before you can start your own business, you must first decide what type of business is best for you, given your conditions. This decision matters because the type of business you choose affects everything from day-to-day transactions to taxes, how much of your personal assets are at risk, and more. You can choose from the following types of activities: LLC, C-Corporation, Sole Proprietorship, S-Corporation, etc.

LLC is the most common (and generally recommended) type of business in the United States (especially if you are a non-US resident). LLC protects your personal property against business debts and lawsuits. The LLC also has a pass-through tax system, which means that your income simply goes to your personal income taxes. This means that accountants do not need to file a separate tax form for the business, which reduces costs.

C-Corporation is another type of business that you can start, if you are a US resident you definitely shouldn’t be doing C-Corporation, you should choose S-Corporation instead. However, if you are not a US resident, you should consider setting up a C-Corporation. Corporations are better for investors because investors can passively own stocks without worrying about tax implications until they sell them in the future.

Sole proprietorship is the simplest type of business and does not require any formal request. This is generally fine for small businesses, but the downside is that you will be personally responsible for all matters of your business if you are the sole owner.

- Decide where to grow your business

If you are a US citizen, it goes without saying that you should set up your LLC or corporation in the state where you are located.

Top 5 cities for doing business in the United States

While it is possible to do business in the United States of America in general, some cities and states have an advantage over others because of the very favorable terms they offer. Various companies have progressed to be born here and they spawned other companies as well. Here is a list of the 5 best cities to do business in America;

- Columbus, Ohio

- Denver, Colorado

- Indianapolis

- Des Moines, Iowa

- Salt Lake City, Utah

But if you are not a resident of the United States and do not plan to be physically present in the United States, you can start your business in the state of your choice, but it is highly recommended that you start your business in Wyoming, because it is considered to be the best and most business friendly. for non-US residents.

Top 5 Reasons Wyoming is Best for Non-U.S. Residents:

- No US citizenship requirement (you can be a non-US citizen and set up your LLC in Wyoming)

- Inexpensive annual report fees ($ 50 per year in Wyoming vs. $ 300 in Delaware)

- More confidentiality (members and managers are not listed on the state)

- No state, personal, corporate or capital gains tax

- Laws more favorable to foreigners

If you have a Wyoming LLC business, you can run your business and live anywhere in the world; You also don’t need to be a U.S. citizen to register in Wyoming.

You should also note that if your non-US corporation operates in more than one US state, you may need to register in one of those states. but you must also register to do business in other states through a process called foreign qualifications.

- Get a registered agent

LLCs and corporations must have a registered agent with a physical address during normal business hours to receive important documents on behalf of the business. This agent must be located in the state you are registering in and must receive official documents on behalf of your business. Many business owners choose to use the services of a registered agent rather than fulfilling this role themselves, as it saves them a lot of inconvenience.

- Register your LLC or S-Corporation

Once you have decided what type of business is right for you and after deciding in which state you should set up your business, you need to register. LLC or S-Corporation by submitting the required documents.

The time it takes to register your LLC or company depends on the state in which you do business and the process can take anywhere from 1 business day to 4 weeks. depending on the state in which you are setting up your business and the time the secretary of state takes.

List of legal documents required to do business in the United States

- Registration certificate

- Business plan

- Non-disclosure agreement (NDA)

- Insurance policy

- Contract documents

- Registration of a patent or copyright

- Operating agreement

- Business license

- Get EIN

The EIN is a tax identification number issued by the Internal Revenue Service (IRS) of the United States to identify a business. The EIN is very important to your business because it can help you do the following:

- open an account with a commercial bank in the United States

- Start a business

- apply for business permits and licenses

- Hire employees

- Submit your tax returns

If you are a US citizen and have a Social Security Number (SSN), you can apply for an EIN using the IRS website. But if you are not a US citizen, it is recommended that you hire a business attorney as an authorized person on your side and apply for an EIN on your behalf.

- Get a mailing address in the United States

Most US banks also require a mailing or residential address to open a bank account. You can provide your business address if you have a business address in the United States. But if you don’t have an address in the United States, there are several companies that can help you get a business address in the United States.

- Sasquatchmail.com (from $ 29 per month), iPostal1.com (from $ 10 per month),USAMail1.com (starting at $ 10 per month).

PhysicalAddress.com (from $ 8 per month)

TravelingMailBox.com (starting at $ 15 per month)

EarthClassMail.com (starting at $ 69 per month)

These companies analyze your emails and send you emails. You can view your letters online or forward them to any other international address, wherever you live. Please note that before you can use their service or forward mail to your inbox, you may need to submit a United States Postal Service (USPS) Form 1583 to authorize these services to open your mail on your behalf.

- Open an account with a U.S. commercial bank

Until recently, companies were allowed to open a commercial bank account from any part of the world, but this fact is no longer available. You have to come to the United States and visit a bank in person to open a bank account today. You can start processing your bank account as soon as you receive your EIN.

You are strongly advised to never allow anyone to open a business account on your behalf. If you find someone or a business offering this service, keep in mind that you might be the victim of a scam. Here are some of the documents you need to submit before you can open a business bank account in the United States;

- IRS EIN letter

- Copy of the charter of the organization

- Ownership agreements (operating agreement if it is an LLC)

- Passport

- Open a merchant account to receive customer payments

Merchant Services accounts allow you to accept credit and debit card transactions from your customers. The most popular options for opening a trading account:

- Stripe.com (no SSN required, all you need is an EIN) Payoneer.com (great for non-US residents)Braintreepayments.com

Authorize.net

Paypal.com (SSN required, which most non-US citizens don’t have)

- Get business insurance

Commercial insurance is another area to look for when starting a business in the United States. Commercial insurance protects you from the unforeseen costs of running a business. You should talk to insurance agents to find out what types of insurance are right for your business and compare terms and conditions and prices to find the best deal for you.

Some of the business insurances that you should look for include; General Liability Insurance, Product Liability Insurance, Professional Liability Insurance, Commercial Property Insurance, Home Business Insurance, and Business Owner Policy.

Note that you may not need all of these insurance policies and you may need more. This is why you need an insurance consultant to help you check the variables at hand. Again, you may need to spend some time to get the best deals out there.

- Get ITIN

ITIN stands for Individual Tax Identification Number and must be obtained if you are not a U.S. citizen without a Social Security Number (SSN). The ITIN is a personal tax identification number issued by the IRS to people who need a U.S. tax identification number but do not have a Social Security Number (SSN).

You need an ITIN for:

- Open a US bank account (for individuals and corporations) (all US banks need an SSN or ITIN to open a bank account)

- Submit your tax return if you have to pay taxes

- Comply with all US federal withholding tax requirements if you received US income.

- Leave it to your employer to help you find a job

- Apply for a mortgage and finance a car

- Request the rental of an apartment

- Open a Paypal or Stripe account that requires ITIN to accept payments

With the ITIN, you will be able to open a US bank account, file tax returns, and file the IRS if you don’t have an SSN.

- Understand your tax obligations and save your taxes

For You To run a successful business in the United States, you need to respect your taxes and make sure they are filed on time. It is strongly recommended that you consult an accountant to ensure you file your income tax returns on time and, if necessary, set up your payroll.

Previously, single-member foreign companies benefited from the US tax exemption. requirements. However, as of the 2021 tax year, LLCs that are wholly owned by foreign entities and have not elected to be treated as corporations for tax purposes are subject to the new reporting requirements of the ‘IRS.

All foreigners who own a US LLC must file a US 5472 tax return with the IRS for disclosure purposes, even if they do not owe US tax. The deadline is April 15 for LLCs that use a calendar year.

- Separate your business and personal bank accounts

If you are setting up an LLC or an S-Corporation, you should make sure that your business and personal accounts are separate. Separating your business assets from your personal assets can help ensure that your LLC or corporation is solely responsible for its debts and obligations, and that you and others are protected.

If you do not support this financial separation, you risk losing the liability protection that your LLC or company provides. This is why this step has been touted as one of the steps to start a business in the United States.

- Support the business and make annual payments on time

If you fail to service your LLC or company under US law and pay your annual fees, you run the risk of breaching your personal liability protection by putting your personal assets at risk.

For non-U.S. Residents trying to figure out how to start a business in the U.S., obeying the law is absolutely essential to avoid visa, immigration, and tax issues. Most states have some form of fixed cost to form an LLC or corporation, so make sure you understand these fees and charges and pay them on time.

- Make sure you meet city or county requirements

Even if you have complied with the state requirements for setting up your LLC or corporation, you will also need to contact the city or county where your LLC is located to determine if you need a license or license. an authorization to do business.

You should understand that if your business is an LLC or a corporation, you may need to apply for licenses and permits from the county or city. Some counties and cities also require you to register your database administrator – business name or notional name – if you use one.

Local governments determine registration, licensing, and authorization requirements, so visit your local government websites to see what you need to do. Additionally, you may need to obtain a federal license or permit if your business is regulated by a federal agency. All of these processes should be taken seriously when setting up your business in the United States to make sure you don’t run into any issues when setting up your business.

Business licenses and permits required to start a business in the United States

To start a business in America, you will need federal and state licenses and business permits. However, there are basic and most common licenses and permits that all businesses need. Without these licenses, you run the risk of being restricted by authorities involved in law enforcement in America, which include the following:

- Fire Department Permit -: You must obtain a permit from your fire department if your business uses combustible materials or if your premises will be open to the public.

- permit for air and water control -. Check with your government environmental agency for any federal or state regulations that may apply to your business.

- Authorization to Sign – Check the rules and get written consent from your landlord before diving into the sign design and installation.

- Permit government county’s governments County often need the same types of permits and licenses that cities. So, if your business is located outside any jurisdiction of a city or town, these permissions apply to you.

- Sales tax license . Sales taxes vary by state and are charged at the retail level. It is very important to know the regulations of the states and places where you do business, because if you are a seller you must collect state sales tax on every sale you make.

- Health Department Approval This costs around $ 25 and varies depending on the size of the business and the amount and type of equipment you have. The Department of Health will want to inspect your facilities before issuing a permit.

List of Government Agencies Responsible for Business Registration and Licensing and Permitting in the United States

There are different licensing bodies around the world. The United States of America has its own agencies that deal with permits and operating licenses. They make sure that a business must be properly licensed before a business can fully operate.

Here is a short list;

- Agricultural Services Agency (FSA)

It is an agency of the USDA that merged with many predecessor agencies, including the Agricultural Stabilization and Conservation Service (ASCS). The ASCS was, like the FSA now, primarily responsible for enforcing conservation laws and regulating agricultural holdings across the country. The FSA Administrator reports to the Under Secretary of Agriculture for Agriculture and Foreign Agricultural Services.

- Food Safety and Inspection Service (FSIS)

This organization is an agency of the United States Department of Agriculture (USDA). It is a public health regulatory agency responsible for ensuring that commercial shipments of meat, poultry, and eggs to the United States are safe, sound, properly labeled, and packaged. He is also responsible for the security of public food-related companies as well as business investigations.

- Small Business Administration (SBA)

The SBA is the body responsible for bringing together innovative entrepreneurs, corporations, universities, foundations and others to increase the prevalence and success of American entrepreneurs.

- Food and Drug Administration (FDA)

This organization is a federal agency of the US Department of Health and Human Services. The FDA is responsible for protecting and supporting public health through the regulation and control of food safety, tobacco products, nutritional supplements, prescription and over-the-counter pharmaceuticals, vaccines, biopharmaceuticals, blood transfusions, medical devices, electromagnetic devices. radiation emitting devices (ERED), cosmetics, animal feed and veterinary products

- Internal Revenue Service (IRS)

The Internal Revenue Service is a very important part of the United States federal government. The government agency is an office of the Ministry of Finance and is below the immediate management of the Internal Revenue Commissioner. The IRS is responsible for collecting taxes and administering the Internal Revenue Code. He has also overseen various benefit programs and oversees compliance with the Affordable Care Act.

Doing business in the USA. Business statistics to know

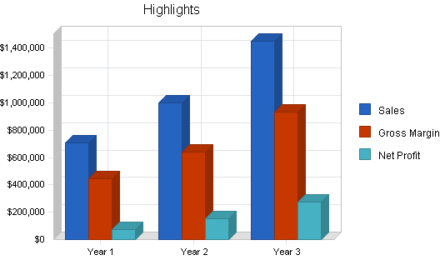

- Economic analysis

When you want to start a business in the United States of America, there are a lot of things to consider from an economic standpoint. Some of the factors considered are: Human capacity building and job creation, social policy and corporate social responsibility initiatives, infrastructure improvements, technology and knowledge transfer.

An important feature of the US economy is the economic freedom granted to the private sector by granting permission to the private sector. make major economic decisions to determine the direction and scale of what the US economy produces.

This is facilitated by relatively low levels of government regulation and involvement, as well as the judiciary, which typically protects property rights and enforces contracts. Thus, the United States currently has 29.6 million small businesses, 30% of the world’s millionaires, 40% of the world’s billionaires, and 139 of the world’s 500 largest companies.

The United States is rich in minerals and fertile farmland, and it is privileged to have a modest climate. It also has extensive coastlines in the Atlantic and Pacific Oceans, as well as the Gulf of Mexico. Rivers flow from far into the interior of the continent and the Great Lakes – five large inland lakes along the US border with Canada – to provide additional access to navigation. These vast waterways increased the country’s money supply and helped unify the 50 separate US states into one economic unit.

American facts and figures that will interest you as an investor / entrepreneur

There are many facts and figures in the United States of America. Not surprisingly, people are forcing states to do business in one form or another. This is due to the enormous mental capacities and resources that the country possesses. Here are some helpful facts that you might find helpful:

- The United States is rich in natural resources, well-built foundations and high levels of production

- The results showed that they have the ninth highest GDP per capita in the world and the tenth highest GDP per capita.

- Americans have also been found to have the highest typical household and worker incomes. In 2010, the country’s income was the fourth highest for the average household.

- The United States is the world’s largest producer of oil and natural gas.

- It is one of the main countries of the world in the world. as well as the second largest producer in the world, representing a fifth of world production. As well as being in the United States, it also has the largest domestic market for goods and trade in services. In 2012, it turned out that the total volume of US trade was around $ 4.93 thousand or more.

- There are fifty states in the United States of America.

Factors or Incentives for Investors to Invest in a Business in the United States

Investors want to reap when they sow, so it is very important that the country in which the funds are invested has very fertile soil which can lead to profitability. There are several incentives that attract investors to the United States of America. Here are some of the benefits of investing in the United States of America:

- A strong economy

- A reliable infrastructure

- Big market

- Economies of scale

- The strength of the dollar currency

- Government support for economic development through infrastructure development, simplification, among others

- The availability of infrastructure and public services such as good roads, electricity, communications, the absence of corruption and bureaucratic delays in obtaining these services contribute to the development of entrepreneurship.

- Economic freedom in the form of promising legislation and several obstacles to starting and running a business fuel entrepreneurship.

- Strict laws related to the protection of labor rights and the environment.

10 well-known foreign brands doing business in the United States

- Lucky Strike England Cigarettes

- Budweiser Germany

- Vaseline england

- good humor from England

- Hellmann Germany

- Purina Switzerland

- French France

- Frigidaire Sweden

- Popsicle England

- 7-Eleven Japan

- Samsung Japan

List of 10 Famous Indigenous Brands Doing Business in the United States

- Apple

- Google Incorporated

- Chevron

- CNN

- United Parcel Service

- Portland branch of the American Indian movement

- Apache Incorporated Services

- HP

- Blue Head Tequila LLC

List of the 10 most popular entrepreneurs in the United States

- Steve Jobs, Apple

- Mark Zuckerberg, Facebook

- Alphabet by Larry Page, Google Incorporated

- Henr and Ford Ford Motor Company

- Oracle Larry Ellison

- Donald Trump Trump Organization

- Robert Kiyosaki The Rich Dad Company

- Sam Walton Wall – Mart