Are you interested in starting an insurance company from scratch? here is a complete guide to starting an insurance company from scratch with little money and no experience .

Ok, so we’ve provided you with a detailed example of an insurance company business plan template. We also took it a step further by analyzing and writing an example insurance company marketing plan backed by actionable guerrilla marketing ideas for insurance companies. In this article, we will go over all the requirements for starting an insurance company. So put on your entrepreneurial hat and let’s take action.

The insurance industry is large and global; Anyone interested in starting an insurance company can choose to specialize in many areas. For example; in the United States of America and even in Canada, pet insurance is one aspect of insurance that is gradually opening up and it is interesting to say that it is a very promising market.

Anyone wishing to set up an insurance company has the option of choosing an area of insurance to specialize in or can set up a general insurance company; an insurance company that sells life insurance policies, health insurance policies, auto / auto insurance policies, and liability insurance, among others.

How easy is it to start an insurance company?

If you are considering starting an insurance company, you will need to obtain an insurance license from your country’s insurance regulator before you can start your own insurance company. In the United States of America, the industry is regulated by the National Association of Insurance Commissioners.

Without a doubt, the process of obtaining an insurance license can be difficult; it depends on what part of the world you live in. Any applicant for an insurance license will have to meet certain set criteria, which sometimes makes it difficult for the bureaucracy to get involved in the whole process.

As stated earlier, you will not be allowed to set up your own insurance company without first obtaining the required license. To be able to apply for an insurance license, you must first take and pass several licensing exams. If you are serious and determined, you can write and pass the exam in one sitting, but if not, you must be prepared to take the exams over and over again. The bottom line is that these reviews don’t come cheap; therefore, you must prove your worth before a license is issued to you.

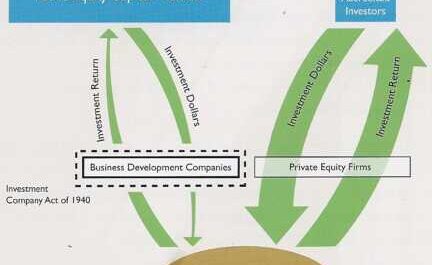

It is also important to note that if you are interested in an investor with a portfolio with an insurance company, you may not need to go all the way to pass the required insurance exams. and obtain the required insurance certificates. All you have to do is provide the necessary finances and relationships and then involve people who have the necessary paperwork / documents to work with when setting up your insurance company.

Like most businesses, the insurance industry is quite open. for so many people who are interested in the industry if you have what it takes to run an insurance company. Even if you don’t have the financial and other requirements to start an insurance company, you can enter the industry by starting with a licensed insurance broker.

Creating an insurance company from scratch. The Complete Guide

- Industry overview

- Interesting statistics on the insurance sector

A report released by McKinsey estimates that the insurance industry in the United States spends about $ 13 billion a year on unnecessary regulatory costs under the government’s regulatory system.

In the insurance industry, only the smallest insurers exist as a single company. In the insurance industry, there is a practice where most of the large insurance companies exist as insurance groups; they usually do business with holding companies. This practice has many advantages and, in fact, insurance groups are known to experience turmoil in the insurance industry year after year, and the survival rate of individual insurance companies is quite low.

In some countries, confidence is one of the main factors hindering the growth of the insurance industry. Additionally, the insurance company continues to grow and as the country’s economy continues to grow; the insurance company usually monitors it.

The fact that there are several insurance companies and insurance brokerage firms does not preclude an investor or entrepreneur from entering the insurance industry. If you know what you want and have the right strategy, you are sure to be successful in the insurance industry.

People are encouraged and motivated to take risks in the insurance industry because of the profitability of the industry and because, despite the saturation of the industry, it is still possible to create their own unique or unique insurance products. even to partner with bigger insurance companies if you can successfully build own insurance company to a certain level of success.

Launch of a feasibility study for the insurance company market

- Demography and psychography

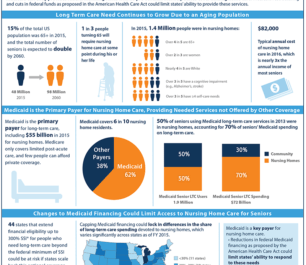

One thing about the demographic and psychographic makeup of an insurance company is that it covers both infants and the elderly, teens and adults, students and the working class, businesses and small business, government (public sector) and private sector, etc.

Basically, the demographic and psychographic makeup of the insurance industry covers it all; it covers so many people who can afford to insure their lives, property, families, pets and other personal valuables.

List of insurance industry niche ideas you can specialize in

When it comes to niches and areas of specialization, the insurance industry has several options. In fact, the insurance company can come up with creative ideas on the areas of insurance in which they want to specialize.

For example, pet insurance is rapidly gaining ground in the United States of America. and in Canada Here are some niche areas of the insurance industry in which an investor or entrepreneur could specialize;

- Life and annuity insurance

- Medical / health insurance

- Auto / vehicle insurance

- Animal insurance

- Agricultural insurance

- Aviation insurance

- Financial reinsurance

- Insurance of guaranteed assets

- Collective insurance

- Inland marine insurance / marine insurance / shipping insurance

- Travel insurance

- Liability insurance / Professional liability insurance

- Property and accident insurance

- Mutual Insurance

The level of competition in the insurance sector

If you are an active player in the insurance industry, or even have one or more insurance companies, you will agree that there is a lot of competition in the insurance industry. Each insurance company is willing to sell as many insurance policies to as many customers as it can find, and hence the level of competition in the banking industry.

Most insurance companies take care to position their businesses to remain competitive, so that instead of sticking to one type of insurance, they participate in general insurance. The idea is to do what you know will give you leverage in the market.

If you understand from your market research and visibility studies that it will be in your best interest to specialize in only a few areas / niches of insurance, then if not, you should try your hand at selling. general insurance policies.

List of famous brands in the insurance sector

There are several leading insurance companies in the world, whose activities are not limited to one country, but to other countries and continents of the world. Here are some of the major insurance brands in the insurance industry:

- AXA Group

- American International Group (AIG)

- Life insurance in China

- ING Group

- Insurance group ping

- Generali Group

- Allianz

- MetLife

- Zurich Financial Services

- QBE Insurance Group

- Allstate

- AS

- Munich re

Economic analysis

There is no doubt that when you decide to start an insurance company, you need to know what you are saying about a capital intensive business. In addition to the money you will need to rent an office, register a business, obtain the required business permits and licenses, and then consider paying your staff for at least 6 months or more, you should also be prepared to respond. financial / funding requirements as indicated. by the insurance regulator in your country.

Like the banking industry, the insurance industry is another industry in which you need to have some basic capital before you can successfully start a full-time business; The money required is generally in the order of several thousand dollars. Indeed, one of the problems that insurance companies usually face is the inability to pay claims. So, to solve this problem, anyone wishing to start an insurance company must meet the established financial / funding requirements.

Is it worth starting an insurance business from scratch or is it better to buy a deductible?

Well, there are several opportunities for any investor who wants to have an insurance company to buy a franchise from a successful insurance company, or at least partner with a successful insurance company.

So if you want to start an insurance company, you have a choice of two options; One option is to buy a franchise or a partner from an insurance company, and another option is to start your insurance company from scratch.

Whether you choose to start your insurance company from scratch or buy a deductible depends on many factors, and it is not a decision that can be made in isolation; Your business plan and, of course, your business partners should have a significant impact on your final decision.

Also, if you intend to start an insurance company in order to build a global brand and take complete control of your insurance company, it is best to start your insurance company from scratch and to build your brand the way you want. But if you are intending to start an insurance company to own a portfolio of insurance business and of course to make money, you may want to consider purchasing a franchise or partnering up. to a successful insurance brand.

Threats and potential challenges you will face when setting up an insurance company

One thing is certain: a weak economy is one of the main factors limiting the growth opportunities of the insurance industry. When you think about it, there is hardly any business or investment opportunity that doesn’t come with its own share of threats and challenges. This is why most organizations regularly conduct risk assessments to enable them to develop strategies that will help them stay afloat in the industry.

Another threat and major challenges that you are likely to face when starting your insurance business is of course the arrival of another insurance company in the same place as yours, and possibly the sale of insurance companies. same insurance policies with you. If you don’t have workable and winning strategies to help you outsmart your competition where your insurance company is located, you are likely to have a hard time growing your insurance company and keeping some of the best hands in your hands. . employment.

In addition, as in any area of business and investment, economic downturns, volatility in financial markets, natural disasters and adverse government economic policies can hamper the growth and profitability of an insurance company.

Creation of an insurance company for legal matters

- Best Legal Entity To Use In Insurance Industry

If you are considering starting an insurance company, creating a relationship with the best legal entity for the business will determine the success of the business.

There is no doubt that choosing a legal entity for a business such as an insurance company is fair or correct. When it comes to choosing a legal entity for your insurance company, you have the option of choosing from a general partnership, a limited liability partnership, an LLC, a C corporation, or an S corporation. It is important to make it clear that these different forms of corporate legal structure have their own advantages and disadvantages; This is why you must carefully weigh your options before deciding on the legal structure on which your insurance company will be built.

Here are some factors to consider before choosing a legal entity for your insurance company; limitation of personal liability, ease of transfer, acceptance of new owners and investor expectations and tax matters. If you take the time to critically research the different legal entities to be used by your insurance company, you will be fine with this limited liability company; LLC is the most appropriate. You can start your insurance company as a Limited Liability Company (LLC) and turn it into a “C” or “S” company in the future, especially if you are planning to go public.

Switching to a “C” or “S” company will give you the opportunity to expand your insurance company to compete with the major players in the insurance industry; you will be able to receive capital from venture capital companies, the stock market, you will have a separate tax structure and you can easily transfer ownership of the business; you will have flexibility in ownership and in your management structures.

Catchy Trade Name Ideas Suitable For Insurance Companies

If you take the time to go through the names of most of the best insurance companies in the world or the insurance companies that you can find around you, you will realize that there are no hard and fast rules for choose a name for an insurance company.

So, if you want to choose a name for your insurance company, you have the option of naming it whatever you like; it could even be the name of your village or a combination of the initials of all your families. Here are some of the catchy names that you can choose from if you are planning to start your own insurance company;

- Access assurance API

- EPL Group

- Mutual fiduciary insurance

- Peak Insurance PLC

- Marine group

- Life insurance

- Headstone Insurance PLC

- Diamond Aviation Insurance PLC

- Hedge Group PLC

- Chicago Life Insurance

Do you need insurance coverage to run an insurance company

The fact that you are starting an insurance company means that you shouldn’t have to wait to buy all the insurance policies needed for your business. Moreover, it can be said with certainty that it is impossible to set up an insurance company in the United States of America without ensuring that you have basic insurance policies established by the regulator.

Here are some of the main insurance coverages that you should consider when buying if you want to start your own insurance company in the United States of America;

- General insurance

- Health insurance

- Risk insurance

- Credit insurance

- Deposit insurance

- Financial reinsurance

- Mortgage lender insurance

- payment protection insurance

- liability insurance

- workers compensation

- provident insurance

- group business owner insurance

Obtain intellectual property protection from your insurance company

Beyond a reasonable doubt, starting an insurance company is a very serious business, so you need to do your best to mark the I and cross the I, and one of the things you need to do is look for the protection of intellectual property. … This is necessary because you need to ensure that your company logo and all other official documents such as insurance policy and claims documents are securely protected to prevent people from taking advantage of the fact that they are not protected.

You can also develop your own individual insurance applications; if you are developing your own custom software application, you should definitely seek intellectual property protection.

Finally, it may be necessary to develop unique insurance products for your customers. The fact that there is stiffer competition in the insurance industry requires that you protect your brain and that someone else can use it.

Do you need professional certification to start an insurance company?

If you are an investor interested in owning a portfolio with an insurance company, you may not have to go out of your way to pass the required insurance exams and obtain the required insurance certifications. All you have to do is provide the necessary finances and relationships and then involve people who have the necessary paperwork / papers to work with when setting up your insurance company.

At least part of your core management team needs to communicate. in the field of insurance and finance, investment, risk and other fields related to finance and insurance.

List of legal documents required to manage an insurance company

The insurance industry is one of the highly regulated industries in the United States of America and of course the world. If you are considering setting up an insurance company, you must comply with the legal requirements required by the constitution of your country.

Here are some of the basic legal documents that you should have with you if you want to set up an insurance company in the United States of America;

- Registration certificate

- Insurance business license

- Business plan

- Non-disclosure agreement

- Memorandum of Understanding (MoU)

- Online terms of use

- Online privacy policy

- Apostille (for those planning to work outside the United States of America)

- Employment contract (letters with proposals)

- Operating contract

- Company charter

- Operating Agreement for LLC

- Insurance policy

Development of a business plan for your insurance company

One of the first steps to take if you want to start an insurance company is to consult with experts to help you develop an effective and achievable business plan. The truth is that in order to successfully run an insurance company, you must have a good business plan.

A business plan is an essential roadmap to the success of a business; Having a workable business plan will help you reduce the trial and error approach to doing business. You will be able to run your business with purpose and possibly with precision; You will know what to do at all times and how to deal with business challenges and business growth / expansion.

Basically, if you want to start your own insurance company, you have to write a detailed business plan that can pass a reality check when it does; you should be working with facts, figures and other metrics in the insurance industry as it relates to the places / countries where you intend to set up your insurance company.

The idea of developing a business plan is not just to have a business document in place; but a detailed guide on how to effectively run your business from scratch. Your business plan should describe and describe the management and development strategies of your insurance company. The rule of thumb when writing a business plan is to try to be as realistic as possible and never overdo projects, relying on income and profits, etc.

These are the key areas to cover in your business plan;

- Resumes and business descriptions: you are expected to write about your business concept, descriptions of your business, a statement about your business, your business mission and location, as well as whether you intend to do doing business with other companies or opening branches in different cities of the United States of America and other parts of the world.

- Other key elements to watch out for in your insurance business plan are product offering, SWOT analysis, competitive analysis, marketing / analysis / sales strategies, target market, market objectives, prices, costs and financial forecasts. , advertising and advertising strategy, expansion and growth strategies, budget and start-up capital, etc.

How much does it cost to create an insurance company?

When it comes to starting an insurance company, you should know that the cost is double; the costs of setting up the office structure (including branches) and, of course, your capital base / capitalization. Basically, the nature and size of the insurance company you plan to start will determine how much you are expected to charge.

When it comes to the costs of setting up an office structure, your job should be about safety. nice office in a busy business district; although it can be expensive, it is a factor that will help you position your insurance company to attract the customers you would like to do business with.

When it comes to starting small-scale insurance If the business may be an insurance brokerage company, you should be guided by the following costs:

- The total business registration fee is $ 750.

- The budget for insurance policies, permits and licenses is $ 10,000

- The amount required to purchase a suitable office space in a business district with a 6 month rent advance (Re Construction of the object included) $ 50,000.

- The cost of office equipment (computers, printers, fax machines, furniture, telephones, filing cabinets, gadgets and electronics, etc.) $ 5,000

- Cost of launching your official website $ 600

- Budget to pay at least 10 employees for 3 months and utility bills of $ 200,000

- Additional costs (business cards, signs, advertisements and promotions, etc.) $ 2,500

- Capital base – $ 1 million (you can confirm that your country has a requirement as it varies from country to country and even state to state in the United States of America)

- Miscellaneous $ 10,000

Based on the study report and feasibility studies, you will need approximately 1.2. Million USD to create a small but standard insurance company in the United States of America.

You will need over US $ 5 million to successfully start a mid-size insurance company in the United States of America. …

If you are planning to start a large insurance company with multiple branches in key cities in the United States and other countries, you should expect a budget of over $ 50 million.

- Finance your insurance business

It may be easier to raise some start-up capital if you decide to set up an insurance brokerage company, but the truth is that setting up a standard insurance company is usually not a matter for an individual. can do it alone, you should always invite business partners / investors who just put the money together because the amount needed to capitalize.

Here are some of the options you can explore when looking for start-up capital for your insurance company;

- Raising money from personal savings and the sale of personal stocks and property

- Raise funds from investors and business partners

- Sale of shares to interested investors

- Apply for a loan from your bank / banks

- Transfer your business idea and apply for business grants and seed funding from donor organizations and angel investors

- Source of loans on favorable terms from your family and friends.

Choose a location for your insurance company

Without a doubt, location is a key factor that contributes to the success of any business. If you are wrong to choose the wrong location for your business, you will likely have a hard time growing the business, and if no action is taken, you could end up closing the store due to a lack of customer base.

For this reason, if you are looking for a starting point, your insurance company, you should be prepared to pay experts to help you conduct a thorough feasibility study and market research; they have to go there to research and then make recommendations.

A suitable place for an insurance company is a place with a healthy and thriving business; a place where there is a constant cash flow. Places such as markets, shopping malls, business districts, etc. Suitable for an insurance company.

Here are some of the factors to consider before choosing a location for your insurance company;

- Location demographics

- The nature of the business activity there

- The purchasing power of the residence at this location

- Seat availability

- Number of insurance companies in this location

- Local community / state laws and regulations

- Road, parking and security services, etc.

Creation of technical staff details of the insurance company

If you are considering starting an insurance company, you should turn to ICT specialists who can help you develop your own insurance software, a secure internet platform, and an online payment system (which will help you simplify payment of your premiums). Here are some of the technical points that you should be prepared to understand before successfully starting your insurance company.

When it comes to choosing between leasing and leasing office space, the size of the organization you want to create and your overall budget for the business should influence your decision. If you want to start a standard insurance company, you should consider renting or buying the property outright; When you rent or buy a property, you will be able to work with long-term planning. But if you just want to open an insurance brokerage business and are short on cash, your best bet is to rent an office.

When it comes to hiring employees for key positions in your insurance company, you should only hire people who are not only qualified and experienced, but also those with whom you are ready to start a business. To attract these people, you can consider incentives such as owning a percentage of the company’s stock. This will make it easier for you to gain support from trusted industry representatives.

You may need at least 10 full-time employees to start an insurance brokerage company, but if you want to start small – if you are growing a standard insurance company, you need to assign more than 10 employees. full-time to help you play key roles in your organization.

Creation of an insurance company marketing plan

- Marketing ideas and strategies for your insurance company

Starting and running an insurance company requires aggressive marketing, so you, the men and women who sell insurance, should always purchase insurance coverage or some other, especially if you live in the States. -United. States of America.

So, to stay afloat in the insurance business, you must be prepared to spend a lot of money on marketing, advertising and promoting your insurance products. Your marketing and advertising departments should regularly publish new innovations and products that can catch the attention of your potential customers.

It is for this reason that when developing your marketing ideas and strategies for your insurance company, make sure you create a compelling personal and business profile, which should include a profile of your board of directors and your management team.

The truth is, if you have an honest, trustworthy, and efficient professional on their advice, clients can easily trust you with their hard-earned money. In some countries, confidence is one of the main factors hindering the growth of the insurance industry.

Here are some of the platforms you can use to promote your insurance policies;

- Introduce your business by sending cover letters along with your brochure to investors and businesses

- Promote your business in relevant business magazines (insurance magazines and trade magazines) and be available for insurance talk shows and interactive TV and radio sessions

- Register your business on local directories / yellow pages (online and offline)

- Attend exhibitions, seminars and trade shows, etc.

- Use online resources to promote your insurance business

- Join local chambers of commerce around you for the primary purpose of networking and marketing your insurance products.

- Use of the services of marketing managers and business developers for direct marketing

Possible Competitive Strategies to Beat Your Competitors in Stry Insurance Industry

Without a reasonable doubt, competition in the insurance industry is high in the United States of America and, of course, in most countries with large numbers of insurance companies. So, if you intend to build a strong and healthy insurance business, you must come up with unique insurance products and creative strategies to outsmart your industry competitors.

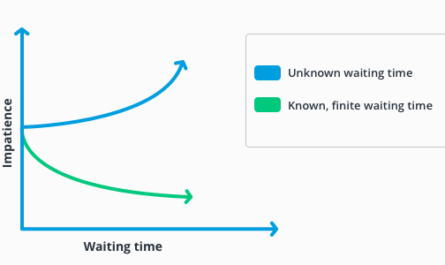

Above all, you need to make sure that you pay your claims on time and that it is in your best interest to lower your premiums and provide better coverage and policies etc. Your customer service must be top notch; the truth is, customers will always go wherever they believe they are getting the best customer service. Along with top-notch customer service, you also need to make sure that your systems and processes are running smoothly and efficiently, especially if you’re involved with premium online payments.

Possible Ways to Increase Customer Retention for Your Insurance Business

Come to think of it, if you want to stay competitive and continue to grow your customers in any business, you have to be creative and always look for ways to outsmart your competition in the industry. In fact, if you can successfully close your back doors and make sure that at least 60% of your customers are retained, your business is healthy and successful.

Some of the things you can do are increase customer retention so you can work to pay your claims on time, streamline the premium collection process, and regularly issue incentives to your customers through promotions and promotions. free services, and more.

Your customer service should be top notch and your CRM software applications should be deployed as much as possible so that you can stay in touch with all of your customers. When you remember and celebrate your customers on their special occasions, you are likely to gain the loyalty of those customers.

Strategies to increase brand awareness of insurance companies and create a corporate identity

The insurance industry, like any other business, needs a hype to get people to buy a brand. Your brand has to do with how people perceive you, so you need to be careful when it comes to communicating and promoting your brand.

When promoting your brand and corporate identity, you should use both print information and electronic media. In fact, using social media to promote your brands is profitable and highly effective. Here are the platforms you can use to increase awareness of your insurance company and promote your corporate identity in the market;

- Advertise on national TV channels, radio stations and newspapers / magazines

- start your own special TV programs

- sponsor relevant community programs

- use on the Internet and on social media platforms such as; Instagram, Facebook, Badoo, YouTube, Twitter, etc.

- Set up display panels at strategic points

- Take part in roadshows from time to time

- Occasionally distribute flyers and leaflets to target areas

- Send cover letters to multinational corporations, embassies and diaspora organizations and networks in and around your region

- Encourage word of mouth use, especially from repeat customers

- Make sure all your vehicles have your company logo

- Make sure all of your employees wear your designer shirts at least once a week during office hours

Tips for successfully running an insurance company

- Whatever you do, your ability to get everyone on your team to be on the same page in The Times is one of the keys you need to successfully run an organization.

- As the CEO or president of an insurance company, you are responsible for the direction of the company and you must partly make sure that you have time for office meetings; when problems, feedback, forecasts and topical issues are discussed. Meetings can take place daily, once a week, twice a week, or once a month. The bottom line is that your organization should have regular meetings.

- Carrying out regular assessments and training your employees will help you manage your organization effectively. Encourage your employees to obtain certifications in their different areas of specialization; this will help your organization’s profile and of course help individuals. You can sponsor some of the certification exams in whole or in part.

- Finally, you need to keep your doors open to suggestions from your team members and clients. It is very important to reward the excellent performance of your organization; this will go a long way in encouraging healthy competition in your organization.