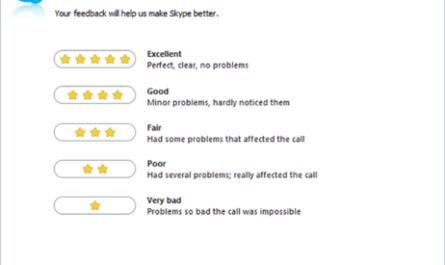

Running a business is managing taxes. Sometimes it feels like all a business does is track FCIA and local payroll taxes, as well as produce quarterly business income data. Keeping track of taxes is a lot of work, and businesses that can’t afford an accountant have to do all the work themselves.

If the person preparing the tax return does not meet the tax requirements, there may be an error that can cause the business problems with the IRS.

Here are some of the most common ways a business can pay taxes and become a headache.

Do not pay FICA taxes

Image via Flickr by Matt from London

Although businesses must pay FICA taxes, these taxes are mostly paid by workers and are intended for their future security, as well as income taxes. An employer who withholds these taxes and does not regularly transfer them to the IRS collects money from workers. It gets worse when the employer uses the money for the business instead of paying the IRS – the IRS condemns “stealing Peter to pay Paul”. Your best bet is to put money aside for taxes and ignore their existence until it’s time to transfer them.

Do not apply for an extension

Sometimes it happens that the documents are not ready to be filed until April 15, the IRS recognizes this fact and offers a six month extension to allow the company to retrieve its documents and file them without penalty. This means that a business should always file taxes or expanding to avoid problems. No renewal increases the likelihood of audits, fines and penalties.

When a business is struggling to maintain order in tax matters, it is high time to seek the help of a professional tax agent. Hiring a third party to take care of taxes will avoid problems with the IRS, allowing the business owner and employees to do more work in a day.

Under the income statement

While this results in a decrease in the amount of taxes owed, it can also trigger an IRS audit. And if the IRS finds that there is undocumented income, the business will incur penalties and interest for non-payment. Never underestimate a company’s income statement. There is always a chance that the IRS will check and find the missing money.

It is best to file the taxes as the IRS expects. Employers should make sure they are charged payroll taxes so that employees get credit, add extensions as needed, and correctly report profits and losses to avoid audits. Honesty is the best policy to avoid problems with the IRS.