What is a third party transaction?

A third party transaction is a commercial transaction that involves a person or entity other than the primary parties. It usually involves a buyer, a seller, and another party—a third party. Third party involvement may vary depending on the type of business transaction.

In some cases, participation is one-time, such as payment by a third party for an item purchased on a website. Sometimes the involvement is long-term, such as a third-party supplier that a particular company always uses.

Key Findings

- A third party transaction often involves a seller, a buyer, and an additional unrelated party.

- Examples of third party transactions are found everywhere in everyday life, including insurance brokers, mortgage brokers and online payment portals.

- In the digital age, thanks to online payment platforms, the number of people and businesses involved in third party transactions has increased dramatically.

Understanding Third Party Transactions

When a buyer and seller enter into a business transaction, they may decide to use the services of an intermediary or third party who manages the transaction between both parties. The role of the third party may vary. This could involve working out the details of the transaction in question, providing a specific service for a company that is slightly outside its wheelhouse, acting as an intermediary connecting two parties, or acting as a means of receiving payment from a buyer and forwarding that payment. to the seller.

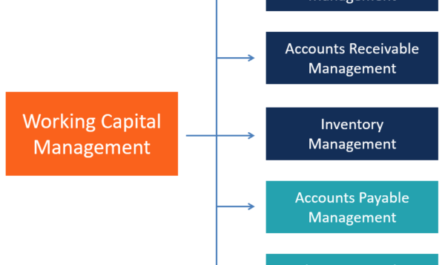

Transactions with third parties are important to a variety of accounting policies and occur in a variety of situations. It is important to note that the third party is not affiliated with the other two parties to the transaction. For example, if Firm A sells inventory to its subsidiary, Firm B, a third party transaction occurs when Firm B sells those final goods to Firm C.

Example of a third party transaction

Many types of transactions involve third parties and occur every day across a variety of industries.

For example, in the insurance industry, insurance brokers are third-party agents who sell insurance products to insurance buyers. The client goes through a broker to get a good insurance contract with reasonable rates and terms, while the insurance company works through the broker to attract a new client. If the broker manages to attract a new client to the insurance company, the insurer pays him a commission.

In the same light, a mortgage broker is considered an intermediary in third party transactions because they will attempt to match the needs of a potential home buyer with the loan programs offered by the lender.

Through digital platforms, the buyer can make payment for the purchase of a product or service purchased from a third party.

Special Considerations

As technology advances and the way we interact in the digital age changes, more people and businesses are engaging in third-party transactions through online payment platforms.

Through digital platforms, a buyer can make payment for the purchase of a product or service purchased from another person. This third-party vendor receives payment from the buyer, verifies funds, and debits the buyer's account. The money is then transferred to the seller's account – usually through the same online portal. The merchant account may be credited within minutes or days, but the funds may be withdrawn to a bank account or used for other transactions once the account is deposited.

PayPal is a good example of an online payment portal that acts as a third party in a retail transaction. The seller offers a product or service, and the buyer uses a credit card entered through the PayPal payment service. The payment is made through PayPal and is therefore a third party transaction.