Cash flow in business is related to money going into the business; it is a receivable or income and expense. Any Business or organization must have a proper cash management system for the business to remain successful.

If you are an entrepreneur, you must manage the cash flow in your business to minimize unreported money and avoid cash. flow crisis in the long run. In fact, you need to manage your cash flow in your business in order to keep track of your finances as well as to easily calculate taxes.

If you are an entrepreneur and are interested in properly managing your cash flow in your business, then the following 10 cash flow management tips will be very helpful for you:

10 Tips for Effective Small Business Cash Management

1.Have a separate entry

Cash flow is about keeping track of your finances, and an easy way to do this is to keep separate records of your income and your earnings. For instance; if you are using accounting software to maintain cash flow, the column for income or debit must be different from the column for expenses or credit. This makes your cash flow records less confusing. Also, make sure that all entries must be made immediately; for example, if a debtor makes a partial payment of a debt owed to the company, it must be entered into the debit books immediately.

2. Regular check

You must take the time to continually review your cash flow. You can do this weekly, biweekly, or even once a month. This will help you remember financial obligations and bills that need to be paid. So that you can do this on time, it will help you track the debtors of the Company and send regular reminders of what they must pay.

3. Increase your receivables

A good way to manage your cash flow is to develop ways to increase your receivables; it is the income that comes to the company. Some ways to increase accounts receivable include; invest more in advertising that translates into sales, bulk purchases to take advantage of discounts, and reminding the company’s debtors to pay their bills. Always check that debits remain high positive while loans remain low negative.

4. Take care of your bills early: … Some bills of exchange accumulate interest if they are not paid on time, so it is necessary to record cash flow data to take note of the due dates of upcoming invoices and pay them. much ahead of time.

5. Have clear ways to receive payments

Another tip to help you manage cash flow in your business is to set up a clear way to receive payments from customers. Depending on the products or services you offer, your business should set up multiple payment options to allow your customers to use any payment method that suits them. Using an electronic payment platform, it is easier than collecting payments online through: Paypal, Payza, Skrill or any other electronic processor. Other means must be entered, such as check, money order, and transfers.

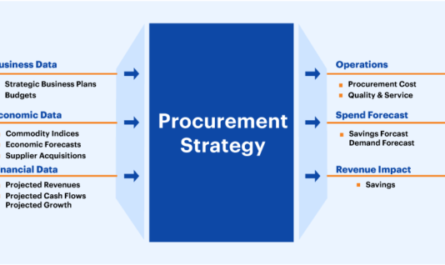

6 use software to make it easy

Using the traditional paper and pen method of writing financial statements can be boring, stressful, and time consuming. You can switch to using the software if your business or company has not yet implemented it; There are many accounting and bookkeeping programs that will make your cash flow management system easier; find it online and buy it.

7. Open different accounts for everyone

This tip applies to different bank accounts. Some people make the mistake of maintaining a single account for personal income and business money, and small business owners are always to blame for this. If your business account is different from your personal account, this will prevent you from having to charge your account to sort out your personal needs.

8. Hire an employee with accounting experience

If you are too busy to manage your cash flow records, or there are so many records that you find it difficult to handle them alone, then you may want to hire someone else to help keep the records. Someone with accounting experience would be an added advantage.

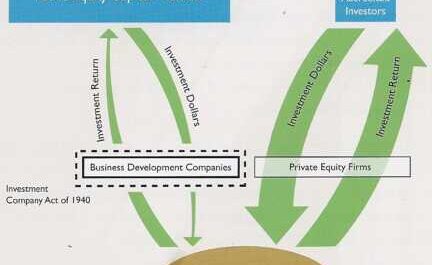

9.Use the services of a factoring company

If you have any debts that need to be paid and you need immediate cash from the organization, you can use a factoring company. The factoring company will issue you the total amount to be reimbursed, minus the agreed interest, which will serve as a payment fee between 10% and 20% of the total amount; while the factoring company returns the debt on due date from the debtor.

10. Set a target for cash flow

You can actually set how your cash flow will be over a period of time. It may be 12 months from now and you need to chart how you will work towards your goal. Your goal might look like this; After launching another product within three months, find another way to advertise the products to increase sales, with 15% of each income earned during that period going towards servicing loan interest and partial debt repayments. Companies that set such targets for their cash flow experience over 50% positive increases in their cash flow.

These 10 tips will help any business owner better manage their company’s cash flow; Finally, also remember to remove bad debts from your debits, because the chances of getting such debts back are slim.