Do you run a manufacturing company and want to correct financial leaks? here are 15 best practical accounting tips for small manufacturing businesses.

One of the most lucrative professions that people love to learn is the accounting profession. This is a course that will never go away, as accountants will always be needed in both private and public companies.

However, the reality is that not all businesses can afford the services of an auditor. The good news is that you can get some useful information to help you manage your small business account.

It is for this reason that whether you are working in a manufacturing company or even in a business, your ability to implement proper accounting processes will go a long way in the growth of your business. The truth is, if there are leaks in your business, you are unlikely to get good profits, and if it is not taken care of, the business can shut down.

When we talk about accounting advice for small manufacturing companies, we are talking about correctly accounting for produced goods, raw materials, human resources, customers and finances, among others. So if you have a small manufacturing business in the United States and want to expand, you will need to heed these accounting tips.

15 best accounting tips for small businesses

- Open different business accounts for different purposes

Of course, this is standard practice for a business that really wants to grow to make sure it has different business accounts for different purposes. Along with helping your small manufacturing business grow, it will also help your business stay focused and use various banks to access credit.

The truth is, if you only use one business account for your small manufacturing business, you are going to confuse things and the chances of having options for applying for loans will be limited to just one.

For example, if you have business accounts with three different banks, if Bank A and Bank B were not able to give you a loan for reasons they know best, Bank C might give you a loan. You can open an account for purchases, payroll, savings account, investment account, etc.

2. Get the right software for your account

I dare say that the most important piece of accounting advice for small manufacturing companies is finding the right accounting software. With the right accounting software, you will be able to effectively manage all of your accounting problems.

The truth is, you don’t have to be a CPA to be able to reap the benefits of accounting software. table.

You can choose from a variety of programs like FreshBooks, Xero, Zoho Books, Sage Intacct, QuickBooks Enterprise, Brightpearl, NetSuite ERP, Happay, SAP Business One, and Microsoft Dynamics GP, among others. Just get yourself a trial run to see if they are right for your business.

3) Hire a competent accountant

Being a handyman is great, but the fact remains that you can’t be a handyman, which is why you need to hire the right people for your small manufacturing business. So, part of the advice you need to run your small manufacturing business effectively is to hire a skilled accountant to handle all of your organization’s accounting issues – it’s easy to do, even if you just want to hire a handful. of employees for financial constraints.

4. Check your account regularly

Another very important accounting tip for small manufacturing companies is to regularly check your accounts.

While it is common in the United States and around the world for businesses to audit their accounts at least once a year or six months, it would be inappropriate to verify their account on a quarterly basis. The truth remains that when you regularly check your account, it will allow you to see what areas you need to work in, what leaks to block and the path to financial projection and growth.

5. Keep proper records of invoices and receipts

If you’re in business, you don’t want a situation where you can’t submit invoices and receipts at the behest of a court, your bank, a tax inspector, the government, or an external auditor. Basically, the importance of keeping track of all invoices and receipts in your small manufacturing business cannot be overstated. Keeping proper records will go a long way to showing that you are ready for growth.

6. Make sure the proper process is followed, especially with regards to requisitioning.

If you’re running an organization, part of what you won’t stray from is getting apps from different departments. So if you really want to grow your small manufacturing business, you need to make sure that due process is followed when filing applications. The truth is, if the proper procedures are not followed when your employees make requests, there can be financial leaks that can hamper the growth of your organization.

7. Create an efficient and practical application system

All successful and well-organized organizations have one thing in common; They have a convenient on-site registration system, which suggests that one of the best accounting tips for a small manufacturing business is to create an effective filing system. filling system that will facilitate the work of employees and management. Just make sure you have a secure, secure, and well-marked file holder.

8. Request and regularly review your account statements

Some business owners are so busy that they delegate a range of business operations that they must defend. The truth is, as a small manufacturing business, part of the accounting advice you need if you want to truly grow your business is to make sure that you regularly request and review your account statements. This will give you a clearer picture of your business finances.

9. Create checks and balances (standard business process for accounting)

Another very important tip that a small manufacturing company should follow is to make sure that it creates checks and balances in its organization. If you have effective checks and balances in your organization, you can easily eliminate leaks and fraud.

10.Adoption of international accounting guidelines for small manufacturing companies

There are international accounting guidelines for small manufacturing businesses and you will be doing your business by adopting international best practices for small businesses. To familiarize yourself with the best international accounting practices for your small manufacturing business, you should join the relevant associations in your industry for helpful advice on which industry is best suited for international small business accounting.

11. Configure a debit order for the payment of loans and debts

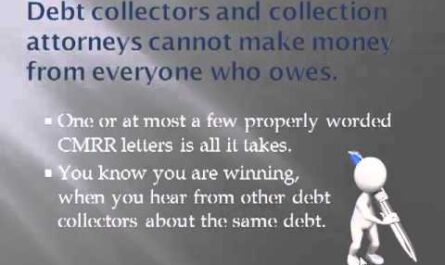

As a business, you are not immune to collecting loans and credits from other organizations and suppliers. The truth is, if you are a persistent defaulter when it comes to paying off loans and debts, it will be difficult for you to access loans or credits in the future as it will negatively affect your credit scores. .

Sometimes you might not have the money to pay off the loans you received, maybe you are very busy and forget the expected timeframe for you to repay the loan. So, part of what you need to do to avoid this is to establish a debit order to pay off the loans and debts. This will dramatically improve your credit scores and qualify you for future loans and credits.

12. Maintain a user-friendly payroll system

The fact that you are running a small manufacturing business means that you will have employees under your payroll and therefore the need for a payroll system. So, if you want to grow your small manufacturing business, you should take some accounting tips that should support a payroll friendly system.

13. make sure you pay your electricity bills on time

Another effective accounting tip that you should take as a small manufacturing business is that you always pay your utility bills on time. Some people might say you don’t have a business if you can’t pay your utility bills. This suggests that it is very important for a business owner to always pay.

14. Minimize your monetary needs when running your business

Another great accounting tip you should take if you want to grow your small manufacturing business is to try and reduce your cash flow requirements if necessary. it’s about running your business. Take, for example, reducing overhead costs as much as possible, managing inventory to make sure cash is not tied to slow moving inventory, or simply reducing monthly expenses that will help your business reduce financial leakage. .

15. Make the right cash flow forecast for your business

Another effective accounting tip that you should follow as a small manufacturing business is to always forecast the proper cash flow for your business. A complete understanding of your business means you should be able to estimate your cash flow for at least a month.

This is possible if you have successfully studied the structure of your business. With that in mind, you will be able to plan, manage your effect on working capital, and ultimately reduce financial leakage in your business.

If you can take the tips mentioned above seriously, you will be able to effectively run your small manufacturing business without having to go bankrupt.