Do you want to legally liquidate credit card debt without paying or causing harm? Your loan? here are 20 tips to get rid of credit card debt fast .

What is a credit card?

Usually the credit card is the issued card. a financial institution to allow them to borrow funds that are used at the point of sale. Credit cards are used for short term financing with borrowing limits that are set based on a person’s credit rating; and interest is still charged by the issuing financial institution one month after purchase.

Although credit cards are prevalent because they can be used in almost any store in the United States, they carry a higher interest rate than other forms of lines of credit or consumer loans. When used correctly, credit cards can dramatically improve your financial life.

How does credit card debt arise?

The fact that many Americans use it as a form of payment, most people tend to have debts that do not pay off their debts properly, which hurts their credit score. Most of the people overwhelmed by this started looking for ways to reduce their credit card debt without harming the credit card.

It should be noted, however, that while some people accumulate debt due to their spending habits, others are unexpectedly faced with debt, especially when something massive happens that they cannot. not control.

Can You Legally Get Rid of Credit Card Debt Without Paying?

Credit card debt is a huge financial burden, especially if you have very large debt. The oppression and turmoil from credit card companies and collection agencies seems better than the more experienced ones, and even if you make a payment plan, it can take months, if not years, to pay it off. debt in full.

The good thing is, you need to know that there are ways to get rid of debt completely or reduce it drastically without having to pay off. And yes, not all of the methods described in this article are illegal.

I. File for bankruptcy

If you are in debt on your credit cards, you can simply file for bankruptcy. Bankruptcy is a legal process that gives you the opportunity to start all over again by getting relief from debts that you cannot pay, offering the lender some measure of payment that may or may not be available.

When you file for bankruptcy, you can easily dispose of your unsecured debts, including credit card debt and medical bills.

Your inexhaustible assets such as second vehicles, second homes, stocks and bonds, high value collections and heirlooms may need to be liquidated to pay off some of your debts, but if you have no assets inexhaustible value, that’s all you have. there are, these are exempt items like a private car, private house where you live, household items, your business tools and personal clothing, they cannot be used to pay off unsecured debts so you can leave without paying.

In general, when you file for bankruptcy, you can prevent your creditors from suing you, calling you, sending you all those reminders and letters that make your heart skip a few beats, or even taking action to collect their debts. .

But don’t sing, hurray! just now; There is an unpleasant side to filing for bankruptcy that you should be aware of. For one thing, it will be noted on your credit report for about 10 years, and because of this, many lenders will refuse to do business with you because you will be considered “high risk.”

Another downside to filing for bankruptcy is that once you file for bankruptcy, most credit card companies automatically cancel their lines of credit. For example, if you file for bankruptcy because of debts you owe Company A, you can expect to lose your line of credit with Companies B, C, D, and E.

Getting a job or a home can also be made more difficult by the fact that some landlords and employers are unhappy with applicants due to recent bankruptcy filings.

While filing for bankruptcy frees you easily and legally allows you to free yourself from credit card debt without having to pay, you should consider it as a last resort and when you are convinced that its ugly side will not have an impact. meaningful in other areas of your life.

ii.Use the Fair Debt Collection Act [FDCPA] to your advantage

The Fair Debt Collection Act [FDCPA] is federal law that restricts the actions and behavior of debt collectors who attempt to collect debts on behalf of another person or entity. Under this law, the law limits the means, time and methods that these collectors can contact you, and if the law is broken, you can sue the debt collector and the original creditor for damages and fees. lawyer.

To make this law work for you, all you need to do is stop paying unsecured credit card debt. Once you have been contacted by the debt collectors, you can dispute or demand documentation of your debt. This is just a legal strategy to get debt collectors to properly document your debts. You will need to send the claim documents or the debt dispute letter to the debt collector.

Now the point is, debt collectors are paid for commissions, and they prefer to spend time and energy harassing legally uninformed individuals. consumers who will respond more easily to their requests than those who are legally complex like you and who seem to know how to manage them.

If a lender hires a collection lawyer, the FDCPA also considers collection lawyers to be collection agents, so you can also send them a documentation letter on request detailing the documents they will need to submit before you can bring a lawsuit. justice. you.

The documents you request will include the original agreement between you and the lender and a detailed record of the amount allegedly owed. Most of the time, lenders have a hard time submitting these documents, and it’s too hard a job for the lender and the collection agency, so most of them will just stop contacting you after you get them. sent a documentation letter on request, and you can simply escape the debt.

iii. Consider debt consolidation

If filing for bankruptcy seems too serious, you should consider debt consolidation. Debt consolidation simply means consolidating all of your debts under one roof. You can transfer your credit card debt to your mortgages so that you only have to process mortgage payments, not credit card debt.

This method is almost the same as getting another loan to pay off your credit card. loans only this time you can negotiate lower interest rates.

iv. Ignore your creditors

This method will hurt your credit score, but what choice do you have when you can’t afford to pay off your credit card debt? You can simply ignore the calls and emails asking you to pay off your credit card debt.

The truth is, your creditors have a limited amount of time to legally file a claim against you; if what you owe is not much, the creditor might just get away with it because the legal fees and process involved in foreclosing the debt may not be worth it if you don’t owe much. .

v. Negotiating a credit card forgiveness

If you don’t want to file for bankruptcy or if you have doubts about using the Fair Debt Collection Act, another way to bend it is to negotiate a credit card pardon. Now, this doesn’t completely free you from debt, but it helps you pay the minimum amount you owe so that the rest of the debt is completely cleared.

Lenders don’t want to waste their money, so if they suspect that you might file for bankruptcy sooner or later, they’ll be willing to negotiate with you and offer you debt relief so they can take what they can get. while they still can. because if you decide to file for bankruptcy, they could end up with nothing.

What you need to do is take a close look at your credit card debt and the funds you have on hand and decide how much you can comfortably pay. Then call the credit card company and let them know that you are in financial trouble and want to deal with your credit card debt. A representative from the company will review your details and offer you an estimated amount. Don’t accept this amount, try to offer 30% of that amount and negotiate until you both get the amount you can pay.

Make sure you write down the details of the conversation you are speaking to and get a confirmation number before sending a check to clear your debts. Although this method will not allow you to leave without paying, you can still get a large amount of your debt to pay you very little.

20 more helpful tips to help you liquidate your credit card debt faster without hurting your credit

1. Ask lenders for lower or special interest rates

A phone call to your lender is all it takes to get you a prime or special rate, but you should consider that your credit rating must be good, which means it must be at 730 or even higher. Also, another consideration is that you must be a regular customer who has made payments on time.

2. Transfer your balance to another with a lower rate

Balance transfer means that you can transfer some of your credit card debt to your other cards at a lower rate. Make sure you find the best transfer deals by knowing what the balance transfer fees are, what annual fees you have to pay, and any other possible terms.

3.Focus on a map (rendering

There are very few people in the United States who use only one credit card for all of their purchases, but most people often have more than one card, which usually means they will take on debt. on all these cards. Make sure you focus on paying off the most used credit card debt, a process called laddering. Thus, your total credit card debt will start to decrease and your credit rating will improve. … It is important to never close your account when it is at zero balance so as not to damage your credit score.

4. Consider borrowing from a peer lender

While it might seem silly to borrow money to pay off your debts, the advantage of these peer-to-peer lending sites is that the loans they offer often have fixed interest rates and usually 20 to 30% lower than the proposed rates. most credit cards. Thus, it saves you several hundred dollars in interest, thus allowing you to reduce your debt without harming your credit rating in any way.

5. Make at least two minimum payments each month

Since the interest on the credit card is charged daily, it is best to make sure that the average daily balance goes down each day. Even if your budget is tight, trying to pay the minimum bi-weekly payment to the card will ensure that your debts will not only decrease over time, but also be paid off.

6. Try not to get into debt through budgeting. To prevent yourself from accumulating debt that you can’t ultimately pay off, it’s best to avoid debt escalation, which means staying on a tight budget and not incurring costs that aren’t. neither elementary nor necessary.

7. Perform automatic debt repayment. If you earn a fixed income, ensuring that a fixed portion of your income is used to pay off your debt is a sure-fire way to ensure quick credit card debt reduction, and it also ensures that you don’t hurt your bankroll. credit score.

8. Get help from your friends and family. While this may seem like a strange way to reduce your credit card debt, the little money and good deeds you receive from family and friends will keep you from accumulating your debt. You can also get loans on favorable terms that you do not have to repay with the interest of your relatives.

9. Take gifts when you can : If there are things you can get for free sometimes, take advantage of them and use the free money to pay off some of your debt. If you keep doing this all the time, you are bound to pay off your credit card debt as soon as possible.

10. Move to another location. If you find that you are spending more than you should in this location, you should move to another location where your daily expenses are likely to be cheaper. For example, you can change apartments to pay lower rent or share your apartment to free up money.

11. Reuse of articles. You should be used to not buying everything, there are things you can buy and reuse. Not only does reuse or recycling ensure that you save the environment, it also frees you up of money that would be used to purchase these items, allowing you to reduce your credit card debt.

12. Create additional sources of income. Although getting a good job can be more difficult, and a little more difficult, it is one way to reduce your credit card debt. If your day-to-day job is very stressful, any extra work or activity you take on to generate an additional stream of income shouldn’t be so stressful that you don’t experience burnout.

13. Try to improve your current income: All employers love employees who are not only good, but also working to help the company meet its goals and objectives. Companies are more likely to increase the salaries of these employees to keep them in touch with the company, from time to time offering a bonus.

14. Booming Living: While it may seem like we need a lot to survive, we just need the basics to live, and therefore, when trying to pay off credit card debt, it’s best that you reduce the excess. It can be difficult for a while, the idea that should motivate you is that you are trying to get yourself out of debt.

15. Try to buy money. To avoid increasing debt, you need to make sure you pay your daily expenses in cash without using your credit cards. This is a good way to make sure that your debt keeps going down.

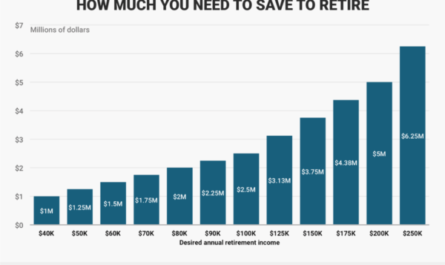

16. Know Your Debt-to-Income Ratio: This helps you keep your debt in perspective and can help you calculate how much you’ll need to save on paying down debt so it doesn’t pile up and keep you red.

17. Pay lowest balances first: This is another form of payment where, instead of paying the highest balances first, you pay the lowest; This way you can pay faster.

18. Make sure you enroll in a debt management program: If you think the need to pay off your debt is a bit difficult, you may need to hire a loan consultant to help you develop a debt plan. refund. However, if you are working on a tight budget, there are several programs and resources on the Internet to help you stay in touch.

20. Get a personal loan. You can get a personal loan from your bank or credit union and then use it to pay off smaller loans. It is important that you take out an unsecured personal loan instead of a secured loan.

20. Sale of unused property. To get free money, you can sell things that you can live without. After you sell your property, use that money to pay off your credit card debt.

In conclusion, getting rid of credit card debt might not seem so easy, but if you are set up enough, you can most definitely get away with it without having to damage your credit score. Being in debt can be a constant concern, and therefore, if you are willing to make the sacrifices, you will likely live debt free. Make sure to check out these tips and tricks and then choose what works for you, because you don’t have to try all the tips in the article.