First, let’s discuss who the real estate investor is and common signs of successful real estate investors. Any of the following can be a real estate investor:

- Someone who buys or builds real estate for rent. He usually owns various properties that he rents in order to get a steady cash flow.

- A person who buys or builds properties to sell them to people for profit.

- A real estate investor can also be someone who helps other people acquire and manage real estate.

7 attributes of successful real estate investors

While the real estate business offers many opportunities for profit, it can also be very risky, leading to huge losses for many. To be successful as a real estate investor, you must have the following attributes:

a. In-depth knowledge of the market – … You need to do a thorough and thorough research before investing in any estate or property. First of all, you would like to know what are the average rental costs of real estate in the area, the incomes and lifestyle of the locals, their tastes and buying preferences, zoning laws and other relevant information. that will guide your investment.

b. Risk -: Investing in real estate is not for the faint of heart. It is a very risky business which can be influenced by a number of factors like economy, taxes, natural disasters etc. Therefore, you need to be someone who knows how to manage risk properly.

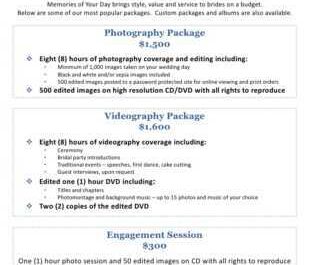

at. Adequate planner … Investing in real estate is not a business to rush into. It’s completely different if you just want to build a property or two to sell it to people and make a profit. A real estate investor brings his real estate to life and everything related to the real estate sector affects his business. Therefore, a real estate investor must have clearly detailed business plan how he will invest and recover all his investments, as well as how he will manage his cash flow.

Understand the Tax Implications: A successful real estate investor should also analyze the future tax implications before investing in a property. You need to have the knowledge and skills to help you lower your taxes, or at least have a financial advisor to do it for you.

e. Diversification of investments -: While we don’t recommend that you become a jack-of-all-trades, it’s important to diversify your investments and spread your funds evenly to reduce risk and ensure stable cash flow.

F. Want to learn – … The real estate industry is quite technical and you have to be ready to learn to be successful. Make sure you have someone who is successful in the industry to act as a mentor and give you tips and advice on how to be successful. You should also hire professionals to work with you. For example, you will need a lawyer to handle all legal matters and an accountant to handle financial advice and guidance.

g. Net -. It is also important that you meet and communicate regularly with other investors who can give you useful advice and keep you abreast of current real estate trends.

To start a business as a real estate investor, you need to take the following steps:

9 proven tips and steps to becoming a real estate investor

- How to start a business without money

1. Fundraising -: The real estate industry is very capital intensive, which means that you will need a lot of money to invest. It is therefore worth contacting professionals who will give you an idea of the cost of building a house in your preferred location. You can also buy an existing property for renovation and resale.

2. Select your preferred location -: This is also very important. You must choose a place that is highly sought after and in demand. You can also go to areas that have good potential for the future. This will provide a fairly quick return on your investment and profits.

3. Build your team -: As I mentioned earlier, it is better to have professionals who will give you adequate advice. Find your team of lawyers, builders, accountants, engineers and all the other experts you need to work with you.

4. Construction – … During the construction phase, you have to be very careful to make sure that your properties have excellent characteristics that will drive sales. For example, in today’s real estate market, alternative energy homes and chic interiors are more likely to exit the market faster than homes. that do not have these characteristics.

5. Decide on the price -: After construction, you need to decide how much you want to sell or rent your property based on your expenses and the profit you expect to receive. Instead, you can also decide to rent, in which case the rent you charge will depend on the average rental rates in the area.

6. Contact brokers and agents – … When you are ready to rent or sell your property, you will need brokers to help you. Brokers are intermediaries who help you find the right tenants for your home in exchange for commissions.

7. Hire a property manager -: It is also necessary to hire a professional property manager to ensure that the rented property is used and maintained correctly. He will be responsible for all claims and repair any faulty devices in the house. Sometimes an agent can also act as a property manager.

8. Start promoting your property: … In addition to the marketing your agent will be doing, you may also need to do your own advertising to ensure quick sales. You can advertise your investment business in real estate magazines, on the Internet, or on your website.

9. Insurance – … Finally, don’t forget to insure your property. Because of the risk associated with the real estate industry, it would be wise to reduce your risks by spreading them. Make sure that all of your property is properly insured against fire, flood and inflation, or other factors that could affect your future investment.