Looking to start an online credit card processing business? here is a complete guide to starting a credit card processing business with no money or experience .

Ok, so we’ve provided you with a detailed example of a credit card processing business plan template. We also took it a step further by analyzing and writing a sample credit card marketing plan backed by actionable guerrilla marketing ideas for credit card processing companies. In this article, we will cover all the requirements for starting a credit card processing business. So put on your entrepreneur hat and let’s move on.

If you are planning to start a credit card processing business, you should know that your new business will provide services to businesses that need to process payments from their customers. Your service will also include the provision of equipment that will be used by your client not only to process payments, but also to send and approve transactions between your clients’ reverse accounts and their clients.

What does it take to start a credit card processing business?

For this business, you will need to do a thorough research on existing credit card processing companies, what they do, how they operate, and the services they offer. Another aspect of the business that you need to be aware of is how credit card machines work, which will require you to contact the credit card machine manufacturers.

You will need to choose your niche in the market by either providing services to retailers through merchant accounts – this is a type of bank account that allows businesses to accept payments from customers; or e-commerce through payment gateways is an application service that enables online businesses to accept payments from customers. If you are going to run a medium to large sized business, you may decide to offer both services, but if you are starting small, you may only choose one of the services.

One of the most important aspects of this activity is meeting and building relationships with many banks and financial institutions, especially those that are members of MasterCard, Visa and Discover Card. Relationships with many banks will also increase the confidence of your customers, existing and potential.

If you are planning to specialize in merchant accounts, you need to make sure that your relationship with banks is physical. However, if you are using payment gateways, you will need online banking relationships.

In addition to relationships with banks, you will also need to establish relationships with developers of credit card machines. You may need to physically send a cover letter or email them to let them know that you are a credit card processing company interested in their products.

Even though in the United States, you may need to deal with multiple brands to provide your customers with more options, which will give you an edge over competitors offering limited options to their customers.

Starting a Credit Card Processing Company The Complete Guide

- Industry overview

The credit card industry has grown into a large and profitable segment of financial services. The broader payments industry is not only large and growing, which is largely due to its stability and predictability in wholesale transactions, coupled with low capital intensity, but also high profitability.

In emerging markets, the growing middle class, as well as increasing consumer activity, remains a largely untapped pool for payment companies, especially those that use mobile money applications, especially for cell penetration in areas such as generally awesome.

- Interesting statistics on the creation of the credit card processing industry

However, in developed countries, this industry has emerged from complex factors caused by the shock of the global recession; which forced financial institutions to tighten credit standards and also led consumers to stop using.

Another factor also includes increased regulation and zero cost of money, which has resulted in lower interest rate spreads, shrinking margins and forcing credit card processors to seek new sources. of income. In addition, large offline and online merchants have seen their market share increase, causing fierce competition between these merchants and financial institutions.

The credit card processing and money transfer industry saw significant revenue growth between 2011 and 2016, especially as merchants have consistently benefited from the widespread adoption of electronic payment technology as well. as the growth of electronic commerce. The industry has revenues of $ 55 billion, up 5.7% between 2011 and 2016. There are also approximately 2,497 credit card processing companies in the United States.

Consumer confidence in this sector is expected to continue, which will lead to an increase in the amount spent by customers, leading to an increase in the volume of transactions. Additionally, industry operators should expand their online services as they force merchants of all sizes to adopt electronic payment methods that will become the norm among consumers.

The Top Four Players in Credit Card Processing Industry The remittance industry is expected to generate 44.8% of industry revenue in 2016. This industry is fragmented, especially as it includes a wide variety of companies with different specialties.

The services provided by this industry cover virtually all types of financial transactions, including check processing, wire transfers, automatic payment services (ACH), credit card purchases, and debit card services. Moreover, due to increasing technology, the industry is entering new innovative and technically inclined sellers who are already gaining market share.

As consumers felt a sense of revitalization, most were returning to their pre-recession habits, especially as higher disposable incomes boosted their confidence in purchasing and using financial services. The credit card industry also offered more rewards and programs than other financial products.

Creation of a credit card processing company, market research and market analysis

- Demography and psychography

The demographic and psychographic makeup of those who use the services of a credit card processing company is important, as it varies from the following;

- Baby boomers

- business leaders

- home owners

- unemployed adults

- young people and many other consumers who need a credit card that allows them to shop for products or pay for services both offline and online.

- Large corporations

- small enterprises

- E-commerce websites are those that require the services of a credit card processing company to keep their business running smoothly.

List of niche ideas in the credit card processing industry

The niches in the credit card processing industry are similar in nature as almost all processors provide the same service to their customers, with some doing their best to provide additional related services to their customers in order to have an edge. over other competitors.

Some of the areas of specialization in credit card processing include:

- multi-currency transaction processing

- web hosting, online shopping

- equipment supplier

- transformers for retail stores

- Processors for nonprofits and many more.

One of the characteristics of these areas of specialization is that small businesses will focus on one or two of the above areas. However, large companies can specialize in other areas.

The level of competition in the credit card processing industry

Credit card processing companies are tricky businesses. especially because you have to deal with many distribution agents who will determine the proper functioning of your business. There are rates that are set whether you are running your business on a small, medium, or large scale, as long as you use the same amount of equipment the fees will be the same.

However, it is easier for small credit card processors to attract local customers to their areas, while large credit card processors gain large customers through open relationships as well as capacity. to manage these customers. … Large credit card processors generally find it easier to bid or compete for government contracts because they have an advantage over small businesses.

List of famous brands in the credit card processing industry

Each industry generally has the best brands that stand out from the crowd, and so do credit card processing companies. The best credit card processing companies are those that think through the unique needs of the business while also striving to be cost effective. Some of the major credit card processing companies in the United States of America include

- Charming

- Land credit

- Payment line data li>

- Flagship merchant services

- Payment deposit

- Pay Pal

- Bandaged

- TSYS Merchant Solutions

- 2CheckOut.com

- Authorize.net

- ClickBank.com

Economic analysis

The credit card processing industry is volatile and dependent on the state of the economy, so if you are intending to start this type of business, you need to do your research and understand the issues and the existing pitfalls in order to make the right decision to enter the market.

The industry has faced a challenge lately, particularly during a recession. where disposable income was less, so consumers only made basic purchases. However, the economy has grown steadily since 2015, resulting in increased consumer confidence and purchasing power.

Traders who mainly charge transaction fees have therefore seen an improvement in their income compared to the years of recession. That is why economic analysis is essential if you are considering doing this type of business.

Whatever your budget, you will need to make sure that certain specific aspects of the business receive more attention, such as how to attract more customers and retain them, how to improve your services for your customers. This business thrives on the volume of demand, which can only arise if you provide efficient and effective services.

Is it worth starting a credit card business from scratch or is it better to buy a franchise? ?

Any serious entrepreneur keen to start a credit card processing business will find that if it is more difficult to start from scratch, it can be more beneficial to them in the long run. Start your business from scratch so you get to know it better than whoever bought the franchise.

Starting from scratch has its pitfalls as you have to deal with paperwork as well as customer acquisition challenges. however, for your business, if you have done extensive research before starting this business, you may encounter less difficulty than you should.

Buying a franchise is not a bad business decision, it just depends on your preferences. contractor. Some entrepreneurs just prefer to have someone else take care of the crude aspects of the business, such as customer acquisition strategies and the tough aspects of paperwork; while they focus on other aspects such as customer retention and other light red tape. However, in a franchise, the major decisions are not in your hands.

Threats and potential challenges you will face when starting a credit card processing business

Threats and challenges you are likely to face when starting your own credit card processing business include a global economic downturn that could affect the way consumers use their credit cards, poor hardware from manufacturers from credit card machines, competitors, processing system failures and many more.

As an entrepreneur, it is impossible to avoid threats and challenges to your business, but you can minimize its impact on your business by ensuring that there are plans to deal with these challenges and threats so that you can make the most of them when they arise. For Your Business.

Creation of a legal business for credit card processing

- Best Legal Entity To Use For A Credit Card Processing Business

The legal structure is one of the most important decisions that an entrepreneur takes in starting a business. This is because the entrepreneur has to decide which legal entity will best serve the interests of his business. Another factor that can help decide which legal structure to choose as a last resort is the financial resources available for the launch.

However, it is important to seek the advice of the professionals who have helped start up credit card processing businesses. These experts will guide you as best as possible on the legal structure to choose according to your budget and your type of business.

There are different types of legal structures you can choose from when starting a credit card processing business including: Sole Proprietorship, Partnership, and Limited Liability Company (LLC). Each legal structure has its own advantages and disadvantages, so you should study them carefully before choosing them.

The sole proprietorship legal structure is fair, if you want to start small and don’t want to expand yet, you can also start as sole proprietor and change the structure once your business grows. To enter into a partnership, you will need to pool resources with someone else for the business. On the other hand, a limited liability company is a company that limits your personal risk in business and where your business can act as a separate entity for you.

Attractive business name ideas suitable for credit card processing businesses

- payment terminal

- Credit solutions

- Shade merchant

- Gateway solutions

- Mining gateway

Better insurance needed for credit card processors

Insurance is extremely important for any business as it helps to limit the risk that exists in doing business. Whatever legal structure you use, you will need insurance if you are serious about your credit card processing business.

If you are unsure of which insurance policies to choose, you can seek professional advice. an insurance agent or broker to help you with the best insurance coverage that will work best for you and your credit card processing business, and any additional services you may offer.

If you are planning to start your own credit card processing business in the United States of America, here are some of the basic insurance policies you might need when buying;

- Errors and omissions

- General insurance

- Liability insurance

- Group insurance for business owners

- Equipment insurance

- Health insurance

Credit Card Processing Company Need Intellectual Property Protection?

A credit card processing business is a service business. and therefore, if you think you need intellectual property protection to start this business, you don’t need to worry because no one in this business prioritizes intellectual property protection.

However, if you have a unique company logo and / or brand name, you may want to consider purchasing intellectual property protection; otherwise, it is completely unnecessary.

Do i need professional certification to start a credit card processing business?

If you are looking to open a credit card processing company in the United States of America, you don’t need to consider getting professional certification as it is not considered necessary.

However, since it is a financial industry, you should be aware of the laws, regulations, permits, and licenses that federal and state governments may have. The credit card processing industry is highly regulated, particularly because you will be handling sensitive customer information.

List of Legal Documents Required to Run a Credit Card Processing Business

Below are some of the basic legal documents that you will need if you want to successfully conduct a credit card processing business in the United States of America;

- Registration certificate

- Business license

- Business plan

- Insurance policy

- Non-disclosure agreement (NDA)

- Operating contract

li>

- Contract document

Writing a business plan for your credit card processing company

Every business needs a business plan if it intends to start competitively and make a profit. A business plan helps you conduct in-depth research that lets you know whether you need to run a business or not, which means you need a detailed business plan that gives you a clearer picture of how you are going to run your business successfully.

A business plan is a document that gives you clear advice that will show you how you also intend to run your business. In addition, this document helps to influence the main actions and decisions that you plan to take in the course of your business activities.

The purpose of writing a business plan is to let your stakeholders and investors know how serious you are about your credit card processing business because your handout will show them all the strategies you will use in running your business.

Your business plan should contain important elements such as: You intend to generate your start-up capital, how you are going to attract your customers and what your plans are for growing your business. Other key things your credit card processing business plan should include include

A resume that describes your business and makes it clear what your credit card business does, your sales and marketing strategies, your marketing goals, your target market, and why you are unique among your competition.

Finally, the other key elements that should not be missing from your business plan are the products and / or services you intend to offer, the SWOT analysis, the marketing and sales strategies, the prices, costs and financial projections, advertising strategy and advertising and how you plan to generate your start-up capital.

Not everyone is qualified to develop a comprehensive business plan, and if you are one of those entrepreneurs, you can get the help of a business plan writer to help you write a plan. business. However, if you are working on a tight budget, you may want to consider going online and getting an online business plan template to help you write your business plan.

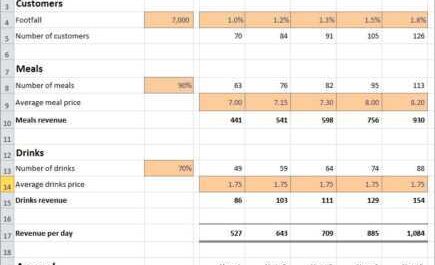

Detailed cost analysis for starting a credit card processing business

If you do your research, you will find that the costs of starting your credit card processing business can be afforded if you are determined enough, especially since some things can be fixed or changed depending on your vendors.

Although start-up capital is not as low as in some other businesses, it will not be as high as in other capital intensive businesses; and therefore, if you are determined, you can start a business. The business is profitable, especially since almost all businesses need a credit card processing point, especially since most customers don’t like having cards with them.

If you are planning to start your own credit card processing business in the United States of America, you may need to make sure that you complete most of the points below to stay in compliance with the laws.

- The total cost of registration will be $ 750

- Liability insurance, permits and business licenses will cost $ 2,000

- The amount required to purchase an office workspace for at least a year will cost $ 40,000

- The amount needed to equip the office with computers, machines, printers, furniture. , phones, filing cabinets and security gadgets will cost $ 5,000

- The cost of launching an official website will be $ 1000

- Additional charges such as business cards, advertisements, signage, advertisements will cost $ 2,500

From the above points, if you are going to start processing a credit card, but on a small scale in the United States of America, you might need an average of $ 51,000.

However, if you plan to operate a business processing small-scale credit cards, you may need a startup capital of 100 000 USD . However, if you are intending to start a large scale credit card processing business in the United States of America, you should further attract over $ 200,000 in start-up capital.

Fund your credit card processing business

Any entrepreneur who intends to start their own business knows how important finance is to a business. Lack of funding to start or run a business can lead to failure of a business, no matter how fancy a business idea is. This doesn’t mean that raising capital for your credit card processing business will be easy, but it is a task every serious entrepreneur should do.

This is where the importance of a business plan comes in. If you don’t have a complete business plan, it can be difficult for you to attract serious like-minded investors when looking for opportunities. capital. No serious investor will listen to your idea without seeing a document that shows that you not only intend to be serious about your new business, but also to know exactly what will happen to your business in five years.

So, you really need a business plan if you don’t have the capital to start a business. As an entrepreneur, there are several options available to you when starting to raise funds to start your credit card processing business. Here are some of the options:

- Apply for a loan from a bank and other financial institutions

- Selection and attraction of money from interested investors

- Raise funds from business partners

- Share your ideas with angel investors and receive funding from them

- Sale of personal property and shares to raise the necessary funds

- Find loan sources from family and friends

Choosing the Right Location for Your Credit Card Processing Business

Another factor that can affect your credit card processing business is the choice of a location for your business. When you want to start your business, it is very important that you carefully choose a location that is suitable not only for your target market, but also for your employees and consumers.

If you are about to start your own credit card processing business, it would not be in your best interest to locate your business in a residential area such as the suburbs as no one will be frequenting your business and it can be inconvenient for you. business owners who wish to visit you. do some physical research, so it would be best if you locate your business in an area where many businesses are concentrated, especially those that make up your target market.

While your location is very important, you don’t have to rent or lease a huge office which could hurt your finances or budget, you don’t have to go bankrupt. You only need a small space where you can have an administrator and an internal office for those who wish to inquire.

This is a responsive business that won’t require you to work from home, especially when working with a lot of employees. of a client. Also, since you are more likely to hire people to work for you, regardless of size – small, medium, or large – you will need to hire workspace of any size, which will put pressure on your staff and staff. customers to take your credit card. takes business seriously.

Creation of a credit card processing company Technical information

At the start of this business, most of the equipment used to start a credit card recycling business is virtually the same, the only difference being the brand used. You have to make sure that you only get the best equipment so that they can serve your customers for a very long time.

If you are planning to start on a small scale, you may need less equipment than you need if you are starting on a medium to large scale. Some of the amenities you’ll need to get started with a credit card include:

- Point of sale machines

- Computers

- Phones

Due to the delicate nature of the credit card processing business, you may need to hire a small facility. If you need a bigger service, it must be because you are running a medium or large business and will be hiring knowledgeable staff to help you run the business.

In terms of numbers, the number of employees required to run a credit card processing business will vary depending on the size of the business you intend to do. You may need to hire a manager, marketers, salespeople, registrar, and accountant. That’s about 7-10 people.

Process of providing services in the field of credit card processing

The process for processing credit cards is exactly the same regardless of the size of your business. The processes range from building relationships with banks and financial institutions to building relationships with private label credit cards so they can provide options to their customers.

Other processes also include website domain and hosting. as design and other related services.

Starting a Credit Card Processing Company The Complete Marketing Plan Guide

- Marketing ideas and strategies for a credit card processing company

Marketing is an integral part of any business because it generates income for your business. Marketing is all about promoting your products and services so that customers can buy from you. In marketing, you will have to use conventional and non-traditional means to achieve your goal and avoid bankruptcy.

If you intend to run a credit card processing business that will generate income, you should get into marketing. the strategies are serious. Before you can confidently market your credit card processing business, you need to make sure you have good relationships with banks and financial institutions as well as with credit card developers and machine manufacturers. This is so that you know exactly what you are telling your potential customers.

Some of the marketing ideas and strategies you might need when marketing your credit card processing business include:

- Make sure to present your business to customers and stakeholders, as well as executives of large companies.

- Quick tender on contracts

- Place your business in local directories

- Advertise your business in newspapers, magazines, television and radio

- Through direct marketing

- Make sure you’re online and using social platforms to promote your business

Factors to Help You Get the Right Price for Your Credit Card Processing Business

Every business has to make an important decision about setting the right price for its products and services. Choosing the right price, however, depends on a number of factors, including the competitors, the environment and the services offered.

You need to make sure you set your rates fairly for your customers based on who they are. offered, you can offer your customers the option of monthly payment or the need to charge interest after each transaction on the machine. Just make sure your overhead and running costs are covered by your rates.

Possible competitive strategies to win over your competition in the credit card processing industry

The credit card processing industry is quite competitive and as such companies are looking to entice customers to use their services, which can be done either by providing superior services, cheaper rates or additional services. that your competitors do not offer. If you intend to beat your competition, you need to make sure your business is designed to give you an edge over your competition.

One of the strategic competitive ways that you may need to adopt to convince your competitors in this particular industry is to make sure that your customers are able to choose the costs with which they will feel comfortable; this is in addition to the fixed payments they will receive from your channels.

Another competitive strategy for you is to secure multiple business transactions related to credit card processing.

Possible Ways to Increase Customer Retention for Your Credit Card Processing Business

Credit card processing is a delicate business which, if mismanaged, can lead to the loss of customers, thereby bankrupting your business.

Research shows that companies spend more money on customer acquisition than on customer retention, so it is in the best interests of any business to find ways to retain customers. Loyal customers also have their benefits, as loyal customers who are happy with your services are more likely to help promote your business through word of mouth (referrals).

Customers will remain loyal to a company they believe will respond to their inquiries or respond to their complaints in a timely manner. Sometimes there can be issues between your client and their customers, and your ability to resolve these complaints quickly will give you an edge over your competition.

Strategies to build brand awareness and create a corporate identity for your credit card processing business

If you want your credit card processing business to stand out, you need to develop strategies that will not only increase your brand awareness, but also create a corporate identity for your business. However, if you are feeling overwhelmed with the strategies you need to create, you can hire an expert to help you deal with that particular aspect.

Some of the strategies you should use if you intend to improve your business branding and promote your business include:

- Make sure your credit card processing business is advertised in newspapers, magazines, television, and radio stations.

- Promote your credit card processing business online through directories and an official website

- Use social media like LinkedIn, Facebook, Twitter to your advantage to promote your credit card processing business

- Make sure to distribute your flyers and flyers in the targeted areas

- List your business in local directories

Build a supplier / distribution network for your credit card processing company

If you are going to run a credit card processing business, you will need to find credit card distributors, build relationships with banks both offline and offline. online and connect with credit card developers. These are the main aspects necessary for the success of a business.

Your business can only get better if you have good business relationships with the various parties required to run a credit card processing business. slowly. When you have a good business relationship, you can get advice and guidance from your suppliers to get your job done without delay.

In addition to getting advice to help your business grow, having healthy relationships with the above parties will help improve your business results, allowing your business to grow and develop, generating more income for your business. you.

Tips for Running a Successful Credit Card Processing Business

A credit card processing business is an area in which a business provides services to businesses that need to process payments from their customer-buyers. The service provided also includes the issuance of equipment that will be used by your client not only to process payments, but also to send and approve transactions between your clients’ reverse accounts and their clients.

In addition, there are other related services that can be offered for business success. To run this business successfully, you need to make sure that your services meet the needs and requirements of your clients, and are affordable as well.

Customers always love a business that not only anticipates their needs, but also makes sure that their complaints as well as their requests are dealt with promptly. Make sure you pay your customers fairly and don’t have hidden charges; this ensures that your customers trust your services and are happy to refer you.