Would you like to create a budget plan but have no knowledge? how? here are 7 easy steps to create and stick to a budget plan for your small business.

Every time a person starts their own business, it is advisable to create a budget plan as this business budget can be presented to investors along with the business plan. This makes them more willing to invest. Most small business budget plans include a list of fixed and startup costs and a list of flexible expenses.

To make sure that your budget plan is as specific as possible, it is important to write down any possible expenses that may or need to be incurred. However, if the do-it-yourself approach doesn’t appeal to you, you can always hire an accountant to take care of your managerial accounts. When you’re ready to learn, here are some practical tips you will need.

7 easy steps to creating and sticking to a budget plan for your business

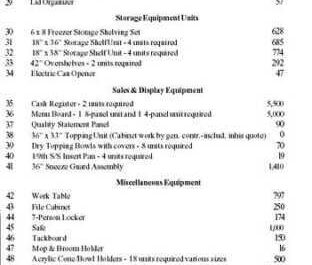

Step 1. Record your startup costs: In most cases, the start-up costs list contains all costs that are incurred when you first open your company. Usually these are costs for computers, PDAs, printers, stationery and office furniture.

The exact cost will largely depend on the type of business you’re starting. Obviously, a computer store has more of a computer cost, while shadow storage may only require one computer to run transactions on.

Step 2. Write down your monthly budget -: In terms of fixed assets, it is important to have a monthly budget. Fixed assets usually include telephone costs, internet costs and rent. In addition, the salaries of the entrepreneurs as well as the salaries of the owners are usually included in the monthly budget. In fact, all monthly expenses should be included in the monthly budget plan.

Step 3. Write down the flexible cost -: The next step in creating an accurate business budget plan is to make a list of flexible expenses. The best way to make this type of list is to think about any expenses that can change from one month to the next. For most businesses, flexible costs include utility costs, business card costs, and marketing costs. In addition, the cost of a business lunch and outsourcing services can also be viewed as flexible costs.

Step 4. Determine How Much Income: Another important part of creating a successful business budget plan is making predictions about how much revenue will be generated from month to month. In this case, the plan can be designed so that the company does not interrupt its spending.

The best way to predict how much income will be generated is to state the minimum expected amount. earn every month; So if more money is made than expected, the company is simply left with extra money.

Step 5. Make adjustments -: After the business budget plan is established, once the business has actually opened, it is important to make any necessary adjustments to the plan. For example, if a company car is purchased, an adjustment must be made within the fixed assets of the budget.

As the business grows and expands, the cost of fixed assets will most likely increase too. It is therefore very important to always make the appropriate adjustments. This helps keep the business budget plan correct.

Step 6. Calculating the profit: … To determine how much a company is worth, it is important to calculate your profit margins. You need to estimate your forecast sales, sales and bottom line. This will help you get a foothold in your cash flow.

Step 7. Update the business plan: … The business budget plan should be carefully reviewed at least once a month. Accountant or business owner. By reviewing the budget, a company will be more likely to bill all of its expenses and also identify areas where money can be saved.