Once upon a time there was only one bank in a city that everyone had to use, in some cases people had to travel from neighboring cities to use a bank in your city. At that time, you had no other choice for a financial institution. It was a bank for life.

However, things have changed and customers no longer need to have lifelong relationships with the bank. If you’ve been a customer of your bank for a long time, here are some of the benefits you need to learn more about changing bank accounts.

1) Reduced bank charges

Owning a bank account these days means paying for everything imaginable, from regular account maintenance fees to ATM card maintenance fees and ATM usage fees.

If you are unhappy with your bank and have high fees, write down the fees. Then look for a smarter bank with its fees and change bank accounts. Look for banks that will stop charging service fees if you have a low balance, don’t charge minimum balance fees, offer refunds for using their cards, and reimburse excessive ATM fees.

2) Accelerated access to funds

If you’ve kept your money in the same bank for the past twenty years, chances are you will have to wait at least a few days after depositing your check to access it. It can be very frustrating if you have financial needs that need to be met as soon as possible, but you don’t have access to your hard earned money.

If the deposit process with your bank is very slow, you may find it helpful to switch to a bank that gives you instant access to your funds.

3) Improved customer service

When you have issues with your bank, do their customer service representatives answer the phone politely? Are there real people chatting with you online or are you chatting with a service robot? Does your bank generally take customer service seriously?

If the answer to these questions is no, you should replace that bank with a bank that will provide you with better service. Poor customer service is bogus and no bank should treat you badly while keeping your money.

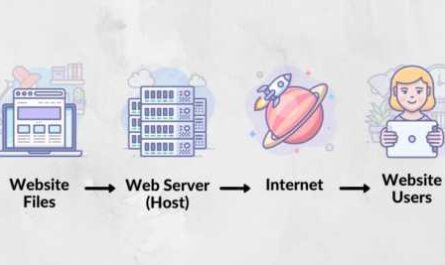

4) Technology-driven service

Look at this, if it takes your bank a few days to process a deposit or help you with a service issue then they are way behind in this new age of technology. At the very least, a good bank should be online and have a mobile app that facilitates deposits and eliminates many customer issues.

If your bank offers services online, but they are problematic rather than useful, you will also benefit from going to a financial institution that offers more reliable and reliable online services.