Do you want to invest in real estate but lack the knowledge? here’s a complete guide on how to invest in apartment buildings and resorts for free.

Investing in apartment buildings and complexes is a big commitment, both financially and otherwise. It is therefore not surprising that we sometimes speak of a career rather than a simple investment strategy. The management of residential complexes requires a deeper involvement than the management of single-family homes, both physical and financial. On the other hand, investing in multi-family homes has its own advantages that are unique to this niche.

Why buildings and apartment complexes are good investments

- Capital accumulation: several tenants pay your mortgage. With fewer transactions, you can accumulate a large portfolio of assets to plan in a shorter period of time.

- Leverage: The cost of capital has never been so attractive and there are many loan products to choose from. It’s time to lock in long-term debt and pay off a significant chunk of principal over time.

- Cash Flow: Equity portfolios do not generate cash flow unless the stock pays dividends. Apartments are traditionally more stable than apartments.

- Active material : a residential building is not an active paper – it is much more tangible. If you properly buy a trade, its value never drops to zero. Apartments are widely regarded as an excellent hedge against inflation (eventually inflation will start).

How to invest in residential complexes without money

Learning how to invest in homes and residential complexes is by no means easy, but the following steps can make the process easier. First, make sure your entry into the investing niche is the right fit for you:

1. Make sure you invest in apartments and construction projects – the investment for you

Whether you have built a portfolio or are not at all familiar with real estate investing, you need to be absolutely certain that investing in apartment buildings is right for you. The cost of owning an apartment building includes the initial capital requirements as well as the constant cash flow matrix associated with managing multiple tenant apartments at the same time.

Secondly, running an apartment building requires more involvement and management, for example with regard to tenant turnover, rental documents and maintenance issues. Before making a financial decision to pursue this line of investment, you should make sure that your schedule can meet it and that you also have the funds to cover the associated costs.

2. Select the type of building for

It goes without saying that not all apartments are the same. Come in different shapes and sizes. One building can be a converted Victorian mansion that has been divided into several sections, while the other can be a modern multi-story building in a metropolitan area.

Determining how many apartments you can afford will help you narrow your search and determine which building types will provide the best return on investment for your budget. Investors are faced with a difficult trade-off between the purchase price and the costs of renovating and renovating.

3. Identify the property

Once you have decided on the type of apartment complex you would like to own, the next logical step is to find a property. You can choose to search for properties yourself, with the help of a specialist or a service, or with a combination of both.

One way to strike a deal on your own is to join a local real estate investment club or association. By talking to other professionals, there is a good chance that you are contacting another investor who knows the property for sale.

On the other hand, real estate agents, especially commercial real estate agents, can be helpful in this process. Not only do they have access to multiple listing services, but they often have business broker listings. However, note that the commissions for commercial transactions are slightly higher than for residential transactions.

4. Pay attention to your due diligence

Before you make an offer to buy an apartment building or complex, you need to think through your due diligence and do a very thorough analysis of the transaction. If you intend to buy an apartment, the following factors should be taken into account: location, number of apartments in the building, available amenities and condition of the building.

These aspects will help you calculate how much rent you can charge and how much you will need to spend on necessary repairs and upgrades. Plus, the general condition of the building can help determine how often renovations can affect your monthly cash flow.

Additionally, the location of the property will indicate local socio-economic factors that will affect long-term profitability. are executed in terms of rental yield, occupancy or resale value. If you are serious about a particular property, be sure to hire a surveyor and get copies of leases, tax returns, and any other legal documents from the previous owner to help uncover hidden issues. if applicable.

5. Make an offer, finance and close the deal

To make an offer, the value of a residential home can be estimated using market comparisons, potential income, and an alternative method where investors estimate how much it would cost to build a similar building. Since properties with five or more units are not eligible for government funded loans, commercial loans are typically provided by traditional and private lenders.

Be prepared when lenders need interest and cash reserves, and when they prefer properties with good market potential and high employment rates, but the good news is that commercial lenders tend to back down. focus on the potential income of the property, rather than focusing on the personal finances and credit history of the investor.

Factors to consider when investing in residences and residential complexes

and. Cash Flow: Will this property be cash flow? This is the most important question to consider and it depends on many factors, including:

- The strength of the local rental market (vacancies and bad debts)

- The type of market you buy (Class C buildings typically have more tenants and more repairs and maintenance than Class A or B buildings)

- Interest rate on your financing (is this regular financing or a hard money loan?)

- The amount of your deposit

Next, you will need to consider whether the property you are looking to buy can actually earn you income. You also need to know this cash flow relative to other potential targets.

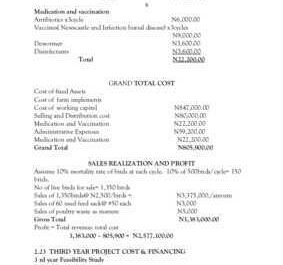

For example, a $ 150,000 house that rents for $ 1,000 per month has a higher earning potential than a $ 300,000 house that rents for $ 1,600 per month. A four story building of $ 400,000 can generate $ 3,000 per month in the same area. Buying in the right neighborhoods and at the right stage of the real estate cycle is of the utmost importance, and if done right, it will lead to a healthy valuation and profit.

The question of whether the property will earn you income raises the question of whether that income is important to you. Do you have another source of income that could allow you to spend more money on building renovations? Do you need more income now or more capital growth in the future?

b. Leverage: Leverage is important when investing. This is because the less you invest in each property, the more real estate you can buy. If property values increase, your rate of return increases exponentially. However, if the value of real estate goes down and you are in debt, the result can be negative cash flow. Negative cash flow can be “bad” or “good”. The “good” guy is short term and makes you money.

Investing “nothing to lose” is very attractive to a heavily leveraged investor, but should be approached with caution. If you’re a long-term player, leverage will usually work in your favor if the markets you invest in are valued over the long term and your income from real estate can pay off most of your monthly debt service.

of. Equity: Equity can take many forms, such as:

- Low price

- Top retainer – potential for “growth”

- Resonage option

- Mismanagement

- Foreclosure loss

There are many ways to build capital, but the best way is to buy it. Alternatively, you can buy properties that require work that can be done for 50 cents on a dollar or less. In other words, if the job requires $ 10,000, make sure you get a price discount of $ 20,000 or more.

re. Valuation: As mentioned earlier, buying in the right neighborhoods and at the right stage of the real estate cycle will result in higher rates and profits. But it is not an easy task. The timing of the real estate cycle is complex and highly speculative. If you buy a property with no home equity or cash flow just for a short-term appraisal, you risk investing.

Buying for a mid to long term appraisal (10 to 20 years) is safer and easier. Examine long-term trends in neighborhoods and the city to select areas that will retain their values and experience an average growth of 5-7%. Combine these tactics with smart cash flow and stock buying and you become a smart investor.

e. Risk: A good investor should always assess the risk associated with any investment before taking it. Ask yourself: “What if my assumptions are wrong?” In other words, do I have a “plan B”? If you’ve bought a property for appraisal and the property is unrated, can you rent for positive cash flow? If you buy with a variable rate loan and the rates go up, will it break you?

If you have multiple vacancies, can you handle negative cash flow or it will negatively impact you and your finances. With an investment like this, you should expect the best, but be prepared for the worst.

Wrong route warning signs

There are telltale signs that when you spot them it could mean the investment trade is going to be bad. Here are a few:

- The numbers don’t add up: you are playing this game because you want to make money. If the numbers don’t add up and the seller won’t lower the price or offer you better deals, you should look for other investments elsewhere.

- Missing numbers: If the seller is unable to provide you with the result and actual numbers for the current year for the previous two years, proceed to another transaction.

- Production figures: pro forma figures are only guesses. These may be educated guesses, but they are still projections. Lenders won’t give any weight to these bogus numbers, and neither will you. Your experience plays a big role here. After a while you will quickly be able to figure out “who smokes the smoke” or the numbers make sense.

- Property of the problem : There are scenarios where a property looks good on paper – the numbers are valid and they add up. However, a visit to the site reveals something very different. It may need a major overhaul as the seller postponed maintenance in hopes of passing the headache on to the customer. Don’t let that customer be you. Look a lot elsewhere.

- Bad area . Don’t waste your money trying to change the trend. If the neighborhood is in decline, the property bears this stigma. The tenants will leave like you.

- Months on the market . Good properties develop quickly. Bad properties stay on the lists month after month. With detective work, you can see why it’s silly. And it’s a viable learning experience, but your time will be better spent on good business.