Do you want to retire young and be financially free? Or do you want to eliminate the debt? here are 50 best personal finance tips and tricks for kids.

Financial management can be very difficult even for adults, let alone those who are just starting to thrive in a world of responsibility and mature expectations. For the most part, everyone has their own unique financial management habits. Some people are fortunate enough to start good financial practice at an early age, so it is not difficult for them to obtain well-structured financial support during the transition to adulthood.

Most, on the other hand, do not have a good track record when it comes to managing their money. So, such practices appear even in their adult life, but this article can help understand some of the tips and tricks that can help a young adult develop good practices with their finances.

Do you really need to work with personal finance?

The truth is, no matter how bad your current financial practices are, you can start paying attention today to what your money is doing to effectively reverse the trend. You will be surprised at how much extra money you actually have each month when you start paying attention to your money. With good financial practice, you can begin to see the possibilities of a future that you only dream of because you have not yet started to build the financial structures to support it.

Finance generally rules around 95% of everything in this world, every desire, need, or desire that we can look for can be attributed to certain amounts of hard currency. You can hardly avoid it, it’s everywhere, and finance is the way we eat, dress, maintain our good health, etc. Thus, adults will be expected to begin to analyze what their money is making, where it comes from and where it is going.

Most people suffer in adulthood because of the bad financial practices they adopted in their youth. Some regretfully reflect on how they handled the huge funds that might have ended up in their possession in the past, either through a good deal or some other opportunity that they used.

But if we start applying the right financial principles from the moment we start making money, as we move into bigger stages in life, we would be well prepared for the many decisions that come with life. If you don’t know where to start managing your finances as a teenager, here are 50 tips and tricks you can use.

50 best personal finance tips for young people

1. Decide what needs to be done better financially

No matter what advice you receive on how to improve your financial life, if you don’t make the decision to improve yourself, you won’t. It’s like an addict and in some ways we are all addicted to bad financial practices.

An addict who does not want to quit smoking from the bottom of his heart will not respond to any treatment he receives because deep down he does not want to change, he can say whatever he wants, but the condemnation has not yet arrived .

The same goes for a correct financial life; must make a firm decision from the heart that they want to acquire the best financial habits. It’s like losing weight, no matter how a person wants to lose weight, if they don’t make the decision to lose weight, they won’t. They will keep going back to the same eating habits that lead to unwanted weight. So, you must be determined to desire the change and to take action that will help you.

2. Write down your budget

So now we are getting into the basic framework for developing your financial lifestyle, write down your monthly budget. Without a budget, you steal blind, spend money emotionally, and it’s dangerous. If you buy things or make financial decisions on impulse, you’ll need a budget to focus on the plan you want to accomplish.

So take your time to sit down and see where your money is coming from and where it is going. Your budget isn’t just about recording your income and expenses; You should also list your debts, savings, etc. A budget is like a wireframe that captures all of your financial commitments.

You can use an Excel spreadsheet on your computer to spell out your entire budget in very clear terms, or you can write one up. on paper. Whichever choice you choose, the same benefits will be achieved if you discipline yourself to stay within your budget.

One of the tips for staying on budget is to check it regularly, so when you think about impulsive spending you’ll know what your budget says and you can effectively resist or succumb to that urge easily because you know your health. financial. Resources.

3. Have a purpose for your savings

Most people wonder why they can’t save; they save money every month, but usually end up spending their money on something else. Aside from a lack of self-discipline, another reason why a person may not be able to save is that there is usually no primary goal in saving that money. If someone was saving for a specific goal, there would be more determination. leave the money intact.

We all respond to goals and objectives in different ways, but in general, when there is a good reason to put that money aside, we tend to be more persistent in our approach to saving. And every month it gets easier to save that money, the walls of discipline will continue to build over time until it almost feels like second nature is saving money to this particular ending.

Somehow we have to learn the practice of salvation; we shouldn’t always be short of money. We also can’t keep buying things on impulse, it’s best to save on those things that we usually want to buy on a whim at the moment.

4. Reduce your phone bill

Our cell phones are now a part of our lives almost like our hands or our feet. We can’t go three days without them; We love to communicate with our relatives and friends. With our cell phones, we can check emails, chat with friends, and even do serious office work. But we have to check how much money is going to the services we buy on our phones.

Some services we participate in on our mobile phones may not be as necessary. Even some of the calls we make sometimes don’t need to last the long minutes we usually get. It is very important to learn to see how the money is spent with these funds. Your cell phone may charge you more money than you imagine, take a look and keep your phone bills to a minimum.

5. Check your credit habits

Buying things on credit can seem very rewarding at first, but he’s a monster that can’t be fed, or even if you’re going to feed him, keep him on a rigid diet. In other words, you have to check how many things you are buying on credit.

They tend to pile up, especially if you have a credit card. Many credit cards are not so far from the young people who are starting to appear in life, it may seem cheeky at first to exchange credit information on multiple cards, but this practice will ultimately lead to financial ruin.

Looking at your budget will also help you see how much you already owe, so that you can curb the urge to buy as much as you want on credit. If you don’t need to have this item now, put it aside for later, put it aside until you have the money to buy it.

6. Explore the options payable for your loans

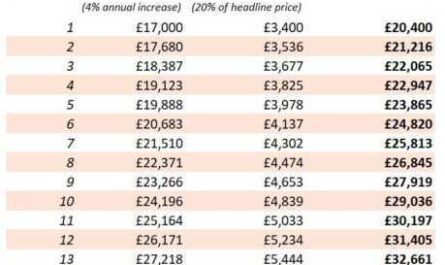

As a young adult on your way to the world, you usually get loans for a variety of things that you might need in your life. A new car, paying your college, college education, and rental fees are just a few of the things you might need a loan for. When applying for a loan, take a close look at the fine print or ask the financial agent who works with you about the different payment options available for that loan.

When you know the different payment methods available. for you, you would have a better understanding of the various creative ways of repaying these loans. If you cultivate the discipline to stick with this process, you may be able to pay off some large loans with some of the gentler methods available. It helps to keep up to date; it is helpful to ask the financial agent questions about the different ways to repay the loan.

7. Practice the First Cash approach

When checking yours, keep in mind that you won’t buy anything except that you have cash first and you will avoid the habit of credit altogether. It is a cash register approach in which you decide to control yourself and wait until you have enough money to buy items. Or you could save money, but the habit remains that if you haven’t raised the money with the proper effort, you won’t buy the product.

The practice of using cash in the first place is extremely beneficial, especially when you want to get out of debt acquired through the misuse of credit cards. It will take a lot of discipline and self-sacrifice, but you will reap huge benefits when you look in your pockets.

8. Don’t delay repayment of loan payments

We generally prefer to delay paying our loans on time, believing we can make up the difference. But the truth is, every time you return a specific contribution, it accumulates. This is something that you cannot escape, he will meet you wherever you are. So it doesn’t make any difference to try to dip your head in the sand like an ostrich; Pay down payments as soon as they are available to avoid much bigger problems in the future.

9. Learn to control yourself

It is the foundation of all your efforts to have a better financial life. Self-control is the ability to sway yourself in the direction you choose, and not in the direction your body wants to go, which may not be very good for what you want to achieve. Well, that’s my personal definition, but you’ll find that you need a lot of evidence to develop good financial practice.

10. Find cheaper ways to relax and have fun

You don’t have to do something extremely expensive to benefit from it. I know it’s cool to meet friends every Friday for a normal hobby, but look what this practice is doing in your pockets. How much do you spend when you go out, so who pays? Wouldn’t it be better to find other cheaper ways to have fun, stay at home, invite your friends to a good movie.

11 start living a healthier life

Whether we want to admit it or not, it’s worth putting more waste into our bodies. It will cost less if we just change our diet and start eating healthier. It also helps to avoid some of the health issues that can result from an unhealthy lifestyle. Many of these types of health problems can cost a person a lot of energy.

12. Sell prizes from time to time

Are you one of those people who buy everything as they’ve been told? There are markets in your area where you can negotiate a price to get a lower purchase price. In this, you will need to become aware of where you are located and then develop your negotiating ability to buy big ticket items at a cheaper price, thus saving your pocket.

13. Expenses based on your income

Have you heard the expression “cut your coat to your size?” And this statement has never been truer when it comes to funding. We all have a little need within us to have the greatest life that we already have. Or maybe we feel like we do, but we don’t have to go broke trying to impress people who don’t really care about you. Spend what you have so that at the end of the day you can get what you spent.

14. Pay attention to your credit habits

Even if you decide to buy things on credit, check your credit habits. Always think about the amount of debt you receive, its cost, and its impact on your overall financial ecosystem. Simply put, you need to know how much you have to pay for the products you buy on credit.

15. Take advice from people who have managed their finances well

One thing often happens when you are young: you already know everything about life. In order for you to take care of yourself, you might find that you don’t need any advice or suggestions from anyone. But if you are fortunate enough to have people in your life who have managed their finances well over the years and have ensured consistent financial growth, listen to them when they advise you on what to do with your silver.

16. Rent things instead of money

I know you like the new game console that just came out and are considering buying it, or some other gadget that you would like to have. If you have friends who have such items, you can borrow them for a short time and then come back until you have enough money to buy yours.

17 Take good care of your belongings and gadgets: If you have a car or any other item under your supervision, it would be much cheaper to make sure it is in good working order than to spend so much money to fix it in the event of damage due to poor service practice.

18. Become structured in your life

You are young, the time for the wild and free is over and you need to be more responsible in your life choices. Refrain from any behavior that could lead to job loss, job loss due to bad behavior is childish and creates too much instability for your finances to grow. Live a more structured, turbulence-free life so that your finances can grow in a healthier environment.

20. Accept an even pair

I know you want to live on your own and be independent, but sometimes when someone else at home shares the bill with yours it goes a long way in keeping your pocket happy. You two will make sure you share the rent, utility bills, gas, and everything in between. It is a good way to save money.

20. Stop Exposing the ‘Bigger Than You’ Lifestyle

You don’t have to prove anything to anyone, you don’t have to brag that you too can get the nicest cars, houses or gadgets. Just live contentedly and be content with what you have. After all, if you adopt the right financial habits, eventually you can afford all of this stress-free.

21. If you can’t pass the money, don’t borrow it

Every once in a while people will ask you for loans, some may be amounts you can write off in case they don’t return the money, others are large amounts that you cannot afford to let go. ‘they don’t refund the money. The rule of thumb is this: If you know you can’t get away with that money, don’t borrow it.

22. Check functionality regularly

If you haven’t already, start because, as the popular saying goes, “prevention is better than cure”. In most cases, the health problems that most people face are from very harmless complications that have turned into what is now a challenge for the person. If regular health checks were carried out, these diseases would be identified in advance and treated accordingly. As a rule, it is more expensive to fight diseases at their full stage.

23. Make your partner your “partner”

One thing you can do is ask the person you are seeing to help you stick to the right financial guidelines. They can help you remember some of the payments you haven’t made or some of the bad practices you are about to use. Either way, it helps to have some type of support.

24. Don’t buy with fancy distributors

Some people just can’t help but buy expensive things; When shopping, make sure these people aren’t with you.

25. Make replacements that reduce costs

There are some things you definitely can’t do without, the point is, these items can be expensive if you look at how much they cost. A much cheaper alternative can be found that does not compromise on the quality of the items, but leaves no hole in your pocket.

26. Explore what you want to buy before you buy

Nowadays, you can go online, view the different prices of the items you want to buy, compare prices before going to the store and buying. This is a good approach to make costs cheaper and more planned.

27. Reduce your bills

Usually, this is one of the most basic ways to get your finances in order. You can cut your bill, you can watch how you use your money, be careful of what’s inappropriate, and cut it so you can focus on your needs and the essentials.

28. Keep track of where your money is going

If you pay attention to where a higher percentage of your money is going, you will know exactly where your money is going. The good thing is, you can always change your financial practice and invest in things that matter.

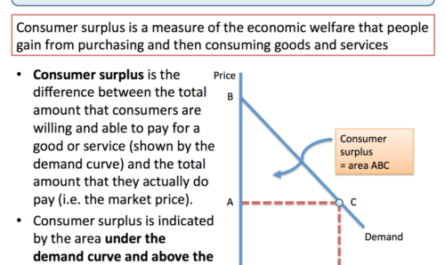

29. Invest your money

This is of course one of the basic tips for your money, learn to invest and learn to invest early. Take a look at the options available to you, discover the different instruments and organizations in which you can invest them. Talk to a broker, get information on everything, and start investing your money.

30. Buy more valuable items

Sometimes it is more cost effective to buy better quality items, but it can be more expensive than buying the cheapest one which earns you even more money through maintenance. So instead of buying a cheaper laptop that will end up hurting your pockets as you try to fix every mistake, it would be better to buy a brand new one so that it will last longer.

31. Stop unnecessary subscriptions

Many services want you to subscribe to their offers on a monthly basis, such as a gym you don’t have time for or magazines you don’t read anymore. Yes, some of these things can cost so little that it seems insignificant, but in the end it all adds up.

32. Use special budget approaches

There are different budgeting methods that may suit your personality type and spending habits. Explore different budgeting practices and find the best budgeting approach that speaks favorably to you.

33. Download the budgeting software

Thanks to technological advancements, we can be of great help in what we want to achieve. One of these is the various budgeting software available for free download. These smart apps can help you track your budget and send you notifications to keep you on top of your spending. Get one for free and start using it.

34. Do it yourself sometimes

There are times when you have to fix or learn something. Now there are professionals who do it for a fee, but today there is a lot of information on how to do something that you can learn to do on your own.

Instead of paying for some, sometimes you can just study and do them yourself. Of course, there are things that require professionals to learn how to draw a line, but sometimes they save costs by learning how to draw a line themselves.

35. Sell things you no longer need

You can play around with things that you probably won’t need anymore. Sometimes we have this sentimental attachment to these things. But in reality, some of these things can be sold for extra money and even help free up space in your home or storage. Find out what these products are and sell them.

36. Maintain control of your deductible.

Sometimes the excess comes in the form of things we love to do that may not be very good for our well-being, but we still love to indulge in them. Sometimes these methods are very expensive, not only financially, but they can also be costly for our health. We can either learn to control the way we engage or we can stop it altogether.

37. Get a cheaper seat

As a young single do you really need this whole place or do you really need to be in the area? If you analyze the situation well, you will find that sometimes choosing such an expensive apartment, without the necessary perks, can do more harm than good. It would be financially wiser to find a cheaper location.

38. Learn to manage your money

Take the time to speak to a financial advisor, have them take a look at your money, and discuss some of the best ways to effectively manage your funds.

39. Track your disability

Now as you get older you will need to stop thinking about just setting up a savings account and start exploring what you are worth in general. Start building your own capital.

40. Work harder to earn more money

Now is not the time to be lazy, to start working harder to make more money, to look for multiple ways to generate income, multiple streams of income will make a big difference in your life.

41. Change jobs if necessary

If your current job is not enough, when it comes to bills and responsibilities that you have on your tablet, you can look elsewhere. Feel free to do this where it’s needed, but think it over before you make the transition.

42. Have an emergency account

Open a dedicated account where you can deposit money when an emergency arises, whether in your life or in the life of a loved one, when you know the financial responsibility will end. by falling.

43. HAVE MULTIPLE ACCOUNTS

It’s Finance 101 again, one of the first things to learn in good financial practice is to have separate accounts for different things. You can have your own expense account; it will be permanently separated from your savings account, etc.

44. Meet with a financial consultant

If you have a prudent financial advisor as a friend, you can get advice on what’s going on in the world of finance and what you can do. full advantage.

45. Build your total wealth

Increase your wealth, build your wealth, focus on the practice of increasing your resources, so that one day what you have at your disposal will be more than what you might need.

46. Start preparing for retirement now

As an adult, it’s easy to tell that retirement is when I get older. But the years are fast approaching, you are getting older by the minute, don’t let the weather catch you off guard. Start planning for retirement now.

47. Investments

Not only do you have to know how to invest your money, but you also have to invest it where it should be. Don’t be afraid to put money into your investments, if you do it right you can see your money grow as it works for you.

48. You don’t need to travel

It is the holiday season, many people are planning different places to stay, you don’t need to go on vacation. Try new things every now and then where you are during the holidays to save some much-needed money.

49. Pay large bills sooner than necessary.

When budgeting, of course, try to pay much bigger or bigger bills before you start investing in less important things like entertainment or clothing.

50. Forget the Social Media Hype

Most people want to follow what they see on social media, thinking it’s real. They also want to wear the latest expensive clothes or drive these cars. But the reality is that most of those who pose with such items don’t own these things, so if you believe in deception, you can make bad financial decisions.

In conclusion, this may sound like a long list, but it is by no means convincing about the many things young people can do to improve their financial practices. Feel free to review the list and find the ones you can start practicing on your own to start enjoying a financially stable life.

I’m sure some will be easier than others, but I’m sure you will find everything useful. A strong financial life is a solid structure to support your responsibilities and the lifestyle you want to live. So start putting these tips into practice today and see how wonderful things will happen to you soon.