As a business owner, you have many options for financing your business. If you are in need of a loan, there are options like SBA loans, equipment finance loans, start-up loans, etc. In cases where a business cannot obtain one of these types of loans, some business owners may choose to receive a cash advance. While this type of financing has its appeal, it may not be the best financing option for you or your business. In this article, we’ll explain what a seller cash advance is and why it can hurt your business in the long run.

What is the seller’s prepayment?

Contrary to what many believe, a cash advance from a merchant is not a loan. A cash advance (also known as an MCA) is a financing option in which a vendor purchases a percentage of sales from a business credit and business card in exchange for a cash advance. Thus, cash advances and financing are based on the future sales of the business. The supplier will take a fixed percentage of the company’s daily sales until the amount covers the advance. This is also known as lag. In the case of a cash advance from a seller, the total amount you pay for the advance, along with its interest, is calculated by taking a coefficient, which can range from 1.2 to 1.5, and by multiplying it by the amount of the advance. For example, if you ask the seller for a cash advance and you get $ 15,000 at a rate of 1.3, the total (including interest) you have to return is $ 19,500. The difference between the two amounts is $ 4,500 and covers interest and cash advance charges.

Why Do Businesses Choose a Merchant Cash Advance?

Since financing is based on future sales, commercial cash advances are cost-effective options for businesses that don’t have a good credit rating. Applicants do not need any collateral or assets to secure the advance, making this an unsecured funding option. As a result, cash advances to merchants are less demanding and can provide businesses with more flexibility in financing. Unlike loans with longer maturities and longer funding processes, cash advances can fund applicants in one or more days. This allows difficult businesses to quickly access liquidity in an emergency when a bank cannot provide credit on time. The money is quickly deposited into your bank account and will be withdrawn from your account to be refunded by automatic payment to the clearing house (ACH).

So why are retail store cash advances dangerous?

Incl. At first glance, business cash advances seem like a great option for a business that needs quick financing. This type of financing has many advantages: quick access to cash, lenient qualifications, an easy application process, and convenient payment and repayment options. However, the main drawbacks start to appear as you dig deeper into the numbers.

Show real numbers

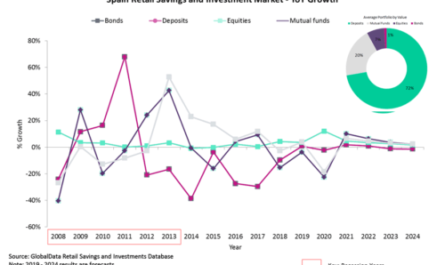

Cash advances to merchants are known for their high APR rates, which can triple the numbers under certain circumstances. Depending on the provider, and also on your terms, when you convert your factor rates and percentages to an annual interest rate, you will see that merchant cash advances have APR rates ranging from 8% to 125%.

When you calculate your daily retention fees, you can also see how the fixed interest rate can affect your daily business income. To visualize the numbers, we can use the previous example of receiving a cash advance of $ 15,000 at a rate of 1.3, which equals a total repayment of $ 19,500. Suppose your provider sets your daily fixed interest rate at 15%. To calculate the overdue amount, which is the daily amount paid to your supplier, you need to take the total sales for the day and multiply it by a fixed percentage. For example, if your total credit and debit card sales per day are $ 4,000 and the flat rate is 15%, the amount you will need to pay the vendor per day is $ 600. Suppose your average monthly income is around $ 20,000.If you calculated the monthly amount to hold, it would be $ 3,000, which would mean that you could pay off your total advance of $ 19,500 in 6-7 months …

These amounts may seem reasonable at first, however, when you use the APR calculator to check the actual annual interest rate in the example above, it turns out to be 102.46%. This shows how tricky the numbers can be when applying for a cash advance. With interest rates so high, cash advances are the most expensive financing option for business owners. In addition, cash advances to traders are not as tightly regulated as loans at marginal interest rates. This means that vendors can legally charge any interest rate they see fit, which can be detrimental to business owners.

Stuck in debt cycles

Business owners who struggle to make ends meet can have a big downside in getting a business lead. Just as a debt cycle can be started for a borrower on payday, a debt cycle can be started for a business owner with a cash advance. Due to the large number of payments and the high interest rate, this can be precarious for businesses that already have limited cash flow. Borrower accounting is common for borrowers trying to cover their debts and unfortunately under dire financial circumstances some business owners end up accepting an additional cash advance from the merchant to cover the costs of the first one, creating a cycle of unnecessary debt.

Find safer alternatives

Rather than risking a debt circle, business owners should find alternatives to cash advances by looking for lenders who can offer other financing options. Opportunity Business Loans is a provider that can connect business owners with over a hundred different lenders with just one app, saving business owners a lot of time and money. Apply today to start finding the best financing option for your business.