Traders and analysts rely on many different indicators to track volatility and determine optimal entry or exit points for trades. While high volatility is often a deterrent to risky trading, increased fear during extreme market movements can also create buying opportunities and provide an exceptional trading platform for savvy investors.

On the other hand, periods of low volatility accompanied by investor complacency can warn of unstable market conditions and potential market tops. Some of the most commonly used tools for measuring relative volatility levels are the Cboe Volatility Index (VIX), Average True Range (ATR) and Bollinger Bands®.

Key Findings

- Volatility can be measured in several ways, including VIX, ATR and Bollinger Bands.

- The VIX is a measure derived from option prices that reflects the current implied volatility reflected in the S&P 500 Index options strip.

- The average true range is a graphical indicator that shows how wide a stock's or commodity's daily trading ranges have been over time, with higher values reflecting higher volatility.

- Bollinger Bands®, created by John Bollinger, help you observe periods of calm and explosive trading.

Cboe Volatility Index

The Cboe Volatility Index is one of the most widely tracked measures of market volatility. The index is updated throughout the trading day and is known by the ticker symbol VIX. The index is calculated using an options pricing model and reflects current implied or expected volatility as measured by the short-term options band on the S&P 500 Index.

Because large institutions account for the majority of S&P index options trading, their perceptions of volatility (as measured by the VIX) are used by other traders to help provide an estimate of likely market volatility in the days ahead.

The Cboe Volatility Index stays between 12 and 35 most of the time, but it has also fallen into the single digits and risen to over 75. Typically, VIX readings above 30 indicate elevated volatility, while readings below the teens indicate low volatility .

Derivatives such as futures and options are actively traded on the VIX. In addition, there are leveraged exchange-traded funds based on the volatility index, such as the ProShares Ultra VIX Short-Term Futures ETF (UVXY) and its partner ProShares Short VIX Short-Term Futures ETF (SVXY).

Average true range

While the VIX measures the volatility of the S&P 500 Index, the Average True Range indicator, developed by J. Wells Wilder Jr., is a technical chart indicator that can be applied to any stock, exchange-traded fund, currency pair, commodity, or futures contract. ATR calculates what Wilder called the “true range” and then creates the ATR as a 14-day exponential moving average (EMA) of the true range. The true range is found using the maximum value obtained using one of three equations:

True Range = High of the current day minus low of the current day

True Range = Current day's high minus the previous day's close.

True Range = Previous day's close minus current day's low.

The ATR is then created as an EMA (calculated using the highest value found by solving the three equations). A higher ATR indicates higher trading ranges and therefore increased volatility. Low ATR values typically correspond to periods of quiet or quiet trading.

Bollinger Bands®

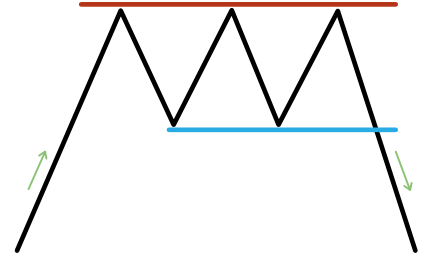

Bollinger Bands® is another charter indicator that consists of two lines or bands that represent two standard deviations above and below the 20-day moving average, which looks like a line between the two bands. Widening bands indicate increased volatility, while narrowing bands indicate decreased volatility. Like ATR, Bollinger Bands® can be applied to any stock or commodity chart.

Bottom line

Market volatility goes through cycles of highs and lows. Analysts watch the direction of the market when there is a sharp increase in volatility as a possible sign of the market's future trend. While the VIX is useful for viewing overall S&P 500 index volatility levels, the ATR and Bollinger Bands® can be applied to stocks, commodities, forex, indices or futures using any number of charting applications.