Are you running an insurance agency and need marketing ideas and tactics to help you grow your business? Next, here are ten marketing ideas for results-driven insurance agents and agencies. …

The insurance market is constantly changing and agents must keep pace. As an agent, you need to be everywhere to be able to compete successfully with direct insurance companies.

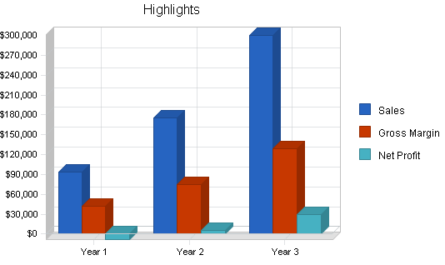

In most cases, insurance agents do not work with a fixed monthly fee as a source of income commission from the insurance company. This means that the amount of funds they will keep at the end of each month will depend on how well they help the insurance company achieve that month with new offers.

So, to earn more as an insurance agent, you need to attract more clients. It doesn’t have to be expensive or stressful; it all depends on your intelligence. Here are 10 easy-to-implement, low-cost marketing ideas that can help you reach more customers and generate more income:

10 best marketing ideas for insurance agent companies

1. Always have a list

As an insurance agent, you should always have a short list of people around you who might be interested in purchasing an insurance policy. Look around and find people with expensive properties or millionaires.

List the names of these people in your notebook, checking each one after you sell them your insurance policy. Having a list will help you remember everyone you want to contact, so you don’t miss a single commission, leaving potential customers behind.

2. Chat with real estate brokers

Build strong relationships with real estate brokers in and around your community. Have them introduce your business to their customers or just have them hand out your business cards or flyers to their customers. Chances are, anyone buying a new property is interested in insurance.

3. Send thank you cards

Show your gratitude to your customers by sending them a big and beautiful thank you card. This extra step will personalize your service and signal that you truly value your customers. This tactic is very effective because most direct insurance companies cannot accept it.

4. Personalize your website

In today’s market, not having a website for your business is like not having a business card. It looks unprofessional and leaves you missing out on a lot of leads and commissions.

If your budget is tight, you should consider setting up an inexpensive one-page website that provides information about your services and prices, as well as your contact details. Better yet, you should start an insurance blog. It requires little to no technical knowledge and only takes a few minutes.

5. Social networks

Social media is now widely used to attract leads and build brand awareness. Create company profiles on major social media platforms (Facebook, Twitter, Google+ and LinkedIn) and share useful and relevant updates that potential customers might find very interesting, so that you can quickly create a wide audience of potential customers and start serving them.

6. Use your electronic signature

Another often overlooked yet effective marketing tool is electronic signatures. So if you haven’t set yours up yet, do so now. Include all contact information like phone number, website address, social media IDs etc. Include as many communication options as possible, because everyone has a loved one.

7. Pay-per-click advertising

This includes paying to advertise your business in search results when people looking for insurance services use queries related to your business. Pay-per-click advertising can be very effective because it only drives traffic to your site from people who are very interested in insurance. And you can choose who will see your ads, as well as where and when you want your ads to appear.

8. Workshops on stage

One of the reasons many people don’t use insurance is because they don’t know much about it and don’t understand its benefits. A good way to educate people about insurance and its benefits is to organize a seminar that many potential clients will attend. Informing them about the benefits of insurance and how to save money on insurance will increase their interest in insurance and they are more likely to purchase insurance through you.

9. Publication of mailing lists by e-mail

You need to find a way to collect emails from potential clients and design an insurance marketing newsletter. Share relevant information with your newsletter as it builds trust and makes you an expert. Examples of good email marketing service providers are Aweber and Mailchimp.

10. Encourage referrals

Ask your customers ( or other people ) refer customers to you in exchange for a reward, which can be a gift or a commission. This will encourage them to promote your business through word of mouth (and other means they can accept).