Thinking of writing a business plan for an insurance agency? here is a sample SWOT analysis for an insurance agency to help you shape a competitive strategy.

Economic analysis of the insurance agency’s business plan

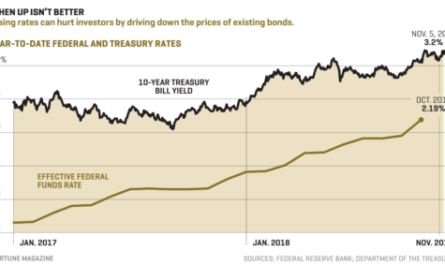

In the five years leading up to 2016, the insurance brokerage and agency industry experienced modest growth due to moderate disposable income and delays in purchasing homes and consumer durables. The industry has also faced increased competition from insurers who provide insurance services directly to customers, threatening revenue growth.

Vehicle sales, home ownership, and employment are expected to increase over the five years to 2021. income. In addition, the unemployment rate is expected to drop, which will lead to increased demand for home and accident insurance. However, the industry will continue to face pricing pressure from external competition such as online carriers.

Example of an insurance agency business plan SWOT analysis

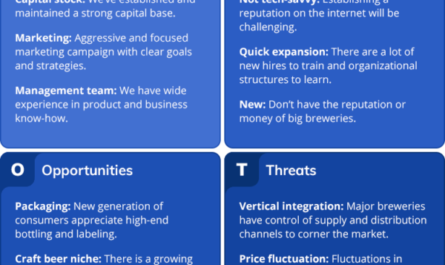

Let Flora insurance brokers know that it is in our best interest to identify our strengths and weaknesses; This is why we enlisted the services of a specialist in consulting and core business structuring to help the company build a well-structured insurance agency capable of competing profitably in the sector / market. highly competitive insurance in the United States. p12>

Part of our team of business consultants was to work with the organization’s leadership on the SWOT analysis for May Flora insurance brokers. Here is a summary of the results of the SWOT analysis carried out on behalf of May Flora Brokers. Before we do this, it’s important to say that we took this very seriously.

It is imperative for a business to have a trace of its core strength. Its main strength lies in the strength of our team; our workforce. We have a team that can do our best to make our clients value their money, we are well positioned and we know that from day one we will open doors for business, we will attract many clients. We also have an efficient and effective dedicated software application to help you manage your ongoing insurance business.

a new insurance agency in the United States, it may take some time for our organization to enter the market; this is perhaps our greatest weakness.

The insurance opportunities are huge and we are ready to take any opportunity that presents itself, so we will be offering several insurance policies / packages.

One thing is certain: a weak economy is one of the main factors limiting the growth opportunities of the insurance industry. When you think about it, there is hardly any business or investment opportunity that does not come with its own share of threats and challenges. This is why most organizations regularly conduct risk assessments to enable them to develop strategies that will help them stay afloat in the industry.

Another threat and major problems that we are likely to face when starting our insurance business is of course the arrival of other insurance agencies in the same place as ours, and possibly the sale of the same one. insurance policy that we.

Of course, if we were able to develop workable and winning strategies that will help us outperform our competition where our insurance agency will be located. That being said, we probably won’t have a hard time growing our insurance company and we will also keep some of the best hands under our job.

Additionally, as with any business and investment vehicle, economic downturns, volatility in financial markets, natural disasters and adverse government policies can hamper the growth and profitability of an insurance company.