Are you going to write a business plan for hedge funds? here is a sample SWOT analysis for a hedge fund company to help you develop a competitive strategy.

Economic analysis of a hedge fund business plan

Example of a SWOT analysis of a hedge fund business plan

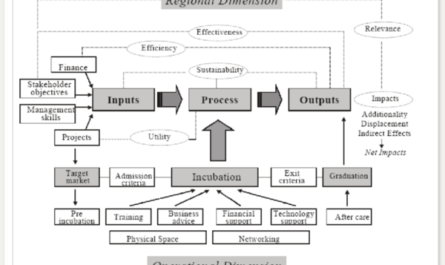

JB Moses Associates, LLP has recruited a key business structuring professional to help our organization build a well-structured hedge fund management business that can compete profitably in the highly competitive fund management and service industry. investment.

Part of the business consultant’s job was to work with our organization’s leadership to conduct a SWOT analysis for JB Moses Associates, LLP. Here is a summary of the results of a SWOT analysis conducted on behalf of JB Moses Associates, LLP;

Our main strength lies in the strength of our team; our workforce. We have a team that can do our best to make our clients value their money (good return on investment); a team trained and equipped to pay attention to detail and do a great job. We are well positioned and know that we will attract many customers from the first day we open our doors for business.

As a new hedge fund management company, it may take some time for our organization to enter the market and be accepted, especially by corporate clients, in an industry already saturated with fund management and fund services. investment; this is perhaps our main weakness. So we may not have enough money to advertise our business the way we would like.

The opportunities for fund management and investment services are immense given the number of investors looking to grow their investment portfolios. As a standard and accredited hedge fund manager, we are ready to seize any opportunity that comes our way.

A hedge fund raises a lot of cash and is known to be a very high risk business. Therefore, whoever decides to manage it must not only have solid investment experience, but also know how to manage risks. The truth is, if you are not based on risk management as a hedge fund manager, you risk wasting people’s money and investments.

This is why it is often said that you do not learn the ropes of hedge funds; Recruits are unlikely to survive hedge fund management without cutting their teeth elsewhere. As with any other field of business and investment, economic downturns, unstable financial markets and unfavorable government policies can hamper the growth and profitability of hedge funds. Continuation of the article …