Thinking of starting a mortgage brokerage company? here is a complete example of a Mortgage Brokerage Company Business Plan Feasibility Study Template that you can use for FREE to raise funds .

Ok, so we’ve covered all the requirements for running a mortgage brokerage company. We also took it a step further by analyzing and writing a sample mortgage brokerage marketing plan template backed by actionable guerrilla marketing ideas for mortgage brokerage firms. So let’s move on to the business planning section.

Why start a mortgage brokerage company?

Housing remains one of the most urgent human needs. People can go all the way to have a place to rest after a hard day’s work. Without a doubt, for the average person, especially the lower class and even the middle class of society, it can be a daunting task to save the money needed to buy their own apartment. But the good news is that with mortgage brokerage companies, you can buy a property as you wish and pay for it over a long period of time.

In fact, if you want to be successful in your mortgage brokerage business, you need to expand your network and build successful relationships with major real estate players and banks. This is because as a mortgage broker you are certainly dependent on how your bank and your real estate companies can make a profit because you only get commissions on loan payments.

It is important to note at this point that if you are not careful with this type of business, you could get into trouble and be sued. That is why you should follow the proper procedures before getting a loan for your client. If you have clients who consistently default on their monthly payments, you have a chance of going bankrupt soon. To protect yourself from any embarrassment, it is important to purchase liability insurance for your mortgage brokerage business.

There must be a good business plan if you are going to build a business that will stand the test of time. With a good business plan, you can easily attract investors and partners to help you realize your dream of starting your own mortgage brokerage company.

The truth is, you will definitely need to present a feasible business plan to any investor you want to talk to in order to invest in your business. Plus, with a good, achievable business plan, you are confident in the growth and expansion of your business.

Sample business plan template for a mortgage brokerage company

- Overview of activities

Mortgage brokerage firms are created for the sole purpose of providing a convenient platform in the form of a long term loan for those looking to purchase their own property. With a loan that you get from a bank through a mortgage brokerage company, you can finance any property you want, as long as you go through the verification and appraisal process.

Verification and appraisal is carried out in such a way as to ensure that the proper procedures are followed before disbursing a loan and that the person receiving the loan must be creditworthy. Style

In other words, mortgage brokerage firms act as intermediaries between the bank and the mortgage bank, as the case may be, and the individual or entity seeking to acquire real estate. Any or group of investors can create and own a mortgage brokerage firm if it meets the conditions required to create such an entity. in the country in which they intend to establish their business.

The mortgage brokerage industry is indeed in a mature state. The stage of its growth. The industry is characterized by growth in line with the overall economic outlook, consolidation of the largest players in the industry and unconditional recognition in the market for industry-specific products and services.

The scope of mortgage brokerage business will continue to be in high demand by businesses and individuals in the United States, especially with the increase in the number of businesses and the need for investments.

The mortgage brokerage industry is indeed a major sector of the US economy. United States of America, which brings in a whopping over $ 8 billion a year from more than 12,609 registered and licensed mortgage brokerage firms across the United States of America.

The industry employs more than 44,756 people. people. Experts predict that the mortgage brokerage industry will grow 6.3% per year. Establishment (online brokerage companies) in this industry, which has a dominant market share in the United States of America; Zillow and the loan tree.

In addition, creating a mortgage brokerage company requires professionalism and a good understanding of the financial and real estate markets. In addition, you will need to obtain the required certifications and licenses, and meet the standard capitalization for such a business, before being allowed to open a mortgage brokerage company in the United States; the industry is heavily regulated to combat fraud and crime.

Summary of the mortgage brokerage firm’s business plan

The Pentagon Mortgage Brokerage Firm, LLC is a registered and licensed mortgage brokerage company that will be located in the heart of Albany – New York. We were able to secure a standard office space in the city center.

We will offer services such as residential mortgage brokerage, commercial and industrial mortgage brokerage, stock brokerage loans, brokerage equipment financing agreements, brokerage services. auto loans, online mortgage brokerage services, online mortgage refinancing mediation, online mortgage intermediary services, providing an online mortgage marketplace and related mortgage advice and advice.

We understand that handle it all – A standard and standard mortgage brokerage firm can be demanding, which is why we are well trained, certified and equipped for superior performance.

Pentagon Mortgage Brokerage Firm, LLC is a client driven, results driven mortgage brokerage firm that will provide a wide range of mortgage brokerage and brokerage services at affordable prices that will by no means leave a hole in the pockets of our clients. We will provide standard and professional services to all of our private and business clients. We will do our best to meet and exceed the expectations of our clients every time they use our services.

At Pentagon Mortgage Brokerage Firm LLC, our clients will always come first and everything we do is guided by our values and professional ethics. We will take care of the hiring of professionals with extensive experience in brokerage and mortgage loans.

The Pentagon Mortgage Brokerage Firm, LLC will continually demonstrate its commitment to sustainability both individually and as a business, actively participating in our communities and incorporating sustainable business practices where possible.

We will deliver on our responsibility to the highest standards by accurately and completely meeting the needs of our customers. We will develop a working environment that offers a human and sustainable approach to earning a living and living in our world for our partners, employees and customers.

Our plan is to grow the company into one of the leading mortgage brokerage and mortgage brokerage brands across New York City, and to become one of the 20 largest mortgage brokerage firms in the United States of America in the First 10 years after its full opening. Company.

It may sound like too big a dream, but we hope it will certainly come true as we have done our research and feasibility studies and are excited and confident that Albany – New York is the right place to start. our mortgage brokerage company before seeking clients from other cities in the United States of America.

Pentagon Mortgage Brokerage Company, LLC is founded by Mr. Campbell Smith and his immediate family. Campbell Smith is well versed in real estate and loans. He has over 15 years of experience in various financial advisory positions with a strong focus on mortgage lending in the United States of America. Mr. Campbell Smith graduated from the University of California at Berkeley with a degree in Accounting and Harvard University (MBA).

- Our products and services

The Pentagon Mortgage Brokerage Firm, LLC intends to offer a variety of services in the mortgage brokerage and loan services industry in the United States of America and of course globally. Our intention is to open our mortgage brokerage company in Albany – New York – using the city’s available capabilities.

We are well prepared to take advantage of the industry and will do whatever is permitted by law in the United States to achieve our business goals, objectives and ambitions. Our commercial offers are listed below:

- Mortgage brokerage

- Commercial and industrial mortgage brokerage

- Mortgage brokerage for the purchase of a home

- Brokerage services equipment financing mechanisms

- Auto loans to brokers

- Online mortgage brokerage

- Online Brokerage Mortgage Refinancing

- Online mortgage brokerage

- Providing an online mortgage market

- Provision of other loans and related mortgage advisory services

Our vision

Our vision is to create a brokerage and mortgage brand that will be the number one choice for individuals, small businesses and corporate clients in Albany – New York. Our vision reflects our values: honesty, safety, service, excellence and teamwork.

- Our mission statement

Our mission is to provide professional, reliable and reliable mortgage brokerage and loan services that help start-ups, businesses and non-profit organizations with their mortgage and loan problems.

We will make the company one of the leading brands in the brokerage and mortgage industry in Albany – New York, and we will also rank among the top 20 mortgage brokerage and mortgage companies in the United States of America for its First 10 years of operation.

- Our corporate structure

Pentagon Mortgage Brokerage Firm, LLC is a mortgage brokerage and lending company that intends to start small in Albany – New York, but hopes to grow to successfully compete with the industry’s leading mortgage brokerage and lending services companies. in the United States and the United States. and globally.

We recognize the importance of building a strong business structure that can support the image of the world-class business we want to own. That’s why we strive to hire only the best hands in our industry.

Normally we would pay for two or three employees and only pay for online mortgage brokerage, but as part of our plan to build a world class standard brokerage and loan company in Albany, NY. we made plans from the start.

The core of the business we intend to build is mortgage brokerage and lending services, and the business goals we want to achieve are what communicates how much we’re willing to pay for the best hands available to you. Albany and New York and surrounding areas, if they are willing and able to partner with us to achieve our business goals and objectives.

At Pentagon Mortgage Brokerage Firm, LLC, we will make sure to hire people who are skilled, hardworking and creative, results-oriented, customer-focused and willing to work to help us build a successful business that benefits all stakeholders (owners , employees and customers).

Subject to f Accordingly, the incentive arrangement will be made available to all of our senior executives and will be based on their performance for five years or more, as decided by the board of directors of the company. In view of the above, we have decided to hire qualified and competent people. to fill the following positions:

- General manager

- Mortgage and loan brokerage consultants

- Administrator and HR manager

- Marketing and Sales Director

- Accounting

- Account manager / Reception manager

Roles and responsibilities

Executive director:

- Improves management effectiveness by recruiting, selecting, orienting, teaching, training, consulting and disciplining managers; transfer values, strategies and goals; distribution of responsibilities; planning, monitoring and evaluation of work results; develop incentives; climate development to provide information and opinions; Provide educational opportunities.

- Creates, communicates and implements the vision, mission and general direction of the organization, that is, leads the development and implementation of the overall strategy of the organization.

- Responsible for pricing and signing trade agreements

- Responsible for providing advice to the company

- Creates, communicates and implements the organization’s vision, mission and overall leadership, i.e. directs the development and implementation of the organization’s overall strategy,

- Responsible for signing checks and documents on behalf of the company

- Measures the success of the organization

Mortgage and loan brokerage. Consultants

- Head of Residential Mortgage Mediation

- Responsible for mediation of commercial and industrial mortgages

- Responsible for residential mortgage mediation

- Responsible for financing mechanisms for brokerage equipment

- Responsible for brokerage loans for the purchase of vehicles

- Online Intermediate Mortgage Manager

- Online mortgage brokerage services

- Brokerage services for granting mortgage loans via the Internet

- Providing online mortgage market services

- Provision of other loans and related mortgage advisory services

Administrator and HR manager

- Responsible for overseeing the proper functioning of the human resources department and the administrative tasks of the organization

- Develops job descriptions using KPIs to manage client performance

- Meet regularly with key stakeholders to review the effectiveness of HR policies, procedures and processes

- Support office supplies by checking inventory; place and expedite orders; evaluation of new products.

- Ensures the operation of equipment by meeting preventive maintenance requirements; call for repair.

- Identifies the jobs to be recruited and manages the interview process

- Provide staff input to new team members

- Responsible for training, evaluation and evaluation of employees

- Responsible for organizing trips, meetings and appointments

- Updates professional knowledge by participating in training opportunities; read professional publications; maintain personal networks; participation in professional organizations.

- Monitors the proper functioning of the office.

Head of Marketing and Sales Department

- Identifies, prioritizes and contacts new partners, as well as business opportunities, etc.

- Identifies development opportunities; monitors development and contacts; participates in the structuring and financing of projects; ensures the realization of related projects.

- Draft winning documents, negotiate fees and rates in accordance with company policy

- Responsible for carrying out commercial research, marker surveys and feasibility studies for clients

- Responsible for monitoring implementation, defending client needs and communicating with clients

- Develops, implements and evaluates new plans to increase sales growth

- Documents all contacts and customer information

- Represent the company at strategic meetings

- Helps increase sales and business growth

Accounting

- Responsible for the preparation of the financial statements, budgets and financial statements of the organization.

- creates reports based on information about financial transactions recorded by the accountant.

- Prepares an income statement and balance sheet using trial balance and ledgers prepared by an accountant.

- Provides social analysis of financial management, development budgets and accounting reports; analyzes the financial feasibility of the most complex proposed projects; conducts marketing research to predict business trends and conditions.

- Responsible for financial forecasts and risk analysis.

- Maintains treasury, general ledger, and financial reports for one or more objects.

- Responsible for the development and management of financial systems and policies

- Payroll manager

- Ensures compliance with tax laws

- Manages all the financial transactions of the company

- Serves as the company’s internal auditor

Customer Service Manager / Front Desk Agent

- Greet guests and clients by welcoming them in person or by phone; respond to or direct requests.

- Ensures that all customer contacts (email, built-in hub, SMS or phone) provide the customer with a personalized customer service experience of the highest level

- Through interaction with customers over the phone, he seizes every opportunity to get the customer interested in the company’s products and services.

- Effectively and timely allocates administrative responsibilities assigned by the manager

- Keep up to date with any new information on the company’s products, advertising campaigns, etc. to ensure the provision of accurate and useful information to customers

- Receipt of packages / documents for the company

- Mail distribution in an organization

- Perform any other task according to my supervisor

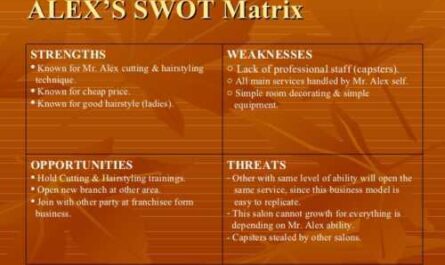

SWOT analysis of the mortgage brokerage company’s business plan

The Pentagon Mortgage Brokerage Company provides core business advisory and structuring services to help our organization build a well-structured mortgage brokerage and mortgage company that can compete profitably in the highly competitive mortgage brokerage market. in the United States and around the world.

As part of the business advisory team, I worked with our organization’s leadership to conduct a SWOT analysis for the Pentagon Mortgage Brokerage Firm, LLC. Here is a summary of the results of a SWOT analysis carried out on behalf of the Pentagon Mortgage Brokerage Firm, LLC;

In addition to our solid business network with financial institutions and real estate players, our main strength lies in the strength of our team; our workforce. We have a team that can do everything possible to make our clients value their money; a team trained and equipped to pay attention to detail and deliver excellent business value We are well positioned and know that we will attract large numbers of clients from day one we open our doors for business.

As a new mortgage brokerage and lending company in Albany, NY, it may take some time for our organization to enter the market and gain acceptance, especially by corporate clients in the already saturated mortgage brokerage industry; this is perhaps our greatest weakness. Also, we may not have enough budget to advertise our business the way we would like.

“The opportunities in mortgage brokerage and loan servicing are enormous given the number of people, startups and, of course, corporate organizations that cannot afford to do without mortgage brokerage and loans. As a standard and well-positioned mortgage brokerage and mortgage company, we are well equipped and ready to take advantage of any opportunity that comes our way.

Some of the threats that we are likely to face as a mortgage brokerage company operating in the United States are adverse government policies, the emergence of a competitor in our operating site. and the global economic slowdown, which generally affects purchasing power and purchasing power. There is little we can do about these threats except to be optimistic that everything will work to our advantage.

Mortgage brokerage firm business plan MARKET ANALYSIS

- Market trends

The mortgage brokerage and loan services industry is indeed a very large industry and of course it is an industry that works for individuals and businesses in different sectors. If you know the trend in the mortgage brokerage and loan service industry, you will find that a lot of people are using the services provided by the industry for empowerment and for business.

The truth is, without the services of mortgage brokerage and loan servicers, some people and even start-ups will have a hard time getting a loan or saving to buy real estate. They are responsible for helping individuals and businesses bypass the bureaucracy associated with obtaining loans from banks and other financial institutions, etc.

Another notable trend in the brokerage and mortgage industry is that the industry has achieved impressive results over the past five years as large reductions in unemployment have boosted industry revenues. Likewise, the mortgage brokerage and lending services industry has benefited from the advancement of online platforms, continued growth in product penetration, and of course, expansion of customer base, which will stimulate the growth of the sector.

- Our target market

The demographic and psychographic makeup of those seeking mortgage brokerage and loan services includes individuals, small businesses, and large corporations.

Pentagon Mortgage Brokerage Firm, LLC will initially serve small and medium-sized businesses, from start-ups to established businesses and individual clients, but this in no way prevents us from expanding to be able to compete with the major brokerage firms. mortgage and credit services. in the USA.

As a standard and licensed mortgage brokerage company, Pentagon Mortgage Brokerage Firm, LLC offers a wide range of mortgage brokerage and lending services, so we are well prepared and prepared to serve. wide range of customer base.

Our target market covers businesses of all sizes and individuals. We are entering the industry with a business concept that will allow us to work with individuals, small businesses and large corporations in and around Albany – New York and other cities in the United States of America.

Below is a list of companies and organizations for which we have specially designed our products and services;

- Real estate investors

- NGO

- Churches and other religious organizations

- Corporate organizations

- Schools

- Individuals and households

- Entrepreneurs and startups

Our competitive advantage

We are well aware that being very competitive in mortgage brokerage and loan servicing means that we need to be able to access mortgages; bypass the formidable obstacles in obtaining loans from the bank and other financial institutions.

The Pentagon Mortgage Brokerage Company, LLC may be a newcomer to the mortgage brokerage and lending industry in the United States of America, but management and business owners are considered gurus. These are people who are leading professionals as well as highly qualified and licensed mortgage and loan brokerage advisors in the United States. It’s part of what we see as a competitive advantage.

Finally, our employees will be well looked after and their social security packages will be among the best in our class (mortgage start-ups and credit companies) in the industry, which means they will be more willing to start businesses with us. and help us achieve our goals. goals and achievement of all our goals and objectives.

Mortgage brokerage business plan SALES AND MARKETING STRATEGY

We are aware of the fierce competition in the United States of America between mortgage brokers and loan companies, so we were able to hire one of the best business promoters to handle sales and marketing.

Our sales and marketing team will be hired on the basis of their vast experience in the industry and they will receive regular training so that they are well equipped to meet their objectives and the overall purpose of the organization. We will also make sure that our excellent services speak for us in the market; We want to create a standard mortgage brokerage and loan business that uses word of mouth from satisfied customers (individuals and businesses).

Our goal is to grow our brokerage and mortgage company to become one of the top 20 brokerage and mortgage companies in the United States of America, which is why we have developed a strategy for help us take advantage of the available market and its growth becomes a major force. , which should be taken into account not only in Albany – New York, but also in other cities of the United States of America.

Pentagon Mortgage Brokerage Company, LLC is prepared to use the following marketing and sales strategies to attract clients:

- Introduce our business by sending cover letters along with our brochure to households, corporations, schools, real estate players and other key stakeholders in Albany – New York and other cities across the United States from America.

- Promote our business in financial and business magazines, newspapers, TV channels and radio stations.

- List our business on the yellow pages (in local directories)

- Attend relevant international and local real estate, finance and business exhibitions, seminars and trade shows, and more.

- Creation of different packages for different categories of clients (individuals, startups and companies) in order to work with their budgets.

- Internet leverage to promote our business

- Use a direct marketing approach

- Encourage word of mouth marketing from loyal and satisfied customers

Mortgage brokerage firm business plan Advertising and advertising strategy

We have been able to work with our brands and advertising consultants to help us define advertising and promotional strategies that will help us penetrate the core of our target market. We intend to take mortgage brokerage and lending services by storm, so we have taken steps to advertise and promote Pentagon Mortgage Brokerage Firm, LLC.

Below are the platforms we intend to use to promote and advertise Pentagon Mortgage Brokerage Firm, LLC;

- Place advertisements in print (community newspapers and magazines) and electronic media. platforms; we will also promote our brokerage and mortgage company in financial magazines, real estate agencies and other related financial programs on radio and television

- sponsor relevant social events / programs

- we will use various online platforms to promote our business. This makes it easier for Internet users to access our site with just one click. We will use the Internet and social media such as; Instagram, Facebook, Twitter, YouTube, Google +, etc. To promote our brand

- Install our billboards at strategic locations across Albany – New York.

- Take part in roadshows over time around Albany – New York to promote our brand

- Distribute our flyers and flyers in targeted areas across Albany – NY

- Make sure all of our employees wear our branded shirts and that all of our official vehicles carry our company logos and more.

Source of income

The Pentagon Mortgage Brokerage Company was established with the aim of maximizing the profits of mortgage brokerage and loan servicing and we will do our best to do our best to regularly attract corporate and private clients.

Pentagon Mortgage Brokerage Firm, LLC will generate revenue by providing the following mortgage brokerage and lending services to individuals, real estate companies, non-governmental organizations and businesses;

- Mortgage brokerage in the residential sector

- Commercial and industrial mortgage brokerage

- Mortgage brokerage

- Brokerage equipment financing mechanisms

- Auto brokerage loans

- Online mortgage brokerage

- Online Brokerage Mortgage Refinancing

- Online mortgage brokerage

- Providing the online mortgage market

- Provision of other related mortgage advisory and consultancy services

Sales forecasts

The fact that it is quite difficult for the average person and start-up businesses to obtain mortgages from banks and other financial institutions gives leverage to mortgage and credit brokerage companies like ours. This suggests that the possibility of earning income for the business cannot be ruled out.

We are well positioned in the affordable Albany – New York market and our online platforms and are very optimistic that we will achieve our stated goal of generating sufficient revenue / profit in the first six months of operation. and to expand our business and our customer base. outside Albany – New York to other cities in the United States of America.

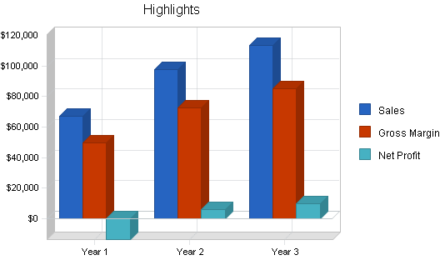

We were able to critically examine the mortgage brokerage and lending services market and analyze our chances in the industry, and we were able to establish the following sales forecasts. Sales forecasts are based on information gathered in the field and on certain assumptions typical of startups in Albany – New York.

Below is the sales forecast for Pentagon Mortgage Brokerage Firm, LLC, based on location. our business and the wide range of brokerage and mortgage services we will offer;

- First year: $ 250,000

- Second year: $ 550,000

- Third fiscal year: $ 950,000

NB : This projection is based on what is available in the industry and on the assumption that there will be no major economic crisis or natural disaster during the period specified. No major competitor will offer the same value-added services as us in one place. Please note that the above predictions may be lower and at the same time higher.

- Our pricing strategy

It is a fact that mortgage brokerage and lending services, online and offline, are driven by demand for real estate / real estate, so prices cannot be fixed; real estate prices fluctuate regularly. In addition, mortgage brokerage and loan services are commission-based as they act as intermediaries between mortgage applicants and mortgage banks and other financial institutions / credit providers. Our service prices and commissions are just below the market average for all of our clients, as our overhead costs remain low and service charges are pre-billed to legal entities and individuals who will hire our services. Outraged,

- payment methods

At Pentagon Mortgage Brokerage Firm, LLC our payment policy will be all inclusive as we are well aware that different people prefer different payment methods as they wish. Here are the payment methods that we will make available to our clients;

- Payment by bank transfer

- Online bank transfer payment

- Payment by check

- Payment by bank check

- Cash payment

Keeping the above in mind, we have selected banking platforms that will help us achieve our projects with little to no itching. Our bank account numbers will be available on our website and in promotional materials for customers who wish to deposit funds or make an online transfer for our service fee.

Mortgage brokerage firm business plan Financial projections and costs

Starting a mortgage brokerage company can be profitable; this is because on average you are not expected to buy expensive machinery and equipment. In addition to working capital or capitalization as required by the regulator.

Basically, you have to be concerned about the amount needed to provide standard office space in a good and bustling business line, the amount needed for office furniture and equipment, the amount needed to purchase the necessary software applications, the amount needed to pay bills, promote the business and get the related business. – licenses and certificates.

Here are the financial forecasts and the cost of launching the Pentagon. Mortgage Brokerage Company, LLC;

- The total fee for business registration in the United States of America is $ 750.

- Basic insurance budget covers costs, permits and business license $ 2,500

- The amount required to purchase suitable office space in the business. District 6 months (including construction of the facility) 40,000 US dollars.

- amount required for capitalization (working capital) 50,000 USD

- Cost of office equipment (computers, software, printers, fax machines, furniture, telephones, filing cabinets, security devices and electronics, etc.) USD 5,000

- The cost of purchasing the required software applications (CRM software, accounting and bookkeeping software, payroll software, etc.) USD 10,500

- the cost of launching an official website is $ 600 .

- Budget to pay at least three employees for 3 months plus utility bills of $ 10,000

- Additional fees (business cards, signs, advertisements) and promotions, etc.) USD 2,500

- Miscellaneous: USD 1,000

According to a market research report and a feasibility study, we will need over one hundred and fifty thousand ( 150,000 ) US dollars to successfully establish a medium-sized but standard brokerage and credit company in the United States of America. ‘America.

Funding / Seed Capital Formation for Pentagon Mortgage Brokerage Firm, LLC

The Pentagon Mortgage Brokerage Firm, LLC is a family owned and operated business to be owned and operated by Mr. Campbell Smith and his immediate family. They are the only funding for the business, but can probably accommodate partners later, so they decided to limit the business start-up capital to three main sources.

These are the areas in which we intend to generate our start-up capital;

- generate part of the start-up capital from personal savings

- source of concessional loans from family and friends

- Apply for a loan from my bank

NB . We managed to get around $ 50,000 . savings of $ 40,000 and a concessional loan from family members ( $ 10,000 ), and we are in the final stages of securing a loan of $ 100,000 from our bank. All documents and documents have been duly signed and submitted, the loan has been approved and at all times our account will now be credited.

USE OF THE MORTGAGE BROKERAGE ACTIVITY: sustainable development and expansion strategy

The future of a business lies in the number of repeat customers who have the capabilities and skills of the employees, their investment strategy and their business structure. If all of these factors are missing from the business (business), it won’t be long after the business closes.

One of our main goals for starting a mortgage brokerage company at Pentagon, LLC is to build a business that will survive on its own cash flow without having to inject funds from outside sources once the business is officially launched.

We know that one way to get approval and attract clients is to offer our brokerage and mortgage services (service fees and commissions) a little cheaper than what is available in the industry. brokerage and mortgages, and we are well prepared to survive for a while with lesser profits.

Pentagon Mortgage Brokerage Firm, LLC will ensure that the right foundations, structures and processes are in place to ensure that our staff are treated well. Our corporate culture aims to move our business forward, and training and retraining our employees is at the top of our business strategy.

In fact, a profit-sharing agreement will be provided to all of our executives and this will depend on their performance over three years or more, as determined by the organization’s board of directors. We know that if this is done we can recruit and retain the best hands we can put in the industry; they will be more committed to helping us build our dream business.

Checklist / Milestone

- Company name availability check: complete

- Business registration: complete

- Opening of corporate bank accounts with various US banks: complete

- Opening of online payment platforms: completed

- Application and obtaining of the tax identification number: in progress

- Business license and permit application: Completed

- Purchase of all forms of commercial insurance: Completed

- Feasibility study: completed

- Rental, renovation and equipment of our establishment: Completed

- Receive part of the start-up capital from the founder: Completed

- Loan requests from our bankers: in progress

- Preparation of the business plan: Completed

- Compilation of employee handbook: complete

- Drafting of contractual documents: in progress

- Creation of the company logo: finished

- Graphic design and packaging printing Marketing / promotional material: finished

- Recruitment in progress

- Purchase of necessary software, furniture, office equipment, electronic devices and reconstruction of the facility: in progress

- Creation of an official website for the company: In progress

- Strengthening of the reputation of companies (Business PR): in progress

- Occupational health and safety conditions: ongoing

- Establishment of business relationships with banks, financial loans to institutions, suppliers and major industry players: ongoing