Do you want to start an auto insurance company? here is a complete guide to starting an auto insurance business with no money and no experience .

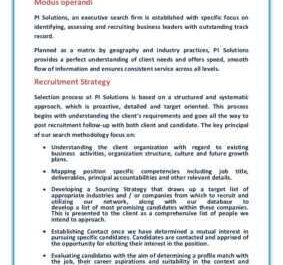

Okay, so we’ve provided you with a detailed example of an auto insurance business plan template. We also took it a step further by analyzing and writing a sample auto insurance marketing plan backed by actionable guerrilla marketing ideas for auto insurance companies. In this article, we will go over all the requirements for starting an auto insurance business. So put on your entrepreneur hat and let’s move on.

Why create an auto insurance company?

The automobile was one of the technological advancements centuries ago. Over the centuries, we have witnessed various and countless developments in the automotive field. There has also been growth in several companies that revolve around the automotive industry.

As people still use cars on our roads, the need for auto insurance coverage will continue to be in demand. Auto insurance is really a lucrative business as you are not allowed to drive a car in the United States and anywhere in the world without a proper insurance policy.

If you are looking for a business to start a business and know that you have an interest in the insurance industry, you should consider starting your own auto insurance business. If you are considering starting an auto insurance company, you will need to get an insurance license from your country’s insurance regulator before you can start your own auto insurance company. In the United States of America, the industry is regulated by the National Association of Insurance Commissioners.

It is important to note that auto insurance is a business that cannot go out of style due to the role it plays in the auto industry. Depending on the scale you want to start, the start-up capital for this type of business can be considered moderate. In fact, you can start your own auto insurance business with a small number of employees and then grow it in a short period of time by reinvesting your profits. in business.

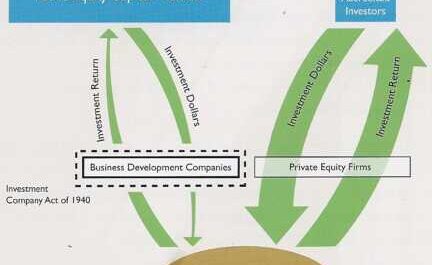

It is also important to note that if you are an investor interested in owning a portfolio in the insurance industry, you may not need to go all the way to pass the required insurance exams and obtain the required insurance certifications. All you need to do is provide the necessary finances and relationships and then involve people who have the necessary papers / documents that you can cooperate with when setting up your insurance company.

So if you have the desire to start your own auto insurance business, just read this article and you will be well equipped. You can start your auto insurance business from a small town in the United States, and if you are consistent and creative, your brand will soon become a national brand.

Complete Guide to Auto Insurance Company Training

- Industry overview

The auto insurance industry is made up of companies that sign or take risks and assign premiums to auto insurance policies. Auto insurance primarily provides financial protection against physical damage to vehicles and bodily injury resulting from traffic accidents. It should be noted that auto insurance can also protect against civil liability.

If you follow the auto insurance industry closely, you will agree that the industry is focused on financial health and net premium growth for liability insurance products that have helped the insurance industry. automobile over the years.

Going forward, auto insurance revenues are expected to increase as the macroeconomic landscape continues to improve, which should improve the investment environment for auto insurers.

In fact, most of the auto insurer’s assets are invested in bonds. Despite this trend, industry consolidation is expected to continue, with large operators viewing strategic acquisitions as a lucrative method to increase their share of the auto insurance market.

The auto insurance industry is indeed a large and quite attractive industry. is very active in all countries of the world. According to statistics, in the United States of America alone, there are approximately 5,420 large and small auto insurance companies registered and licensed in the United States, employing approximately 224,705 people, and the industry receives an amount whopping $ 228 billion. … Annually.

The industry is expected to grow by 2.8% per year between 2011 and 2016. It is important to clarify that the preferred share of affordable insurance companies Allstate, Berkshire Hathaway Inc., Progressive and State Farm Market in the industry.

A recent report published by IBISWorld shows that the performance of the auto insurance industry in the five years to 2016 was helped by a stronger insurance market in the second half of the period and an increase of net profit. premiums issued for each of the industry’s product lines, in particular for liability insurance offers. The report also showed that in a difficult market, insurers are focusing on strengthening their financial position and, therefore, increasing premium rates.

However, price competition remains an essential pillar of competition in the industry, as the dichotomy between traditional discount insurers and those targeted online becomes increasingly important. In addition, this competitive industry continues to follow broader consolidation trends in the insurance industry, with auto insurers making strategic acquisitions to gain market share.

In some countries, confidence is one of the main factors hindering the growth of the insurance industry. In addition, the insurance company continues to grow and as long as the country’s economy continues to grow, the auto insurance company will generally follow suit.

The fact that there are several auto insurance companies and insurance brokerage firms in no way precludes an investor or entrepreneur who wants to take risks in the auto insurance industry. If you know what you want and have the right strategy, you are sure to be successful in the auto insurance business.

People are encouraged and motivated to take risks in the auto insurance industry because of the profitability of the industry and because, despite the saturation of the industry, it is still possible to create their own products. unique auto insurance or even partnering with larger insurance companies if you are able to successfully build your own auto insurance company to a certain level of success. …

Finally, the auto insurance industry is open to many people interested in the industry if you have what it takes to run an insurance company. Even if you don’t have the financial and other requirements to start an auto insurance company, you can enter the industry by starting with a licensed auto insurance broker.

Start of market research and feasibility studies for an automobile insurance company

- Demography and psychography

Demographic and psychographic makeup of those who frequent auto insurance policies for all genders over 18 with financial means and who own cars, hence the demographic makeup of the auto insurance company that covers everything . Basically, your target market cannot be limited to a group of people, only those who own cars.

So, if you are planning to start your own auto insurance company, you should make your demographic target an overall demographic target, which should include auto dealers, auto repair shops, auto repair shops, repair shops automobile, auto repair shops and transportation companies in the vicinity where your insurance company will be located.

List of niche ideas in the auto insurance industry that you can specialize in

It is important to note that there is no known niche in the auto insurance industry; Auto insurance is a niche in the insurance industry. Each actor in this field is directly involved in passenger liability insurance, private passenger insurance / comprehensive insurance, commercial liability insurance and collision / all commercial risk insurance, etc.

The level of competition in the auto insurance industry

Competition in the auto insurance industry goes beyond competition from auto insurance companies; You will have to compete with insurance companies who also sell insurance policies. So, it is fair to say that the competition in the auto insurance industry is fierce.

The truth is, regardless of the level of competition in the industry, if you have done your due diligence and branding and market your product or business properly, you will always advance in the industry. Just make sure your premiums are affordable, you pay your claims as needed, without too much stress from your customers, and you know how to attract and reach your target market.

But beyond that, there are several auto insurance companies scattered throughout the United States. So, if you decide to start your own auto insurance company in the United States, you will certainly face stiffer competition from auto insurance companies and insurance companies in your area who also sell auto insurance. auto insurance. In addition, there are larger auto insurance services that are setting trends in the industry and you should be prepared to compete with them for customers.

List of well-known brands in the auto insurance industry

In all sectors, there are always brands that perform better or are better perceived by customers and the general public than others. Some of these brands are the ones that have been around the industry for a long time, while others are best known for the way they run their business and the results they have achieved over the years.

These are some of the major auto insurance companies in the United States of America and around the world;

- Allstate Insurance Company

- Berkshire Hathaway Inc.

- Progressive auto insurance company

- Federal Automobile Insurance Company

- USA Insurance Co

- America Auto Insurance

- Wilcox family insurance

- Amica insurance mutual

- American Family Insurance Tom Moody

- Com auto insurance agency

- Wawanesa Insurance

- Dunn Insurance

- American agency insurance

- Insurance Connection United States

- America Auto Insurance

- Parsons, Dan Nationwide Insurance

- Geico Auto Insurance Company

- Esurance

- Mutual Freedom

- AAA Auto Insurance Company

Economic analysis

If you are looking to successfully start a business and maximize your profits, you need to make sure that you have done the right economic and cost analysis and that you have tried to make the most of the best practices in the industry in which you decide to operate. grow your business.

Auto insurance is not a green business; in fact, you will come across several auto insurance companies when you are driving around town or searching online and offline directories. So, if you are planning your economic and cost analysis, you should do a thorough market research and estimate the amount needed to rent office space, office equipment, creation of software applications, the amount required as funds capitalization, the amount required to acquire the necessary business licenses and the cost of successfully running a business.

Also, if you are considering starting an auto insurance company, your concern shouldn’t be limited to the cost of renting an office. equipment, office furniture, etc., as well as branding and how to build a strong customer base. The truth is, if you can successfully build a strong customer base, you will be maximizing your business’ profits.

Start your auto insurance business from scratch or buy a deductible

There is no hard and fast rule for how you are going to start a business. Basically, you need to be guided by your overall business vision and mission statement. If you want to start an auto insurance company, you will have to start from scratch because you can hardly buy an auto insurance company deductible.

Additionally, starting an auto insurance company, especially an auto insurance brokerage agency from scratch, is less stressful than other related businesses, which usually require detailed preparation before starting. to work.

In an auto insurance company, you should simply try to secure as much as possible a standard office space in a good business district, and then use all the marketing tools available to you, especially on the Internet, to promote your insurance company. automobile. …

Please note that most of the major successful auto insurance companies started from scratch and were able to build a strong business brand.

Threats and potential challenges you will face when starting an auto insurance company

If you decide to start your own auto insurance company today, one of the main challenges you are likely to face is having established auto insurance companies. and insurance companies in your area that also sell insurance policies. The only way to avoid this problem is to create your own market.

Some other problems and threats you are likely to face are the economic downturn; If the economy is in bad shape, companies like auto insurance companies and the like usually have a hard time charging their customers a premium, retaining old customers, or even recruiting new ones.

Likewise, unfavorable government policies can also hamper the growth of your auto insurance company. There is nothing you can do about these threats and challenges except to make sure that all is well with you.

Creation of a legal company for automobile insurance.

- The best legal entity to use in this type of business

Typically, you have the option of choosing a general partnership or a limited liability company for an auto insurance company. Usually, a full partnership should have been the ideal business structure for a small auto insurance company, especially if you are starting out with little start-up capital in a small area.

But people prefer a limited liability company for obvious reasons. If you intend to grow your business and sell auto insurance policies in major cities in the United States of America and elsewhere in the world through franchising, then choosing a sole proprietorship is not an option for you. A limited liability company, LLC, or even a general partnership will do this for you.

LLC training protects you from personal liability. If something is wrong with the business, only the money you invest in the limited liability company is at risk. This is not the case for sole proprietorships and partnerships. Limited liability companies are simpler and more flexible to manage, and you don’t need a board of directors, shareholder meetings or other management formalities.

Here are some of the factors to consider before choosing a legal entity for your auto insurance company; limitation of personal liability, ease of transfer, acceptance of new owners, investor expectations and of course taxes.

If you are in no rush to critically examine the various legal entities that can be used for your auto insurance company with the ability to franchise and sell your auto insurance policy in all major cities in the United States – United of America, you agree with this limited liability company; LLC is the most appropriate. You can start this type of business as a Limited Liability Company (LLC) and in the future turn it into a “C” corporation or an “S” corporation, especially if you are planning to go public.

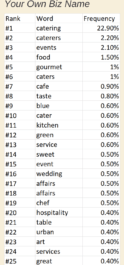

Attractive business name ideas suitable for an auto insurance company

When it comes to choosing a name for your business, you need to be creative because whatever name you choose for your business will go a long way in creating a perception of what the business stands for. This is usually a normal occurrence for people who follow trends in the industry they intend to work in when naming their company.

If you are considering starting your own auto insurance company, here are some catchy names you can choose from;

- Vicar Mica® Auto Insurance Company, Inc.

- Bourn Mort® Auto Insurance Company, LLC

- ClassicTM Auto Insurance Company, Inc. policies

- All Autos® Auto Insurance Company, LLC

- Mark Festus Group® Auto Insurance Company, Inc.

- Tennessee Ribbon® Auto Insurance Company, Inc.

li>

- C-Plus ™ Auto Insurance Company, Inc.

- Guaranteed Autos®, LLC

- Ken & Family® Auto Insurance Company, Inc.

li>

- Mutual Contract® Auto Insurance Company, Inc.

Insurance conditions

Here are some of the main insurance coverages that you should consider purchasing if you are looking to start your own auto insurance company in the United States of America;

- general insurance

- risk insurance

- credit insurance

- Deposit insurance

- Financial reinsurance

- Mortgage loan insurance

- Health insurance

- Liability insurance

- Complete vehicle insurance

- Workers compensation

- General disability insurance costs

- Business Owner Insurance Policy Group

- payment protection insurance

intellectual property / trademark protection

Beyond a reasonable doubt, starting an insurance company is really serious business, so you should do your best to mark the ‘I’ and cross the ‘I’. One of the things you need to do is apply for intellectual property protection.

This is necessary because you need to make sure that your company logo and all other official documents, such as your auto insurance policy document and claims documents, are well protected to prevent people from taking advantage of the fact that ‘they are not protected.

In addition, you can also develop your own personalized auto insurance applications; if you are developing your own custom software application, you will need to apply for intellectual property protection. If you want to register your trademark, you must begin the process by filing an application with the USPTO. The final approval of your mark is subject to legal review, as required by the USPTO.

Finally, you may need to develop unique auto insurance products for your customers. The fact that the auto insurance industry is extremely competitive forces you to protect your child’s brain, otherwise others will use it.

Do i need professional certification to run an auto insurance company?

In addition to the payment results of your claims by date, professional certification is one of the main reasons some auto insurance companies stand out. If you want to make an impact in the auto insurance industry, you should strive to achieve all the required certifications in your area of specialization.

It is strongly recommended to obtain professional certification; this will go a long way to show your commitment to the business. The certification validates your competence and shows that you are highly qualified, engaged in your career and up to date in this competitive market.

Here are some of the certifications that you can use to achieve your goal if you want to run your own auto insurance company;

- Certified Insurance Consultants (CIC)

- claims representative (AIC)

- Insurance Services Lawyer (AIS)

- Associate personal insurance agent (API)

- Accredited Insurance Consultant (AAI)

Note that if you are an investor interested in acquiring a portfolio in the insurance industry, you may not need to go all the way to pass the required insurance exams and obtain the certifications of insurance required. All you have to do is provide the necessary finances and connections and then bring in some people who have the necessary papers / documents that you can partner with when setting up your auto insurance company.

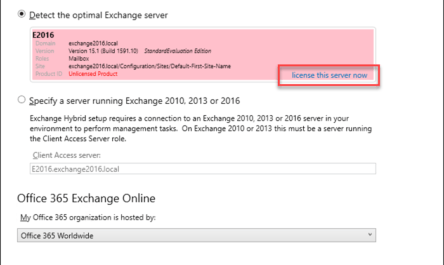

List of legal documents you need to manage an auto insurance company

The essence of having the necessary documentation before starting a business in the United States of America cannot be overstated. It is a fact that you cannot conduct business successfully in the United States without proper paperwork. If you do, it shouldn’t take long before the long arm of the law catches up with you.

Here are some of the basic legal documents that you must have in place if you want to legally operate your own auto insurance company in the United States of America;

- Registration certificate

- Business license

- Tax identification number / Tax identification number

- Business plan

- Proof of ownership, correct identification and license of the vehicle

- Fire certificate

- Non-disclosure agreement

- Employee Handbook

- Employment contract (letters with proposals)

- Operating Agreement for LLC

- Insurance policy

- Online terms of use

- Online privacy policy document (mainly for an online payment portal)

- Company charter

- Memorandum of Understanding (MoU)

- Construction license

- Franchise or brand license (optional)

Finance your auto insurance company

Starting an auto insurance company can be profitable, especially if you choose to start small as an auto insurance broker. Rent for office, office equipment, building software applications and the amount required as capitalization funds, along with the amount required to acquire the necessary business licenses, are some of what will require a significant portion of your capital from start-up. Therefore, if you decide to start a large-scale business, you will need to find a source of funding to fund the business as it is expensive to set up a standard large-scale auto insurance company.

There is no doubt that when it comes to financing a business, the first thing to consider is to write a good business plan. If you have a good, achievable business plan document, you may not have to work on your own before convincing your bank, investors, and friends to invest in your business.

Here are some of the options that you can use when looking for startup capital for your auto insurance company;

- Collect money from personal savings and sell personal stocks and property

- Raise funds from investors and business partners

- Sale of shares to interested investors

- Apply for a loan from your bank / banks

- Transfer your business idea and apply for business grants and seed funding from donor organizations and angel investors

- Source of concessional loans from family and friends

Choosing the right location for the auto insurance company

Insurance companies and most financial services companies require that you physically meet with your clients, so it must be in a good location; a place conducive to human and car traffic, and a place at the epicenter of the business district if you really want to serve a multitude of customers and maximize your business profit.

So, if you are looking for a location for your auto insurance company, make sure it is in your city’s business district, a location that is visible and easily accessible. Of course, you wouldn’t want to find this type of business on the outskirts of town. Your customers should be able to drive by and find your office without too much difficulty or hassle, and salespeople should also be able to easily locate your office when they need to submit their offers / offers, documents, or for a verification history, etc.

Most importantly, before choosing a location for your auto insurance company, be sure to do a thorough feasibility study and market research first. It is possible that you come across a similar company, which has simply closed the store in the place where you want to open yours. For this reason, it is very important to gather as many facts and figures as possible before choosing a place to start your own insurance company.

Here are some of the key factors that you should consider before choosing a location for your auto insurance company;

- Demographics of the location versus the number of cars

- The auto insurance policy request is covered locally

- The purchasing power of the inhabitants of the place

- Seat availability

- the number of insurance companies and insurance companies that also sell car insurance policies on the site

- local laws and regulations in the community / state

- traffic, parking and security, etc.

Creation of an automobile insurance company. Technical and personal information

If you are planning to start an auto insurance company, you should look to ICT specialists to help you develop your own insurance software, secure internet platform and online payment system (which will help you to facilitate emiums payments).

Here are some of the technical questions that you should be prepared to address before successfully starting your insurance company. In addition, you will likely need computers, internet, telephone, fax machine, and office furniture (chairs, tables, and shelves), all of which can be used fairly.

When it comes to renting or buying an outright office space the choice depends on your financial situation, but the truth is, to be on the safe side it is advisable to start with a short term lease / lease. during the on-site commercial trial period. If everything works as expected then you are taking a long term lease or a full purchase of real estate, but if not then go and find another ideal location / object for such a business.

When it comes to hiring employees for a standard auto insurance company, you should plan to hire a knowledgeable CEO (you can fill this role), administrator, and resource manager. human resources, risk manager, prosecution investigators, sales and marketing manager / vendors, and salesperson, accounting and customer service manual.

Here are some of the key people you can work with. You may need at least 10 full-time employees to start an insurance brokerage company, but if you want to start a small out-of-the-box insurance company, you should consider more than 10 employees. full time to help you. Key roles in your organization.

Service process involved in an auto insurance company

When it comes to auto insurance companies, there are no hard and fast rules as to how they provide their services. Indeed, the business process is simple and straightforward.

Basically, an auto insurance company lists the insurance policies it has and then goes into the market to cover the insurance policies. Regular premium collection and claims settlement methods should be in place at a time when the appropriate claims need to be investigated.

It is important to clarify that the auto insurance company can make the decision to improvise or adopt any business process and structure that will ensure their efficiency and flexibility; The auto insurance company business process described above is not built in stone.

Creation of an automobile insurance company. Marketing plan

- Marketing ideas and strategies

Generally, running a business requires being proactive when it comes to marketing your products or services. If you decide to start an auto insurance company, you need to make every effort to use strategies that will help you attract customers, otherwise you will probably have difficulty with the business, as there are some well-known brands that define market orientation for the auto insurance industry. …

Car owners will buy your auto insurance policy if they know they will get claims on time and, of course, value for money (premiums).

How, in fact, your marketing strategy will be based on reliability, speed, security, pricing, secure payment platform and above all excellent customer service. You need to make sure that every time your customers purchase insurance, they receive great service. The truth is, if you can apply the above on the spot, you won’t have a hard time keeping your old customers and gaining new customers at the same time.

These days, businesses are realizing the power of the Internet and that is why they will do their best to maximize the Internet to promote their services. In other words, a greater percentage of your marketing efforts will be directed to Internet users; Your website will become your number one marketing tool.

Here are some ideas and marketing strategies that you can use for your auto insurance company;

- Introduce your auto insurance company by sending cover letters with your brochure to auto dealers, car owners, auto repair shops, auto repair shops, auto repair shops and transportation companies, as well as ” other key businesses in the city where your insurance company is located.

- Advertise online on blogs and forums, as well as social media like Twitter, Facebook, LinkedIn, to get your point across so that social media users or bloggers know who to call when they go. need to purchase auto insurance policies in your area

- Create a basic website for your business to have an online presence

- Direct marketing of their products

- From time to time participate in roadshows in targeted communities to promote your vehicle. Insurance company

- Join local auto insurance associations to learn about industry trends and advice

- offer discount days to your customers

- advertise your business in local newspapers, local TV and radio stations

- list your business on yellow ad pages (local directories)

- Encourage the use of word of mouth marketing (referrals)

Strategies to increase awareness of your auto insurance company and build your corporate identity

If your intention to start an insurance company requires developing a business outside of the city from which you intend to become a national and international brand, selling insurance policies across the United States, then you should be prepared to spend the money to promote and market your brand.

No matter what industry you belong to, the truth is that the market is dynamic and requires continuous brand awareness and promotion in order to continue to reach your target market. Here are the platforms you can use to build brand awareness and build brand identity. style for your auto insurance company;

- Advertise on print (automotive newspapers and magazines) and electronic media platforms

- Sponsor relevant community events

- Use on the Internet and social networks such as; Instagram, Facebook, Twitter, YouTube, Google +, etc. To promote your products.

- Set up bulletin boards at strategic points around highways and major roads in your city or state

- Take part in roadshows from time to time in targeted areas to learn more about your auto insurance company.

- Distribute leaflets and flyers to targeted areas.

- Contact auto dealers, car owners, auto repair and maintenance services. and servicing garages, transport companies and transport companies and other key stakeholders throughout the city where your insurance company is located, keeping them informed about your business and the products you sell

- List your auto insurance company in local directories

- Promote your auto insurance company on your official website and use strategies to help drive traffic to your website

- Place our Flexi banners strategically where your auto insurance is located.

- Make sure all your employees are wearing your branded shirts and all your cars and vans have your company logo etc.

Suppliers / business network

It is advisable to enter into business partnerships with key stakeholders in the automotive and transportation industry, in particular a car dealership. garages, car owners, auto repair, garage maintenance and repair, transport and shipping companies and other key stakeholders, etc. they are in a better position to purchase auto insurance from you.