The dream of every employee and even business leaders goes beyond a good income. the ability to pay your bills, care for your family and enjoy retirement when the time comes. If your intention is to work hard and to be able to enjoy and maximize your life to the fullest when you are actively working and when you retire, you should start planning for your life after retirement.

There is no doubt that you want to maintain the lifestyle you currently enjoy even in retirement; You need to be mindful and plan your retirement effectively. What is the point of working hard, earning a lot of money, living a luxurious lifestyle without creating a pension? The truth is, many retirees go bankrupt just because they don’t spend time planning for life after retirement. …

After you retire from work or business, you can lead the same lifestyle or even a higher standard of living. The idea is that you have to plan and invest properly: some people start enjoying life after quitting their jobs in difficult careers. They can afford to travel for fun, play golf, and do whatever charity they choose, all while paying all of their bills stress-free.

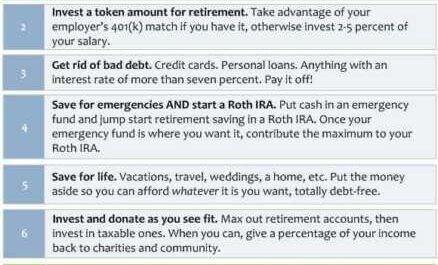

So, if you are still actively working or running your own business, and if you want to adopt a modest or luxurious lifestyle, you should consider these 10 retirement investment options for beginners;

Investment for retirement. Best options, useful tips

1. Register with a pension fund manager

This In most countries of the world it is a law that a certain amount is deducted from each employee’s salary, as well as from the company account, and this money is paid into an account opened in your name by your manager. pension funds. It’s one of the easiest ways to save for retirement. The fact that you cannot log out of your account while you are still active makes it the best option for accumulating funds to finance your retirement lifestyle. The responsibility of the management of your pension fund is to help you invest and reinvest your savings, and after you retire you will be paid a certain amount on a monthly basis.

2. Invest in stocks

Another way to plan for retirement is to allocate a certain percentage of your salary to investing in stocks. While investing in stocks can be risky, it is therefore advisable to hire the services of stock brokers to help you manage your stock portfolio. When you buy the right stocks, you will surely receive good dividends for a long time after retirement, and you can use the money you receive to fund your retirement.

3. Invest in hedge funds

Another tip to consider when planning for retirement is to invest in hedge funds. Sure, investing in hedge funds can be capital and risky, but the truth remains that it’s a sure-fire way to secure retirement if you have the financial ability.

4. Invest in mutual funds

Another tip that you can consider when planning for your retirement is to invest in mutual funds. Mutual funds are a collection of funds generated by various private investors with a common investment objective, interests and philosophy, for the sole purpose of investing in stocks, bonds, assets, other securities and money market instruments. The fund is managed by a professional fund manager on behalf of investors. The advantage of a mutual fund is that investors can decide to sell their shares directly to the public, just like any other publicly traded company.

5. Investment in private capital

Private investing is another good investment to start when planning for your retirement. Since this type of investing requires the investor to acquire an existing company or acquire most of the available-for-sale shares, this means that you must have accumulated enough money to be able to invest in private equity. Just make sure that no company you buy a business from requires your active participation in running the business.

6. Invest in commodity futures

This is an area of investing that a lot of people don’t seem to understand how it works, and it’s actually a smart way to invest for retirement, the fact that it requires you to pay for a product that you will have. need in the future. makes it a good way to invest in your future, especially for retirement. Sincerely, he will pay you to put your money in the item and then wait for the matter to be settled before collecting the interest or buying the item you paid for.

7. Invest in venture capital

The venture capital business by all standards is for serious investors who know what they want; it’s another way to plan and invest in retirement. Venture capital is all that is needed to buy growing businesses or start-ups in order to inject money into the business so that it grows and becomes more profitable. Just make sure you invest in a business that can work without you.

8. Invest in gold, silver, bronze and diamonds

Learn More To plan for retirement, you must buy gold, silver, bronze and diamonds and hold them for the duration of your retirement. The advantage of investing in gold, silver, bronze and gold is that you can hold them for a long time and sell them at interest whenever you need cash.

9. Invest in your children and other family members. … One of the best retirement investments you can make is to invest in educating and empowering your children and other family members – in truth, some of the best services you can get after the retreat will be provided by your children. …

10. Build a business that can function without you

If you don’t have the financial capacity to invest in venture capital, you can start a small business and grow it in a way that can work without you. This business will serve as your source of income when you retire.

Here; 10 retirement tips for beginners. Success stories have been shared by those who have tested these steps. You can also activate it to get the desired result.