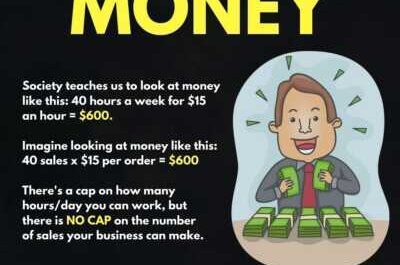

Just as life is full of risks and uncertainties, the business world is also very risky. A lot of nasty things can happen in the course of running your business which, if not prepared, can suddenly bring your business to a halt and lead to debt.

A pharmaceutical company that has been manufacturing a specific brand of teething formula for children for several years has recently been taken to court. Why? Some babies died and the teething mixture was found to be directly responsible for the unfortunate deaths of these children.

The hugely popular bottled drink company has been asked to pay several million dollars in compensation to some consumers who have found dead insects in their drink. I am sure you have surely heard of cases of people falling in restaurants because of wet and slippery floors, and you have been asked to compensate the victims of such accidents.

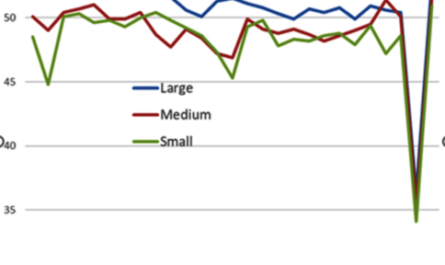

I could go on and on with hundreds of examples of such cases and problems. Some of these compensations are not cheap. This is why it is very important to purchase commercial liability insurance for your business, regardless of its size.

If you run a small or a very large business, if you do not already have such an insurance policy, you should consider getting one when you have finished reading this article. Before deciding that your business does not need insurance, check out some of the items covered by commercial liability insurance.

and. Employee practice: you never know what you can achieve with your employees. If you suddenly decide that you no longer need an employee’s services, perhaps because you have too many employees or you feel they are not doing their job, they may turn around and sue you. justice, and God will help you. you will be asked to pay damages if he has a better lawyer.

In another scenario, you could just recruit people, then advertise the job, ask people to apply, do a background check, and choose the candidate you think is the most suitable. Don’t be surprised if one of the candidates decides to sue you for wrongful refusal of employment or illegal discrimination.

When do employers decide to do background checks or private investigations on their employees just to be sure of the character of the person they hire, and then the employee finds out and sues the company for breach of privacy? private life?

We usually don’t want this to happen, but in any case, it happens unexpectedly, so the best thing you can do for yourself is protect yourself with insurance so that if and when it does happen. , you would not only have enough funds to pay legitimate bills, you would also have enough funds to compensate victims if you needed to.

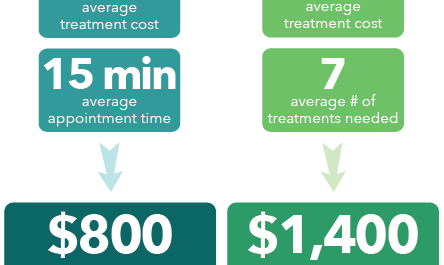

b. Professional liability insurance – … This is especially important if you are a professional in fields such as medicine, mechanical engineering, etc. We all know what happened to Dr. Conrad Murray, to Dr. Michael Jackson; Not only did he face a long legal battle which must have cost a fortune, he also had to go to jail for several years which also affected his source of income. No matter how careful you are or how much knowledge you have in your field, it’s important to protect yourself with professional liability insurance.

vs. Responsibility of the premises: you must also protect your premises and all equipment against fire and theft.

re. Health insurance – … Except when working with robots, expect a medical issue or two to arise that could cost the company dearly, but once you have medical insurance for your staff you don’t not to worry about it. costs when they arise.

e. Product liability – … I mentioned several cases above involving companies whose products endanger the lives of their consumers. I bet these companies never expected this to happen in the last century, but if they had a commercial general insurance policy it would cover all claims and costs.

These are just a few of the risks covered by commercial liability insurance. Others include fire, automobile and liability insurance for debt, error and omission, and alcohol liability insurance. To obtain general liability for your business, you must follow these steps:

How to buy commercial liability insurance for your business in five steps

1. Assess your business risks – … First, you need to take a close look at your business and the products or services you provide to determine the risk your business is exposed to. If you run a courier business, for example, you already know that you need to cover the goods you transport, the vehicles you use, your employees, the warehouse where you will store the things you transport, as well as any errors. . that your employees can engage in parcel processing. Every business has its own level of risk; while some can be very risky some can just be risky which is why it is your responsibility as a business owner to assess the risks to your business or to ask someone else to do it for you.

2.Decide on the types of insurance coverage your business needs: … The next step is to determine the type of insurance policies you will need to take out to cover the risks to which you are exposed.

3. Select a broker or an insurance company:. You can choose to work directly with an insurance company or use an insurance broker. Whichever method you choose, you should make sure that the company you are purchasing the insurance policy from is in good standing.

4. Get competitive quotes – … The next step is to get more quotes, especially if you are using a broker. This way you can save a few thousand.

5. Take a close look at what the company offers: make sure you read the contract carefully and understand what the insurance policy covers before signing it.

6. Sign the contract