Every business owner has to start somewhere, and at some point, even in the world. Successful business owners are naive and inexperienced entrepreneurs. It is only when you create and run a business for yourself that you truly understand what it is. There will be mistakes along the way, but if you do your research and prepare as much as possible, you will give yourself the best chance for success.

Here are some things to keep in mind when starting or just starting your first business.

Not wanting to delegate

This is a problem that many new business owners may face. Your business is your child, it’s easy to feel that no one can do a job as well as you. You end up taking too much and over time nothing will be done to the best standards. As things get bigger and better, you need to have trusted employees to do the job. Micro-management is bad for you and for them and adds stress. Take your time with the hiring and hiring process, and hire a candidate who you think is right for your job. Provide them with good preparation, then let them continue with the work you give them. This is the only way you can grow and grow as a business. The ultimate goal of most business owners is to have a business that “works alone” and makes money without having to do any work. You can only achieve this by hiring the right staff and allowing them to continue. job.

Work with friends and family

When it comes to hiring workers, a mistake many new business owners make is hiring loved ones. It seems logical, you know them and their past, they need a job and you have vacancies. But in most cases, it’s not the smartest decision. As this personal connection has already been made, it is difficult to establish business partnerships – conflicts of control can arise and it can be difficult to discipline them if they do not lose weight. You may feel pressured to keep them even if they are not suitable for the role due to personal circumstances. And such things can lead to misery for your business. When it comes to the employee-boss relationship, it’s often best to hire a stranger – be friendly and professional at the same time, and there are clear limits for that. When your employees are also your loved ones, it can cause headaches and heartaches.

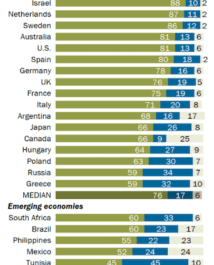

Unprepared for fluctuations in sales and profits

A more tense and calm environment is observed throughout the year in all industries. For example, retail and hospitality businesses will always be busier on public holidays like Christmas, and then there will be quieter times. Many industries will see fewer customers in April with the arrival of taxes and everyone is spent after tax bills! However, if you are an accountant, for example, this will be your busiest time! As an inexperienced new business owner, it’s easy to ignore seasonal trends like this, but it’s important that you be prepared. Know when is the quietest time for your industry so that you can still be able to cover the costs. There is software that you can use to analyze data related to spikes in sales or changes in website traffic on certain days. It can help you plan for a more stressful and calmer time. It can also let you know for sure whether a particular marketing method you have used was particularly successful.

Ignore the importance of marketing

Speaking of marketing, this is another extremely important thing to do when starting any type of business. Many naive entrepreneurs “build this and they will come” without realizing the competition for each type of business. You need to get the message out to people who might be interested in what you are doing. Not only that, but you have to convince them that they should choose you from other similar companies. Find a good marketing company that uses techniques like blogger reach and SEO, video marketing, and social media marketing to promote your business. There are some things you can do as well, even if you don’t have a lot of marketing knowledge. Prepare key chains (key chains, cups, pens and other small items with your brand name) and give them away at trade shows or as free shopping gifts. Host an event at your premises, inviting people to come and donate food and drink – you can show samples of your products or what you do and use them to educate people about your business.

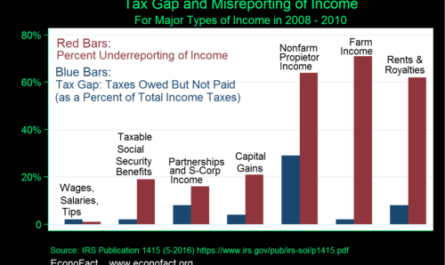

Not preparing a tax invoice

As a business owner, you are responsible for paying your own taxes, which are not always the easiest to solve. It’s worth getting into the habit of setting aside twenty percent of your profits up front, or you may find yourself in a situation where you can’t afford to pay. An accurate tax invoice depends on accurate bookkeeping, so your records must be perfect, you can hire your own accountant and find good software, or you can outsource the work to a professional company. If you want to avoid the headaches completely, ask them to file your return, the tax accountants will know how to recover the necessary expenses so that you do not pay more. Do yourself badly and you can get fines and fines if you underpay (and the government thinks it was done on purpose) you can even get jail time! Get the right tax, prepare an invoice, and hire the right people to do your refund.