Are you looking to open an insurance brokerage firm? here is a complete guide to starting an insurance brokerage business with no money and no experience .

Ok, so we have provided you with a detailed example of an insurance broker business plan template. We also went one step further by analyzing and writing an example insurance brokerage marketing plan backed by actionable guerrilla marketing ideas for insurance brokerage firms. In this article, we are going to go over all the requirements for starting an insurance brokerage business. So put on your entrepreneur hat and let’s move on.

Why create an insurance brokerage company?

The insurance industry has grown exponentially over the decades, and this is due to the tremendous benefits that come with insurance. Companies that offer commercial insurance products are called brokers and are divided into two parts; independent agencies acting as an agent for a single insurer; and independent brokers who sell products from multiple suppliers.

Most brokerage firms usually fall into the latter case, as it gives them the opportunity to have a wide variety of clients who may prefer to have insurance options rather than sticking to a specific insurer. In the United States, almost everyone has insurance, and all businesses are required to have insurance, which means that it is a lucrative business for any entrepreneur.

If you have the right entrepreneurial spirit, you may find that it is better for you to start your own insurance brokerage company than to work for an insurance company. Additionally, you should note that setting up your insurance brokerage firm as a freelance means you stand a chance even against already established brokerage firms as clients are tired of the disruption caused by mergers. or redemptions. However, before you start this business, make sure you have the attitude, vision, insurance background, experience, sales success, and business acumen to make your business a success.

Besides having the attributes that will contribute to the success of your business, it is also important to understand the rules set by the industry and the government regulations that govern your business, as there is no legal excuse to ignore these. rules and regulations. Your insurance brokerage firm should adhere to all guidelines, as breaking any law can not only punish you, but also prohibit you from doing such business anywhere in the country.

If you are going to be in order to get start-up capital from outside investors or a commercial bank, you must create a comprehensive business plan.

As an independent insurance brokerage firm, you may need to list insurance companies to compare what they offer, and then settle for the carriers you end up representing. While it is imperative to choose as many carriers as possible, you should not choose too many at startup or overload the entire process.

Once you have decided which carriers you want to represent, then you need to contact the carriers, explain your intentions, and then request a set of agents so that you can understand each carrier’s agreement with the brokers.

Establishment of a comprehensive guide to insurance brokerage firms

- Industry overview

The insurance brokers and agencies industry in the United States of America generated revenues of $ 157 billion annually and grew 3.7% from 2012 to 2021, according to IBISWorld. There are approximately 425,000 insurance brokers and agencies in the United States of America, employing approximately 996,000 people.

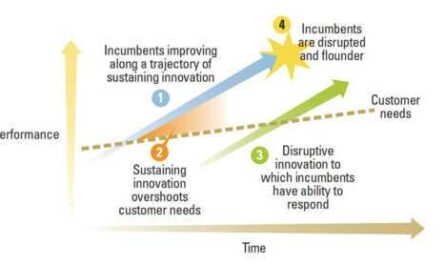

This industry is growing steadily, especially in the context of a strong economy, which leads to an increase in the level of disposable income, while simultaneously reducing the level of unemployment. However, the industry had its own challenges, especially as it faced intense and growing competition from insurers providing direct insurance services to clients.

These insurers reduced the client’s dependence on independent brokers and agencies by starting to expand their negotiating skills by investing in their own sales websites and diversifying their sales teams.

The insurance brokerage and agency industry is also facing price pressure from internet operators as well as online brokerage firms. The outlook for the insurance brokerage industry over the next five years is that there will be moderate growth even as the overall economic landscape improves dramatically. It is believed that niches such as life insurance and health insurance expand significantly as the global economy improves.

To counter growing competitive pressure from insurers, traditional insurance brokers have sought leverage by offering value-added services such as risk management and insurance advisory functions to clients.

In addition, insurance brokerage companies hire highly skilled employees to ensure fair competition, which has contributed to the growth of the industry segment despite the activity of the reinsurance market and declining premium rates. in the primary and commercial insurance markets.

Most of the income (57.7%) generated by insurance brokerage and the sector agency in 2021 comes mainly from commissions for commercial and personal property insurance and accident insurance (PC).

Most brokerage firms in the industry generally choose to specialize in life insurance, property insurance, and accident or health insurance, but more and more brokerage firms are choosing to sell multiple lines of insurance, not least because the type of insurance sold determines the organization of the industry. for which more brokerage firms prefer to be independent than to work directly for insurers, it is to be able to generate more income than to be limited.

Globally, the insurance industry, which includes agents and brokers, generates nearly $ 5 trillion in premiums per year, according to a study by Swiss Re. Non-life insurance markets are experiencing rapid growth in developed countries in North America and Asia, while emerging markets in Asia and Latin America show strong sales, particularly in the form of life insurance premiums.

In the United States alone, there are approximately 133,000 insurance agencies and brokerage firms – that number includes businesses that have one or more locations – and all of them generate nearly $ 120 billion in annual revenue.

According to analysts, the global insurance brokerage industry is expected to grow at a constant CAGR of 4% in 2015-2021. The main drivers of market growth are changes in customer demographics and economic growth.

The number of people born during the population boom has also increased, as has the population of millennials, which has resulted in an increase in the number of different health insurance products. The major insurance brokerage firms are using this period to develop various strategies that will allow clients to get a better price for what they pay.

In 2015, North America accounted for 53% of the market share. and the region’s CAGR is expected to increase by 5% between 2015 and 2021. The North American region is growing at such a rapid rate because there is enough local consolidation in the industry coupled with high tech growth. Opportunities that have allowed insurance brokerage firms to enter markets that were previously untapped or underserved.

In addition, brokers and agents were able to challenge traditional operations and take advantage of the opportunities created by the disruptive market, to be able not only to innovate, but also to create long-term sustainable strategies.

Creation of an insurance brokerage company for market and ES feasibility studies

- Demography and psychography

The demographic and psychographic makeup of those who need the services of an insurance brokerage firm are not just individuals, but businesses, as well as insurance companies, suppliers and underwriters.

This shows that those who need insurance are not limited to a specific group or person or business as they cover all kinds of people and businesses in the United States of America, so if you want to define the demographics of your insurance brokerage company, you should strive to do so. it is complete.

List of niche ideas in the insurance broker industry that you can specialize in

An insurance brokerage firm is like a third party agent in that it helps those who are unsure of which insurance policies to choose, as well as those who want to choose, compare what multiple providers have to choose from. what they think is best for them.

There are several areas in the industry, and if you decide to specialize in certain services or areas, you should try to research the niche that will bring the most profit to your business. If you are starting out small, you may need to offer several specialized services; however, if you are starting out on a large scale, you can offer all the services so that you can have more clients.

Here are some of the niches available to you if you are looking to start an insurance brokerage company;

- Brokerage services for property and accident insurance

- Brokerage life and accident insurance

- Health brokerage and medical insurance

- Annuity brokerage service

- Management and administration of reinsurance brokerage

- Risk management consulting

The level of competition in the insurance brokerage industry

The level of competition in the insurance brokerage industry is such that one can compete from anywhere in the world. United States as long as you can sell products to as many insurance companies as possible. This doesn’t mean, however, that you don’t need to be physically present anywhere, as most people usually go to the closest insurance broker they can see, even if they are. they have few suppliers.

Demand in the insurance brokerage industry is directly related to consumer income as well as business activity. This means that if the economy is growing, the demand for personal and business insurance will also increase, but once the economy slows, the demand for insurance products will decrease significantly. Therefore, it means that the industry depends on the growth and stability of the economy.

If you want to open your own insurance brokerage company in the United States of America, you must be prepared to compete with other brokerage firms, especially since this type of business requires convincing skills. While large insurance brokerage firms have largely shaped the trend in this industry, smaller businesses have also been able to compete by offering their clients personalized services.

List of famous brands in the insurance broker industry

Every industry has brands that stand out and become well known to stakeholders in the industry and even outside the industry for several different reasons, such as location, brand name, customer relationships, length their business, marketing and advertising strategies, or even the logo and insurance. the brokerage industry is no different from each other as several brands have made an impact.

Therefore, below you will find some of the best known insurance brokerage companies in the United States of America and even around the world;

- Brown Brown, Inc.

- Arthur J. Gallagher Co.

- Marsh McLennan Companies, Inc.

- Aon Corporation

- Willis Towers Watson PLC

- Jardine Lloyd Thompson

- BBT Insurance Services

- HUB International

- National financial partners

Economic analysis

The insurance industry is benefiting greatly from the fact that more baby boomers are living longer, which means they can increase their demand for health insurance, although this is seen as bad news for the health care system in the United States. To maintain their profit margins, health insurance companies are starting to charge more to cover less.

The insurance industry has seen an increase in demand for its products, especially with the growing population in the United States. The insurance sector is undergoing many consolidations and technological advancements, leading to job losses in the sector. The insurance industry only grew 8% between 2002 and 2012, according to the U.S. Bureau of Labor Statistics.

The increase in the number of redundant jobs emerging in this industry is also driven by the fact that some internal business processes and interactions with clients are increasingly automated, which means that fewer people are needed to occupy these positions. This growing role of technology will greatly affect most insurance agents, brokers and insurers.

However, all of this is not doomed and bleak, as some roles cannot be replaced by technology, and those roles are expected to continue to grow. Likewise, insurance brokers who sell different insurance policies with different carriers are probably much better at waring against technology than those who are traditional insurance agents and brokers.

Starting your own insurance brokerage from scratch vs. buying a franchise

If you are planning to purchase a franchise, you should review the franchise opportunities available to use their opportunities and prices to determine what will be best for your business. Doing thorough research will prevent you from wasting money on buying a franchise that is not worth it. A good franchise should allow your business to grow in the direction you want it to be, while providing you with the support that will make your business successful.

When you start your business from scratch, you have the opportunity to know your business early on, although starting from scratch can be a bit overwhelming. When you start your business from scratch, you have the opportunity to steer your business in the direction you want, especially when circumstances arise that warrant your reaction.

Threats and potential challenges you will face when starting an insurance brokerage company

When opening any type of business in the United States of America, it is important to be aware that you will be faced with many threats and challenges, you must adequately prepare yourself to deal with the challenges. threats and challenges that arise in starting or running a business. You should know that while some threats and challenges can be controlled, others cannot, and when the ones you cannot control arise, you have no choice but to be optimistic.

There are some threats and challenges that you will face when starting your insurance brokerage firm; intense competition from existing insurance brokerage firms, increased government regulation, an economic downturn that will affect demand for insurance products and competition from new insurance brokerage firms.

Creation of a law firm in insurance brokerage law

- The best legal entity to use for this type of business

There are several attributes to consider when making a decision. which legal entity is best suited to your business and these characteristics; flexibility, taxation, ease of ownership, control and accountability.

While there are basically five types of legal entities in the United States for any entrepreneur wishing to start a business; not everyone is suitable for all businesses. For example, a single legal entity which is the owner and the partner, when used for this type of business, will restrict business opportunities somewhat, so entrepreneurs usually look to a corporation or a liability company. limited (LLC).

An LLC type entity is much like a corporation in terms of separating owners and businesses, but this type of entity tends to be more flexible when setting up as well as when taxed. While this may seem like the best legal entity for your insurance brokerage business, you should be aware that some of the procedures may differ depending on the state in which you will be working.

Attractive business name ideas suitable for an insurance brokerage firm

When you start a business you need to think about what you are going to call your business, because just like people should be named, so too is a business. Your company name can lead to widespread acceptance of your company and therefore should be chosen with care. Some of the factors that you should consider when choosing a name for your insurance brokerage firm include: easy to pronounce, catchy, catchy, and representative of your industry.

Therefore, some of the catchy company names that will work for you when starting your insurance brokerage business include:

- GG Corporation

- Mass insurance brokers

- Mesh Corporation

- McWells and Co., Inc

- Arthur Bonang, Inc

- Servis Group

Insurance conditions

Even if you run an insurance brokerage company where clients come for advice on which insurance policies would be best for them, as well as buying premiums, it is believed that you are running a business and that you will need insurance policies to protect you. Knowing how compulsory insurance is for businesses in the United States, it is important to create a budget that will allow you to purchase any insurance policies your business may need.

Below are some of the main insurance policies to consider when buying if you want to open your own insurance brokerage company in the United States of America;

- Health insurance

- General liability insurance

- Errors and omissions insurance

- Workers’ compensation insurance

- Business Owner Policy

- Car insurance

- Home Insurance

Protection of intellectual property / registered trademark

The business of an insurance brokerage company is a service-based business, so you won’t have to worry about acquiring intellectual property protection when starting your business.

Some entrepreneurs in this sector consider their company name, logo, slogan or certain elements to be very important and therefore seek intellectual property protection for these aspects. If you also see this as a priority, you may want to consider using the services of an attorney who is knowledgeable about the business to help you file your trademark rights with the USPTO.

Is professional certification required to purchase insurance? Brokerage company?

As an insurance broker, you are the agent who helps individuals and businesses find the insurance policies that best suit their needs and requirements. To become a successful broker, you need to know the insurance market and you will also need to be licensed in certain areas of insurance before you sell policies to clients.

If you want to get professional certifications to improve your profile, you should consider the following:

- Certified Insurance Consultant (CIC)

- certified risk manager (CRM)

- Chartered Insurance Representative (IRB)

- Certified Financial Planner (CFP)

While these certifications help increase the credibility of your business, you should understand that they are completely voluntary.

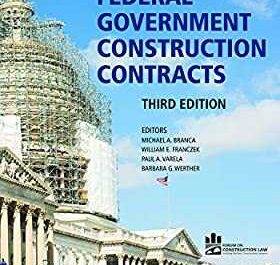

List of legal documents you need to manage an insurance brokerage company

In any business that you intend to open in the United States of America, it is imperative that you have the necessary legal documents to start and run your business without any complications from the law or regulatory authorities.

If you don’t have all of the required legal documents of you, not only will you be breaking the law, but you will also be punished if caught. The sanction can range from a financial fine to a ban on doing business in the country. If you are not sure what kind of legal documents you might need, it is best to contact a lawyer to help you.

Some basic legal documents you will need to run your insurance brokerage firm:

- Registration certificate

- Operating contract

- Contract documents

- Commercial licenses

- Business plan

- Insurance conditions

- Employer Identification Number (EIN)

- Federal tax identification number

- Hiring contract

Financing your insurance brokerage company

No matter what business you are targeting, start-up capital is needed to get started, although the business may seem trivial, and the insurance brokerage business, which requires a modest capital investment, does not have to be. been left out. Finding a source of start-up capital can be quite difficult for an entrepreneur, so it is generally advisable to have a business plan as this will help you secure a source of capital from private investors and even a bank.

Some sources where you can look for start-up capital for your insurance brokerage company:

- generate part of the start-up capital from personal savings and the sale of stocks or properties

- Apply for a loan from a commercial bank

- Apply for a loan from a venture capitalist or private investor

Choosing the right location for your insurance brokerage firm

Choosing a location for your insurance brokerage business is very important because the location you ultimately choose for your business can impact the business, so it is important that you take the time to choose the right location. The location you should aim for should be in an area that is considered highly respectable and has a lot of traffic, as this will ensure that some of that traffic will reach your desktop for research at certain times.

That doesn’t mean, however, that you can’t run your home insurance brokerage firm, especially if you’re starting out on your own and on a budget. Not everyone can handle working from home, however, especially with the many distractions that can come from family, pets, and the TV.

Also, you should create an area separate from the rest of your house so that your documents are not tampered with. While working from home can help you cut overhead and running costs, working in a formal business will be of great help in propelling your business to the success it deserves. …

When choosing a location for your business, it is imperative that you choose a location that is prominent, central to your target market, and easily accessible. If you move your location to a less visible location, you may need to spend more to get your business’s attention.

If you are not too sure which location is best for you for your business, you may need to hire the services of a real estate agent with the necessary knowledge about your business, as they will know which area will be the most suitable. more suitable for your business. in your own budget so as not to strain your overall budget.

Creation of an insurance brokerage company. Technical and personal data

When you start an insurance brokerage business, you need to be aware that there will be a lot of costs, especially if these are things that need to be in stock before your business can be launched. You may need different licenses to cover multiple niches that you intend to offer; costs may vary depending on the state in which you intend to do business. In addition, some licenses will require you to take an exam and pay for the exam in addition to the license.

In addition, when you start your insurance brokerage business, you will need to make sure that your business is registered with the appropriate government agencies so that you can report and collect sales tax.

Setting up an office and purchasing the equipment needed to keep it running depends on the location and condition from which you intend to do business. As businesses, especially those in the insurance industry, begin to become largely automated, it is essential that you purchase the equipment that will allow you to run your business effectively. Some equipment can be purchased for fair use; However, make sure they are working well before you use them fairly. The equipment you need; computers, telephones, printers, fax machines and software.

It is very important that you build the right business structure so that you can achieve all of your business goals and objectives. When hiring the staff you need, make sure they are not only experienced, but also understand and are committed to meeting your business goals and objectives. The employees you should be looking for to hire; Managing Director (CEO), Administrator and Director of Human Resources, Director of Business Development and Marketing, Insurance Sales Agents, Administrator, Accountant, Cleaners and Security Officer.

From the above analysis, you will need at least 9 key employees to ensure the success and effectiveness of your insurance brokerage company.

The process of providing services to an insurance brokerage firm

In the insurance brokerage and agency sector, the firm acts as an agent or broker for the sale of insurance policies and annuities. Operators in this industry typically earn their income from commissions, which represent a percentage of insurance policies sold to clients. In addition to commissions, traders can also generate a small income by providing advice on risk management and other services.

To be able to function and be competitive, operators must be convincing enough for customers to take out insurance policies. they want them, so most operators stick not to just one insurance provider, but to as many as possible; thus, they can tell the customer which insurance from different providers would be of most benefit to the customer.

Customers are targeting multiple environments, especially as the area becomes increasingly crowded with different carriers vying to grab the attention of those customers. Before deciding on insurance from different carriers, a thorough research is needed, which is likely to be more beneficial. for customers so that you don’t make deals with carriers that won’t benefit your business.

Creation of an insurance brokerage company. Marketing plan

- Marketing ideas and strategies

When starting any type of business, you should know that the ability to make money for the business is of the utmost importance, and the only way to do that is to promote the services of the business to target audience. Marketing is one of the primary ways to generate income for your business, penetrate your target market, and gain an edge over your competition, so you need to take it very seriously if you are looking to become your business. success.

However, before you can create marketing strategies that you believe to be effective and successful, you must carefully study the market for the industry you intend to enter, as this will allow you to understand which niches you want to enter, which they expect you, what to expect from them and who your competition is.

The insurance brokerage and agency industry is so large that, as a newbie entrepreneur, you can find yourself overwhelmed by all the big companies you have to deal with when marketing and promoting your business.

Not only do these large companies perform well, but they also have a network of clients that may be difficult for you to get, and so if you think the odds are against you, you can use the services of a marketing consultant. who has a good understanding of the market you are in to help create marketing strategies that will make your insurance brokerage firm stand out.

Additionally, you can also hire highly experienced marketers who are aligned with goals and objectives. your brokerage firm to help you develop marketing strategies that match your business marketing goals and modify or remove ineffective marketing strategies.

Below are some ideas and marketing strategies you can use to generate income and promote your insurance brokerage business;

- Introduce your insurance brokerage company to your target market by sending cold emails listing your services, contact details and rates

- Offer your marketing managers direct marketing from your brokerage firm

- Advertise in local and national newspapers and magazines, as well as on radio and television stations

- Use your social networks like Facebook, Twitter, Google Plus and LinkedIn to promote your insurance brokerage firm

- Participate in seminars, conferences and events to network and promote your insurance brokerage firm

- Make sure your insurance brokerage business is listed in the yellow pages as well as in online directories

Strategies to increase the awareness of your insurance brokerage firm and develop your business idea

As an entrepreneur, your challenge in starting your business is not final; You need to get people to notice your business. One of the goals of advertising your business is not only to gain the attention of your target market, but most of the attention can be given to your business sales; This is why large companies do not take the advertising issue easily because they are always ready to commit a certain amount every year to strengthen their brand and create a visual identity for their business.

It is very important that you do a thorough study of the market in which you plan to promote your brand, as this will allow you to determine which channels will be very effective in capturing their attention and generating the interest of your brokerage firm. insurance.

Because the insurance brokerage industry is so huge that it includes several well-known brands, you may need to hire the services of an advertising consultant who knows how to best represent your business in your target market and beyond that, and make sure you do. don’t spend more than you’d like.

Below are some strategies you can use to increase your brand awareness and create a corporate identity for your insurance brokerage firm;

- Make sure to install billboards in various strategic locations to build awareness of your brand

- place advertisements in local and national newspapers and popular magazines, as well as in radio and television stations

- hand out flyers and business cards, and place your flyers at various strategic points in the area where your brokerage firm is located.

- Create a website and use it to promote and promote your brand. Hire an SEO expert to make sure your site is in the top search engine rankings

- Use your social networks like Facebook, Twitter, Linkedin, Google Plus and Instagram to promote your insurance brokerage firm

- Ask some of your repeat customers to help market your business

- Participate and sponsor some community events to promote your insurance brokerage firm