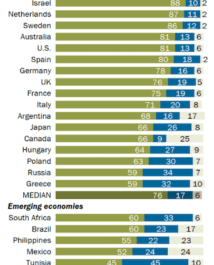

Want to know the average rate of return in the construction industry? here is an estimate of the annual revenues of construction companies.

There is no denying that the construction industry is a profitable industry, but the fact remains: profit margins in this huge industry can be hard to predict.

In 2013, business entrepreneurs made on average 2.96% profit. However, in busy years like 2021, this figure appears to have been higher than slower years. However, this means that the profit margin of this industry generally depends on the activity level of the industry.

With the growth of construction work globally, around 54% of contractors expect their profits to increase next year, and 29% of contractors expect profits to increase by 7% or more.

Costs to watch could affect the overall profit margin in the construction industry

When construction companies prepare their offer of contracts, they usually take into account many costs, including overhead and project profits. They should also take into account labor, materials, equipment costs, gluing, consumables and any other costs associated with the project.

The overheads are one of the costs to be taken into account when carrying out the construction. Company. These are the expenses of rent, support staff, insurance, tools, accounting, legal fees, landlord’s salary, debt payment and other expenses associated with operating a business. company.

Profit is what’s left over when you deduct the cost of labor and your overhead. This profit is a reward for the construction company. This is what allows a company to develop and invest in itself. Without a construction company making a reasonable profit, the business will be in trouble.

Types of profits in the construction sector

There are different types of benefits when you think of the construction industry and they include:

- Adjusted contract income

This is one of the costs that construction industries incur and that other industries generally do not have to bear. The adjusted contract product means that a fixed amount can be set aside for the contract, but when the buyer and contractor make it to the closing table, the contract price goes down.

In the construction of a new house, this represents 9 to 11% of the contract price. For renovations, restoration contractors, and those completing additions, the rate is less than 2%. This is mainly due to the allocation problems.

- Gross direct profit (direct margin)

It is the dollar value of the adjusted negotiated price minus the actual direct construction costs. These costs include land, materials, subcontractors, labor, and other direct costs (permits, insurance / bonds, engineering services, utilities, etc.).

- Gross indirect profit (gross margin)

This equates to direct profit minus indirect construction costs. Indirect costs are costs associated with construction, but cannot be directly attributed to a specific project. Examples include management, transportation, communications, employee compensation insurance, payroll taxes, equipment, tools and supplies.

It is important to understand that these types of costs are distributed among projects. These types of costs typically represent 18-21% of total contract revenue.

- Business profit (gross profit)

It is not the actual net income of the business; Typically, it does not include tax deductions for the business or owners. If the owner did not include his compensation in indirect costs or overhead, then this number should be called gross margin.

The value is calculated by subtracting the overhead (office operations, marketing). and company costs) of gross profit. For most small entrepreneurs, overhead costs are around 7% of contract income.

- Net profit

This is the last number; no other deduction can reduce this number. These are usually after-tax expenses. For most small businesses, a reasonable 23% tax rate to cover federal and state income taxes is what we’ll try to estimate for the construction industry.

What is the average rate of return for the construction industry?

from a new home builder to a modeler, a reasonable profit given the risk is generally set at 9%. It is about going home or real benefits; the amount that remains available after tax for the business. It does not include a reasonable salary for the owner for his leadership role.

So why should the profit be 9%? Well, that’s the profit needed to reward the owner (s) for starting up and taking responsibility for owning the business. The reasonable expectation of any business owner is 3-5%. If a typical small entrepreneur has adjusted his or her sales by $ 1,200,000 per year, he or she is looking between $ 36,000 and $ 60,000 to own a business. It is reasonable on all sides.