Are you fundraising for your startup in India and want to attract angels? here are 7 easy steps to finding and contacting Angel Investors in India.

Angel investing is one of the fastest ways to raise funds for your startup, especially if your idea is very brilliant.

Angel investors are usually wealthy people who understand how important it is for their money to work for them, instead of starting their own business with their own money, where they will have to participate in the management. on the contrary, they are more likely to come up with other viable business investment ideas and cash them out when the startup becomes profitable. This way they can get rid of a lot of stress and risk and grow their fortunes without the stress of running and running the business itself.

Some angel investors also do this for humanitarian purposes that want to help the economy grow, so they invest in businesses that can potentially create jobs and jobs for other people. Before approaching angel investors, know that many of them are successful business leaders themselves.

They are generally very smart and it takes a long time to impress them and get them to invest in your startup, especially since hundreds if not thousands of other budding entrepreneurs are just like you looking for angel investments. .

This article will help you know where to find angel investors to finance your business idea in India. You will also learn how to approach and dramatically improve your chances of investing in your business. Here are several ways to find and get the attention of angel investors in India.

7 Best Places to Find Angel Investors in India

1. Find them on the Internet … There are many famous angel investors in India and it is easy to find them on the internet especially on LinkedIn.These investors have funded a lot of startups in India and you can find them on LinkedIn and send them a brief idea of your startup.

If you can come up with a short but powerful pitch that you can submit to LinkedIn, you might receive an invitation from them to officially submit your business idea.

Some of these popular Indian angel investors include:

- Sunil Kaira : Sunil Kaira has invested in a number of startups including Hashcube, CrayonData, CultureAlley and Airwoot.

- Sharid sharma : Sharid Sharma is known for investing in the mobile and SaaS and consumer Internet sectors. Other startups he has invested in include Mobile Walla, Frrole, Druva Software and Vayavya Labs.

- Raban Anandan : Raban Anandan also invests in the SaaS and Internet mobile sectors. He has invested in projects such as InstantMojo, StepOut, Culture Alley, Targeting Mantra, Cappillary Technologies, MissMalini.com, Mobile Walla and Socialblood.org.

- Krishman Ganesh : Krishman Ganesh is generally interested in the consumer internet, education, technology and health sectors. He has invested in startups such as Onlineprasad.com, Must See India, delyver.com, Overcart, Oximity and HackerEarth.

- Mina Ganesh … Another famous angel investor and one of the few famous female angel investors in India is Mina Ganesh. Mina Ganesh has invested in consumer internet, healthcare and SaaS startups like Oximity, Must See India, Overcart and Silverpose.

- Ritesh Malik : Ritesh Malik has invested in a large number of technology and hardware startups such as Asimov Robotics, Bisko Labs, Inc42, Sectorqube Technolabs and RHIvision.

- Nikunj Jain : Nikunj Jain invests in various industries. He has invested in startups such as Inc42, Gingr, Workouttrends.com and Piquor.

- Anupam Mittal … Another popular angel investor is Anupam Mittal. He is interested in the healthcare, mobile and Saas, C lean technology and consumer internet sectors. He has invested in projects such as Taxspanner, Interactive Avenues, Tushky, Olacabs, PrettySecrets and Peelworks.

- Kunal Bahl : Kunal Bahl is another angel investor that you can share your idea with, especially if your business is in the e-commerce industry. Kunal Bahl has invested in projects such as Olacabs, Tripoto, Bewakoof and Unicommerce.

- Sacchin Bansal : Sacchin Bansal invests in tech startups and is known to have invested in projects such as SpoonJay, Ather, MadRat Games, NewinShorts, TouchTalent and Roposo.

All of these angel investors are easy to find on LinkedIn when you search by their full name.

2. Join angel groups and online networks … Another effective way to quickly find angel investors for your Indian startup is to join dedicated online platforms to meet angel investors and entrepreneurs.

Some of the most reliable are: Indian Angel Network

- Angel.co

- Investment network

- Let’s adventure

- Your nest

- Doctor. Hempel network

- Delhi Angels

- The angels of Sarti

- Angels of Hyderabad

- The Angels of Chandigarh

- Ruling angels

- Seed Fund

- Clarion vp

You can register on any of these platforms to give you easier access to angel investors who are also actively looking for investment projects.

3. Hire a professional fundraiser … Another good option is to hire a professional fundraiser. Some professionals act as intermediaries between investors and entrepreneurs. When you contact them, they study your business idea and, if it meets their expectations, they help you put you in touch with the right angel investor for your business. However, you may need to part with the money or offer some sort of reward for their services.

4. Registration in a business incubator … Another good idea is to register with a business incubator. Business incubators can help you prepare your business idea so that you can better attract investors and connect you with potential angel investors for your business.

five. Participate in business storefront events and contests … You can also find angel investors for your business by participating in business fundraising contests and attending events and conferences where you can pitch your business idea.

4 Easy Tips To Find Angel Investors In India And Get Their Money

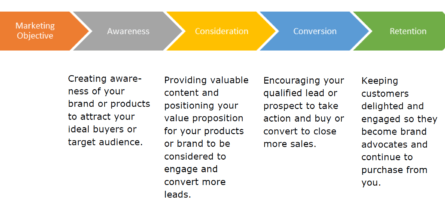

It’s not just about finding angel investors. Even when you find potential angel investors for your startup idea, you need to learn how to approach them and pitch your ideas to them so that you can get what you want. Here are some tips to help you.

and. Prepare your business plan … Of course you need a business plan. Your business plan should show potential investors what you are trying to accomplish, what skills you have, and most importantly, how they will benefit if they decide to invest in your business.

The business plan has different sections, but the first section that an investor is likely to see is the summary or overview section of the business plan. This section summarizes the entire contents of the business plan and you should understand that many investors may never read this part, especially if they do not find it memorable.

You have to take advantage of this part and make it attractive to your investors. Try not to go around in circles and rush to show them where the money is so that they are encouraged to take a hard look at the business plan.

b. Prepare a product prototype : Many angel investors are more comfortable seeing a hands-on demonstration of your idea, so it helps to prototype your product to show angel investors that your plans are achievable and not just wishful thinking. It’s easy to make a 3D prototype of your product idea inexpensively these days, so it shouldn’t be a problem.

vs. Assess … Another important thing is to do a valuation of your business before you start presenting your idea to investors. You need to know how much your business is worth, how much you need and how much stock you are willing to split in order to get the financing you need for your business.

re. Prepare to submit your business idea … Finally, make sure you are sufficiently prepared to explain your business idea to angel investors. It helps pre-prepare your PowerPoint presentation so that you can use it anytime to make a professional presentation.

You should also remember that investors are not only interested in a business idea, but entrepreneurs as well. They want to make sure they’re putting their money in the hands of confident, smart entrepreneurs who have what it takes to be successful in business.