Are you looking to make money as a successful entrepreneur for insurance companies? here are 7 easy steps to becoming the preferred insurance company entrepreneur.

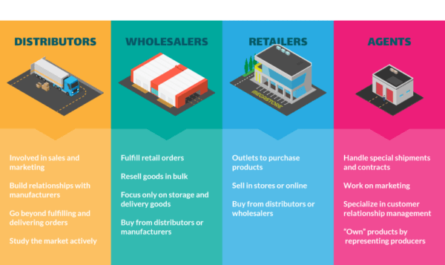

Insurance companies can have clients scattered across the country, but chances are they don’t have their own offices. in every town or village where their customers live. So when they have complaints from areas where they do not have a branch, they may decide to send a contractor to help them investigate the complaints.

Insurance companies also hire contractors to do construction work or cut down on auto services. to help assess the extent of damage suffered when the customer files a claim and to help repair or rebuild what has been damaged. This is why this is one of the areas of the insurance business that has attracted a lot of people lately.

Without further ado, becoming a subcontractor for insurance companies is a cool way to make a lot of money – that is, if you have the necessary experience and qualifications. month depends on your efforts.

Besides the money you will have to spend to get the certification you need, getting your license, printing your business card, and researching deals or investigating a claim are all areas that you will be spending huge amounts of money on.

Here are some must-have tips to help you become an entrepreneur for insurance companies;

7 easy steps to becoming an insurance contractor

1. Make the decision that you really want to do it.

The School of Thought rightly states that the first step to success in any endeavor is to first make a decision. This also applies to becoming a contractor for insurance companies. Weigh your options, pros and cons, then decide if this is truly the one for you.

2. Obtain the required certifications and experience

Before an insurance company takes over your services as a contractor, they usually check your CV; Your certification and work experience are very important in this type of business. No one wants to contract you if you don’t have the required certification. In addition, you also do not have work experience.

If you are looking to become a construction contractor for insurance companies, make sure you have at least a college diploma or degree in civil or civil engineering, or any other relevant field of study. It is advisable not to come straight out of college to pursue a career as a construction contractor with insurance companies; apply and work for a reputable construction organization that can provide you with the experience you need.

In addition, if you want to become an auto repair contractor or investigate claims with insurance companies, you must complete a college degree or degree in mechanical engineering and, therefore, in insurance, psychology. or in sociology with relevant work experience.

3. Register your business and obtain the required license

Since you will be doing business with legal entities, be sure to register your business with the corporate affairs commissions in your country and obtain the required license applicable to your industry.

You will also need to prepare your invoice and your commercial contract. You can consult your lawyer to help you prepare a good business contract. It is also imperative that you apply for and obtain your tax identification number, as well as purchase liability insurance for your business.

4. Configure your office and purchase the necessary work tools

While you can run this type of business from the comfort of your home without any hassle, however, when the business starts to grow, you will need an office with a small number of employees working for you. If you are confident in the success of the business from the start and have the financial capacity to lease office space, be ready to lease it.

If you want to work as a construction contractor you will need to purchase construction work tools and equipment, and if you want to work as an auto repair contractor you will need to purchase work tools and equipment. auto repair equipment.

5. Make a list of insurance companies available to you, review the terms of their contracts and fill out their contractor application forms.

I’m sure there may be several insurance companies within your reach in your city or even your area. a country. You should preferably go online to compile a list of insurance companies that are available to you, take the time to familiarize yourself with the terms of their contracts, and fill out contractor quote forms for those that are right for you. search. … In some cases you may need to visit their office to speak with the responsible person.

6. If an interview is required, make sure you are well prepared.

Usually, before an insurance company takes over your services as a contractor, they will not only review your resume and proposal, but they will also invite you for an interview and a chat. Even if you have a fantastic resume and your proposal is out of this world, if you can’t defend it when you’re invited to an interview, you probably won’t get a contract. If there is a need for an interview, make sure you are well prepared.

7. When assigning to an employment contract, make sure you do the job right.